Trade Alert - (SPY) July 20, 2021 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

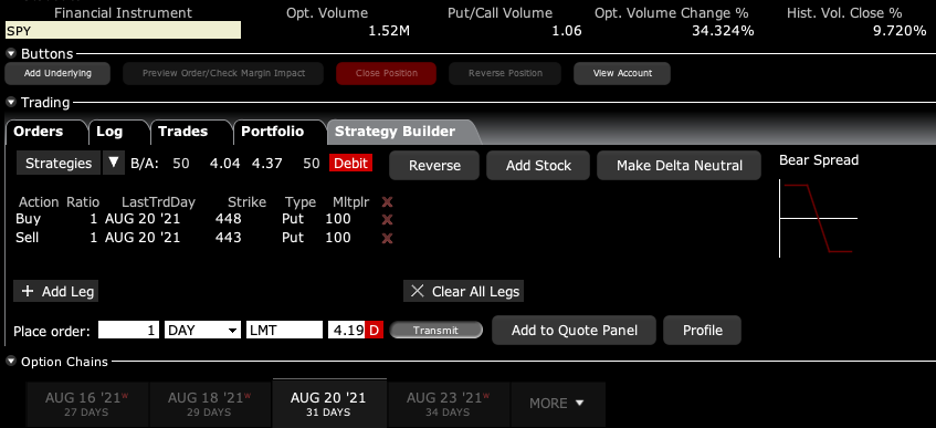

BUY the S&P 500 (SPY) August 2021 $443-$448 in-the-money vertical BEAR PUT spread at $4.10 or best

Opening Trade

7-20-2021

expiration date: August 20, 2021

Portfolio weighting: 10%

Number of Contracts = 24 contracts

We got a nice little 470-point rally in the Dow Average this morning, so the window is once again open for a short sale.

Bonds hit new lows in yields at 1.13%, and highs in prices today. Until the bond market definitively turns down, stocks will remain under pressure.

Call this the “delta” correction. Spiking covid cases in Arkansas and Missouri have created fears that a fourth wave of the pandemic via the delta variant could cause the reopening trade to stall in its tracks. Unvaccinated states are leading the surge.

We are coming off of extreme overbought conditions, especially in technology stocks. In any case, selling off on spectacular earnings reports has become a regular part of this market.

I am therefore buying the S&P 500 (SPY) August 2021 $443-$448 in-the-money vertical BEAR PUT spread at $4.10 or best

Don’t pay more than $4.40 or the risk/reward is not worth it.

This is a bet that the S&P 500 (SPY) will not rise above $443 by the August 20 option expiration day in 23 trading days.

Here are the specific trades you need to execute this position:

Buy 24 April 2021 (SPY) $448 puts at………..….………$19.00

Sell short 24 April 2021 (SPY) $443 puts at…………...$14.90

Net Cost:………………………….………..……....………..….....$4.10

Potential Profit: $5.00 - $4.10 = $0.90

(24 X 100 X $0.90) = $2,160 or 21.95% in 23 trading days.

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.