Trade Alert - (JPM) February 4, 2021 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (JPM) – TAKE PROFITS

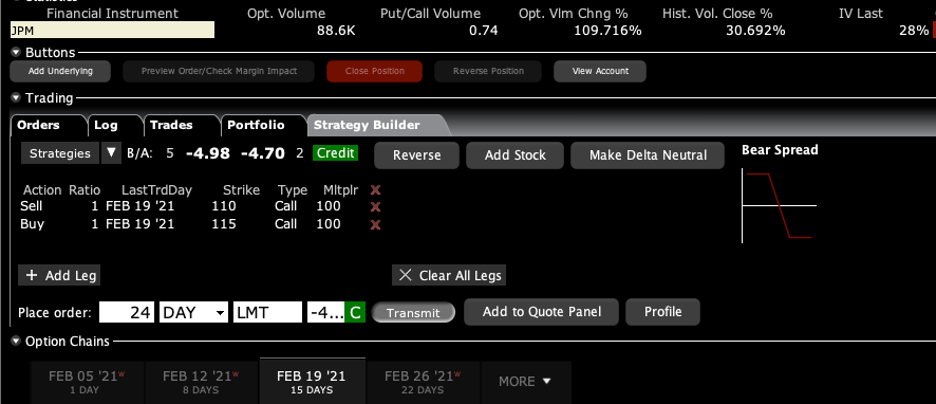

SELL the JP Morgan (JPM) February 2021 $110-$115 in-the-money vertical Bull Call spread at $4.95 or best

Opening Trade

2-4-2021

expiration date: February 19, 2021

Portfolio weighting: 10%

Number of Contracts = 24 contracts

If you don’t do options, keep the stock. My target for (JPM) this year is $200, up 60%.

This has been a perfect trade. We caught a $10 move in the stock in four days. We caught the top of the (VIX) move from $38 down to $22.

In addition, my own Mad Hedge Market Timing Index was strongly in “BUY” territory at 35. This is the lowest level since before the presidential election three months ago. Our engine is firing on all cylinders.

However, with 92.86% of the maximum potential profit in hand, the risk/reward of continuing until the February 19 option expiration day in 10 trading days is no longer favorable.

I am therefore selling the JP Morgan (JPM) February 2021 $110-$115 in-the-money vertical Bull Call spread at $4.95 or best. By coming out here, you get to take home $1,560, or 15.11% in 4 trading days. Well done and on to the next trade.

To quote the former Governor of California, “I’ll be back.”

JP Morgan Chase (JPM) announced blockbuster earnings and the shares sold off big. It was a classic “Buy the rumor, sell the news” type move.

That gave us a gift. (JPM) is the class act in the global banking sector, and CEO Jamie Diamond is the best CEO in the country.

I believe that massive government borrowing and spending will drive US interest rates up through the roof and the value of the US dollar (UUP) down. Banks love high interest rates because they vastly improve profit margins.

Covid-19 is rapidly approaching its third peak. Total US deaths could exceed the 1919 Spanish Flu 625,000 peak by the time it is all over. We passed all WWII deaths last week.

This was a bet that JP Morgan (JPM) would not fall below $115 by the February 19 option expiration day in 14 trading days.

Here are the specific trades you need to exit this position:

SELL 24 February 2021 (JPM) $110 calls at……….....….………$28.00

Buy to cover short 24 February 2021 (JPM) $115 calls at…...$23.05

Net Proceeds:....…………..…….………..….................……….….....$4.95

Profit: $4.95 - $4.30 = $0.65

(24 X 100 X $0.65) = $1,560, or 15.11% in 4 trading days.

If you are uncertain on how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.