Trade Alert - (VXX) September 26, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Trade Alert - (VXX)- TAKE PROFITS

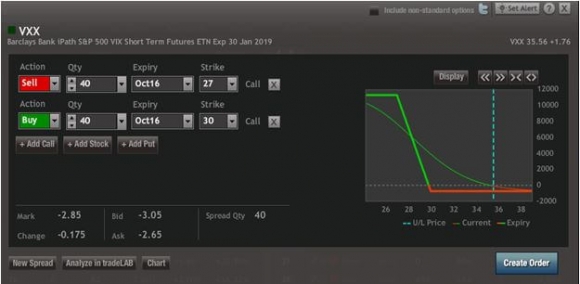

SELL the iPath S&P 500 VIX Short-Term Futures ETN (VXX) October, 2016 $27-$30 in-the-money vertical bull call spread at $2.85 or best

Closing Trade

9-26-2016

Expiration Date: October 21, 2016

Portfolio Weighting: 10%

Number of Contracts = 40 contracts

With the 17% spike in the Volatility Index (VIX) this morning, I?m taking profits in my position in the iPath S&P 500 VIX Short Term Futures ETN (VXX) October, 2016 $27-$30 in-the-money vertical bull call spread.

At a price of $2.85 I get to keep 68.7% of the maximum potential profit in this position, and I don?t have to hold it for an additional 19 trading days to capture the rest.

It also allows me to derisk ahead of tonight?s presidential debate which could trigger a big move up OR down in the markets tomorrow.

When the markets offer you a gift, TAKE IT! A 13.09% profit in a mere two trading days is nothing to sneeze at.

This was a bet that the iPath S&P 500 VIX Short Term Futures ETN (VXX) wouldn?t trade below the $30 level by the October 21 expiration date, in 21 trading days.

As of this moment, it is trading at $35.40.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bull Call Spread? by clicking https://www.madhedgefundtrader.com/ltt-executetradealerts/. You must be logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 40 October, 2016 (VXX) $27 calls at????.?.??$8.60

Buy to cover short 40 October, 2016 (VXX) $30 calls at.?..$5.75

Net Cost:???????????????????........$2.85

Profit: $2.85 - $2.52 = $0.33

(40 X 100 X $0.33) = $1,320 or 13.09% in 2 trading days