Are Altcoins Relevant?

As some of you may have figured out, there are other cryptocurrencies out there besides Bitcoin (BTC).

In fact, there are thousands of different cryptocurrencies out there.

Generated, in part, by the transformational narrative of BTC, many have tried to replicate the success of Bitcoin in terms of percentage gain of the underlying asset.

These other peer-to-peer digital currencies have emerged over the last decade and are all chasing BTC.

First, let me get it out of the way by saying that BTC has extraordinarily benefited from its first-mover advantage and the subsequent snowballing network effect.

Altcoins, not even one, have replicated these super boosters.

These digital currencies, better known as altcoins, are mainly designed to overcome the structural and technical limitations of BTC while supporting a diverse set of real-world use cases.

Why should investors keep tabs on altcoins?

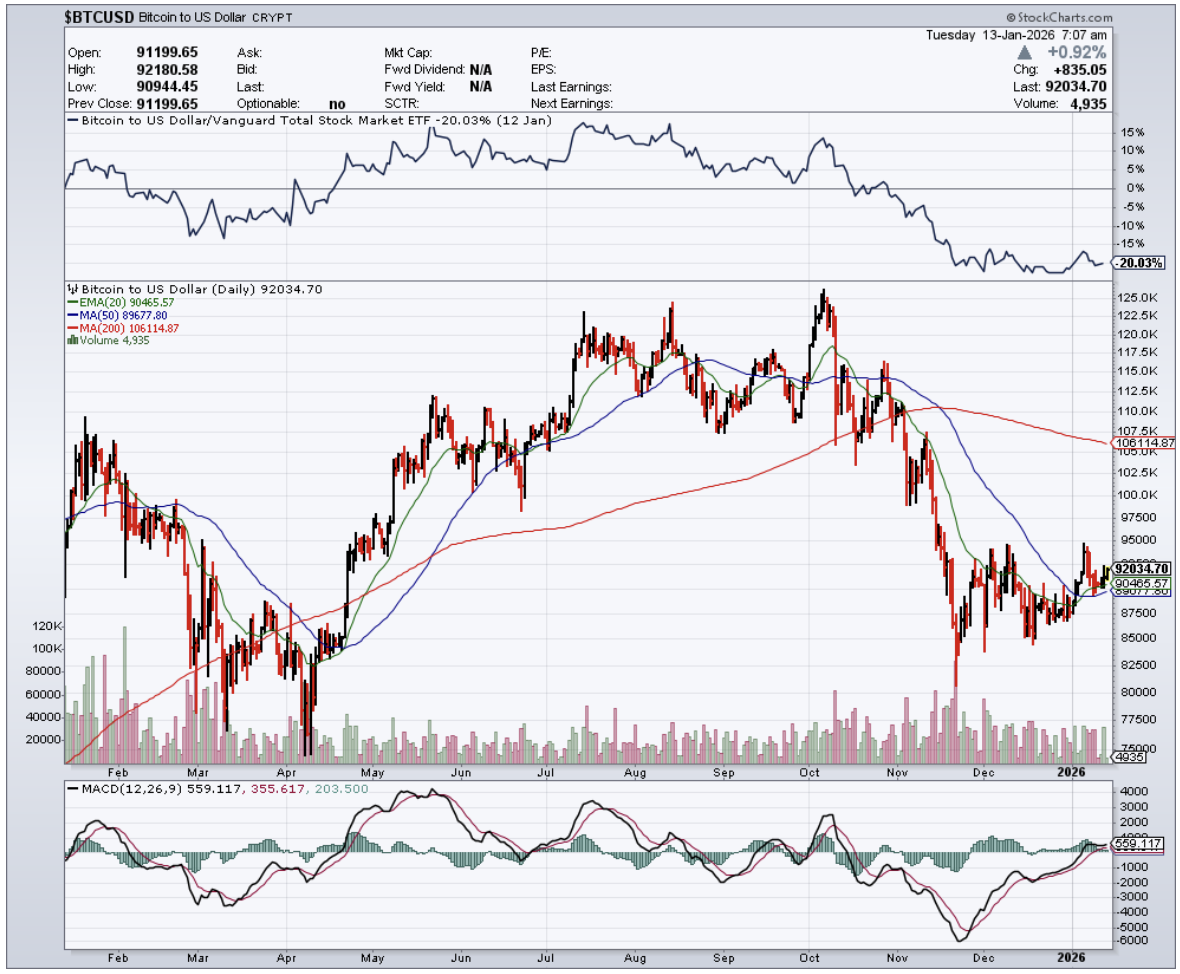

Per the date of this writing, BTC has reached market capitalizations well over one trillion dollars at cycle peaks, and altcoins have represented a comparable share of total crypto market capitalization across cycles.

Commanding a substantial portion of the crypto market is enough to warrant attention.

Since altcoins are such a large part of the market, every crypto investor should understand how they work.

In fact, the way you might profit from crypto is not in BTC itself, but in the diverse set of other assets in the space.

It’s true that many missed the BTC boat. Make sure you don’t miss the next boat.

Owing to the growth of the decentralized finance ecosystem, the increased use of smart contracts, and the introduction of environmentally friendly consensus mechanisms, altcoins expanded their market capitalization rapidly between 2020 and 2021, followed by consolidation and shakeouts in subsequent years.

Altcoin popularity signaled the growing breadth of high-quality crypto assets entering the industry.

Many blockchain companies and projects issue their own cryptocurrency tokens, making them the primary utility token for users to interact with their network.

Since there are hundreds of projects and decentralized finance opportunities available, such as staking and yield farming, together with an open market to choose from, it has proven increasingly difficult to determine the most promising projects.

One major variable that must be baked into the pie is that altcoins tend to offer higher risk and higher reward as a cryptocurrency investment.

Although Bitcoin is volatile, it remains the market leader and has already gained substantial value and name recognition, so investors looking for extra juice gravitate toward lower-priced, nascent coins with more upside.

Altcoins have more room to grow, but they also carry higher idiosyncratic and survivorship risk. Therefore, I can’t advise readers to pour their entire net worth into altcoins.

A wonky altcoin has repeatedly gone to zero across cycles, and there is no way to recover fiat capital once that happens.

Readers looking for altcoin exposure should only allocate a small portion of their portfolio into this space, and I would still emphasize using reputable platforms such as Robinhood or Coinbase.

Altcoins are often more experimental. Since they came out after Bitcoin, they have attempted to improve on its technology. In terms of transaction speeds and costs, many altcoins are superior to Bitcoin in narrow technical dimensions, though often at the expense of decentralization or security.

Should you consider investing in altcoins?

The proverbial low-hanging fruit in BTC was harvested earlier, although Bitcoin remains the benchmark asset in the space.

Another serious challenge with altcoins is how to pick the right one in a crowded setup, which is where we come in.

We continue to navigate through altcoins and give readers the best chance to succeed.

Like real estate, many altcoins are priced relative to the value proposition they offer when compared to a high-five figure or six-figure BTC, which is essentially seen as the best house in the best neighborhood and therefore priced the highest.

The altcoin that performs best in the short run is often the worst house in the best neighborhood, while the greatest long-term potential tends to come from the best house in a rapidly gentrifying neighborhood.

Altcoins and their underlying prices have behaved in a similar fashion to real estate prices, which is why Ethereum and some others have cycled between periods of apparent undervaluation and excess when measured against BTC.

In short, the rising tide lifting all boats has applied unevenly across digital assets over multiple cycles. Bitcoin itself moved through a full market cycle after 2021, but the broader crypto asset class survived, matured, and validated its existence through repeated stress tests.