High Inflation is a Gift to Crypto

The writing has been on the proverbial wall as central banks around the world struggled for years to contain inflation without destabilizing financial systems.

A steady stream of economic data over the past several years has highlighted how fragile the global financial balance became after the pandemic, with inflation emerging as one of the most persistent challenges.

Central banks were slow to tighten policy because moving too aggressively risked triggering recession, asset market stress, or outright financial accidents. For a long time, it was simply easier to keep policy loose than to risk being blamed for breaking the system.

That hesitation reshaped how investors viewed scarce assets.

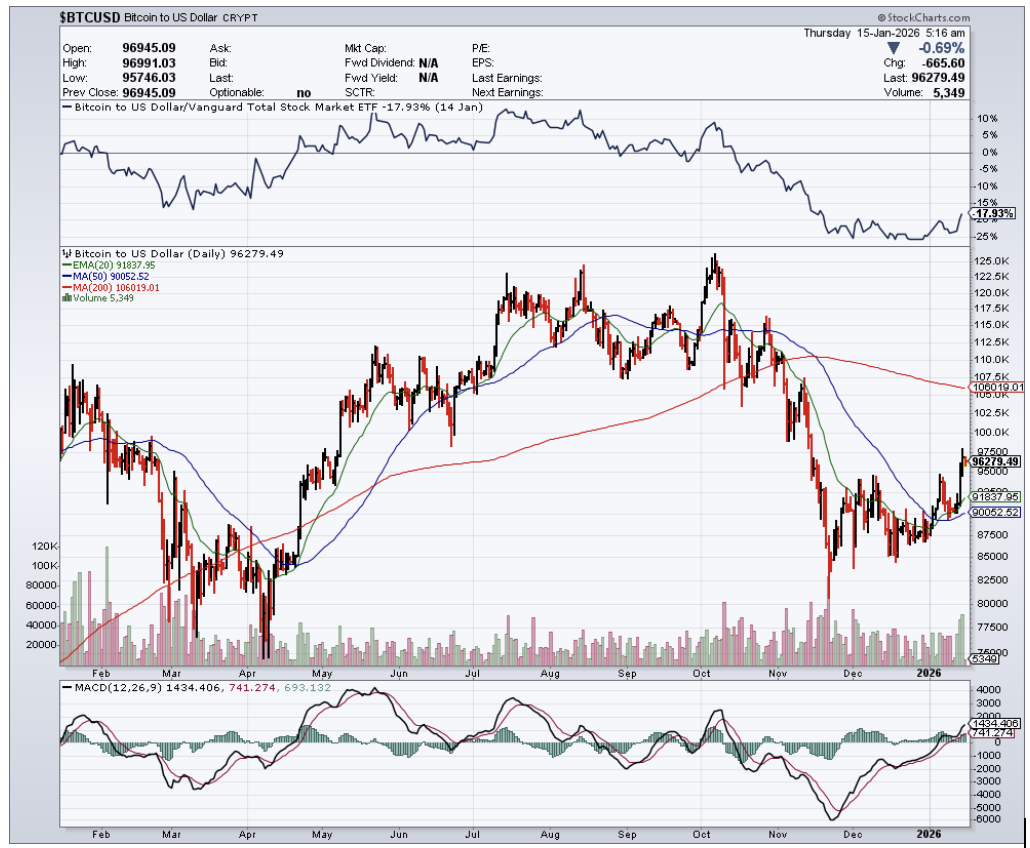

The appeal of Bitcoin has consistently strengthened during periods when inflation outpaced wages and purchasing power eroded. While Bitcoin is not mechanically linked to inflation data, its narrative as a hedge against monetary debasement gained traction as inflation surged across developed economies between 2021 and 2023.

Canada was an early warning sign. Inflation surged to levels not seen in decades as supply chain disruptions, labor shortages, and rising energy costs collided. Prices for housing, transportation, and food rose sharply, forcing central banks to abandon the idea that inflation was merely transitory.

Similar dynamics played out across Europe and the United States.

Supply chains proved far more fragile than expected, and they did not normalize quickly. Worker shortages, geopolitical disruptions, and energy market volatility repeatedly pushed costs higher, even after headline inflation began to cool.

Governments were forced to step in at times simply to keep essential goods moving. Fuel shortages, transport bottlenecks, and labor constraints became recurring reminders that modern economies are more brittle than they appear.

Inflation acted as a quiet tax on consumers, businesses, and savers. Wage increases often failed to keep pace with rising prices, meaning higher nominal income did not translate into higher real purchasing power. For many households, raises were effectively absorbed by higher rent, food, energy, and insurance costs.

That erosion of purchasing power pushed more people to reconsider where they stored long-term value.

Rising interest in crypto during high inflation periods was not driven by optimism alone, but by frustration with traditional systems that appeared unable to preserve real wealth. For many investors, crypto represented an opt-out mechanism rather than a speculative gamble.

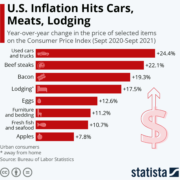

Supply shocks compounded the problem. Energy disruptions, extreme weather, and geopolitical tensions repeatedly slowed logistics and increased costs. Food prices were especially sensitive, with meat, eggs, and dining costs rising sharply during peak inflation periods, even as other categories stabilized later.

These pressures reinforced a broader narrative. When trust in institutions weakens and policy responses lag behind economic reality, alternative systems attract attention.

The rise in crypto adoption has reflected that shift in sentiment. It has been less about chasing rapid gains and more about hedging against policy uncertainty, currency debasement, and institutional fragility.

Crypto price cycles have remained volatile, but the underlying demand story has matured. Participation has broadened, infrastructure has improved, and access through regulated investment products has expanded globally.

The result is an asset class that responds not just to speculation, but to macroeconomic stress.

High inflation did not single-handedly drive crypto adoption, but it accelerated it. And as long as confidence in monetary policy remains imperfect, digital assets will continue to benefit from that uncertainty.