The Appeal of Ethereum

I’ll take you on a short journey on the next best thing after Bitcoin in crypto land.

Ethereum, or ETH.

It’s most likely the most profitable opportunity from the established crypto assets today.

ETH is the second-largest cryptocurrency by valuation, coming in at over $400 billion.

I know many of the readers out there have a hard time wrapping their heads around Bitcoin, and I will vouch that ETH could be the real catch up trade if the initial breakout phase in Bitcoin was missed.

Let’s take a look at what’s driving Ethereum’s price action.

Why is Ethereum on the rise?

ETH was launched in 2015, and it’s famous for being the first cryptocurrency with a programmable blockchain.

While other cryptocurrencies were using blockchain technology to record transactions, ETH offered a blockchain that developers could use.

Through ETH, developers can create decentralized apps, or dApps.

These dApps are a fundamental part of some of the biggest current trends in cryptocurrency. They are used for decentralized finance, or DeFi, which are platforms that provide financial services without a middleman, such as a bank. They are also used with non fungible tokens, or NFTs, which are digital assets that people buy and sell as collectibles.

Offering a robust platform to build other apps on it is one of the biggest differences between bitcoin and ETH and also why ETH could have more upside to the price in the long term.

As of last count, about 60% of dApps are built on ETH, reflecting increased competition from alternative layer one networks.

Fortunately, ETH benefits from the first mover advantage in this respect and continues to attract high quality developers to work on dApps.

The development of dApps has created an ecosystem that far exceeds anything bitcoin can produce at the base layer.

Another critical reason for higher prices in ETH is that the asset has gone through a series of structural upgrades.

The Ethereum network’s long planned transition to a scalable, proof of stake consensus model was completed in September 2022.

This transition, commonly referred to as Ethereum 2.0, fundamentally changed how the network operates.

Major upgrade milestones did produce classic buy the rumor sell the news price action, with strong rallies into events followed by periods of volatility afterward.

These upgrades made ETH significantly more environmentally friendly and improved security, while scalability has increasingly been achieved through layer two rollups rather than the base layer itself.

More specifically, Ethereum’s upgrades fulfilled its original vision of becoming an efficient, global scale, general purpose transaction platform while retaining crypto economic security and decentralization.

Should you buy Ethereum right now?

I believe ETH could outperform Bitcoin on a relative use basis over time, even though Bitcoin remains dominant as a monetary asset.

Why?

Its co originator, Vitalik Buterin, is an Elon Musk type figure in the crypto community, capable of moving mountains and pulling off technical breakthroughs time and time again.

He is the individual who built ETH from scratch.

Second, ETH remains the cryptocurrency of choice for creating dApps.

Ethereum’s transition to proof of stake proved to be a major improvement, allowing it to support far greater transaction volumes through scaling layers while reducing energy usage by more than 99%.

It is relevant in terms of volume and market capitalization, meaning there is a minimal chance this is a fly-by-night phenomenon.

After Bitcoin, ETH has remained the most popular asset for institutional allocation, particularly through ETFs, custody products, and staking-enabled investment vehicles.

Access to ETH is also top-notch and available for purchase at most cryptocurrency exchanges. It is easy to buy compared to many irrelevant coins.

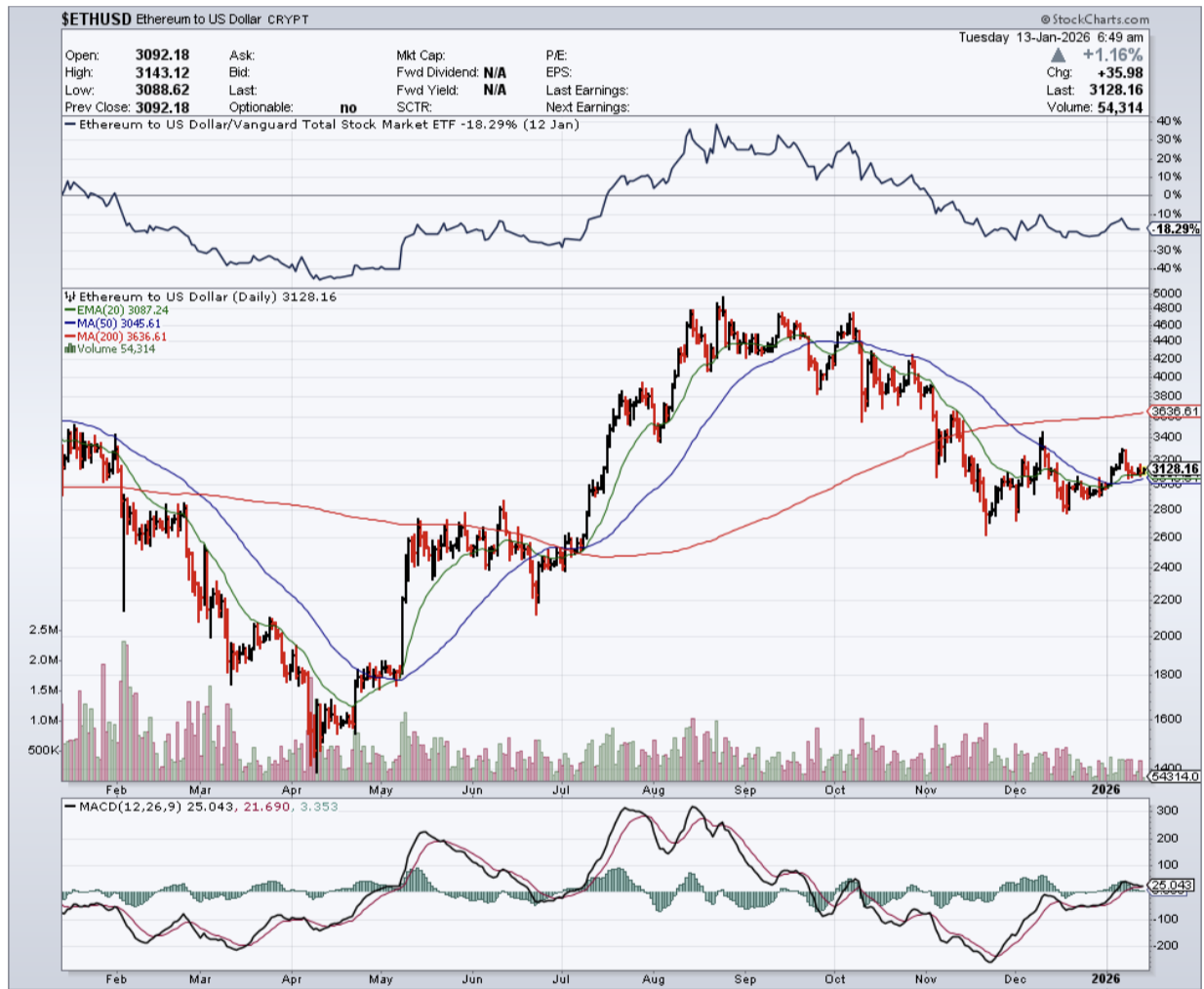

ETH prices have continued to trade through macro uncertainty driven by global rate cycles, regulatory shifts, and alternating risk-on and risk-off regimes.

Historically, ETH has been volatile, reflecting its dual role as both a technology platform and a financial asset.

It has recently traded around $3,000, and ETH continues to position itself as core infrastructure for the digital asset economy.

Ultimately, while near term price targets are always speculative, ETH has already traded well beyond prior cycle highs, and future upside will likely be driven less by hype and more by adoption, fee generation, and real economic usage.