Trade Alert - (SPY) March 18, 2019 - SELL-STOP LOSS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SPY) - SELL-STOP LOSS

SELL the S&P 500 (SPY) April 2019 $285-$290 in-the-money vertical BEAR PUT spread at $3.70 or best

Closing Trade

3-18-2019

expiration date: April 18, 2019

Portfolio weighting: 10%

Number of Contracts = 23 contracts

This position is approaching my maximum loss tolerance, so I am going to bail. It’s easier to dig yourself out of a small hole than a big one. I’m too old to lose all my money and go back to work at Morgan Stanley as an entry-level trainee.

This is a classic example of “Markets can remain irrational longer than you can remain liquid.” As they used to tell me in karate school in Tokyo, the only way to avoid a punch in the nose is not to play the game.

The market is exiting its consolidation far sooner than I anticipated based on no apparent news. It seems that everyone who sold in December is trying to buy back now. It appears that investors are willing to pay higher multiples for falling earnings than I thought with the justification of lower interest rates. This will end in tears, but not yet.

I am therefore stopping out of my position in the S&P 500 (SPY) April 2019 $285-$290 in-the-money vertical BEAR PUT spread at $3.70 or best. We are getting too close to our upper strike price.

At least today, our loss is offset by the maximum profit we will be making on our short bond position, which expired at the close on Friday.

Here are the specific trades you need to exit this position:

Sell 23 April 2019 (SPY) $290 puts at………….………$8.30

Buy to cover short 23 April 2019 (SPY) $285 puts at…………...$4.60

Net Cost:………………………….………..……………..….....$3.70

Loss: $4.40 - $3.70 = -$0.70

(23 X 100 X -$0.70) = -$1,610

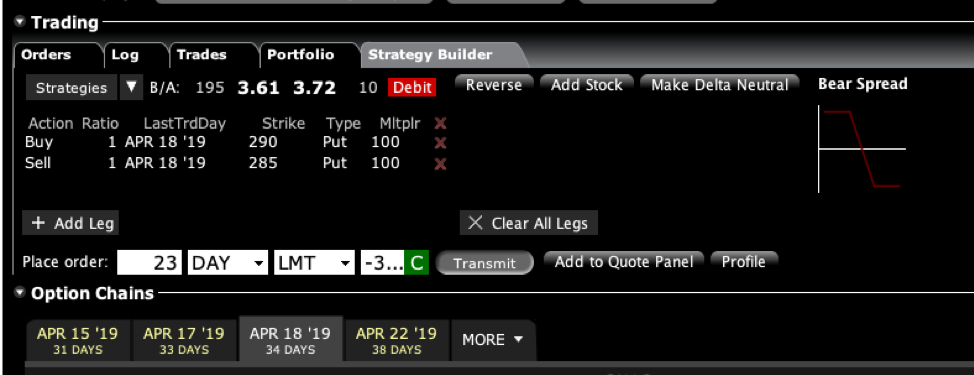

To see how to enter this trade in your online platform, please look at the order ticket above, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on How to Execute Vertical Call and Put Debit Spreads by clicking here.

You must be logged into your account to view the video.

Please keep in mind that these are ballpark prices only. There is no telling how much the market can move by the time you get this.

Be sure you've signed up for our FREE text alert service. When seconds count, this feature offers a trading advantage. In today's market, investors need every advantage they can get.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you.

The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don't execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile close to expiration.

If you don't get done, don't worry. There are another 250 Trade Alerts coming at you over the coming 12 months.