Trade Alert - (TLT) May 16, 2022 - SELL-TAKE PROFITS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (TLT) – SELL

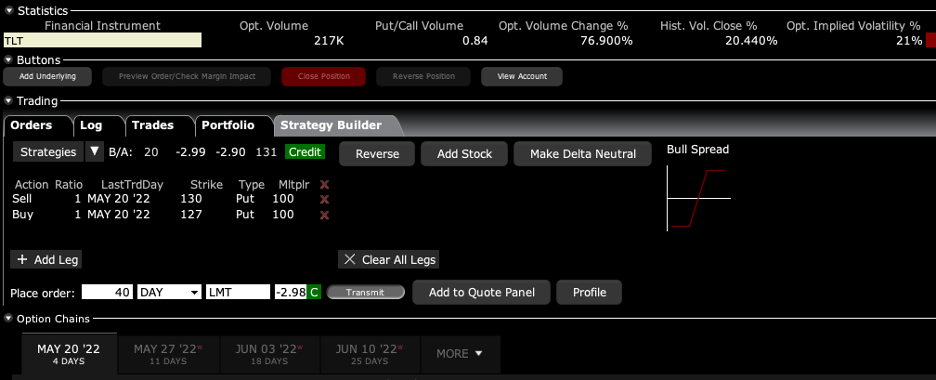

SELL the iShares Barclays 20+ Year Treasury Bond Fund (TLT) May 2022 $127-$130 in-the-money vertical Bear Put spread at $2.98 or best

Closing Trade

5-16-2021

expiration date: May 20, 2022

Portfolio weighting: 10%

Number of Contracts = 40 contracts

Our Bond Shorts are at Risk, thanks to a US Budget Deficit is in Free Fall.

I am coming out of this position four days early this week for two reasons.

I want to free up cash to pile into a new position. As long as the Volatility Index (VIX) is hugging $30, making money is like falling off a log.

In addition, some brokers have adopted the annoying practice of issuing margin calls and force liquidating positions two days BEFORE expiration to eliminate their risk, even though the risk of an actual cash call is less than 0.10%.

By coming out here you get to take home 95% of the maximum potential profit in only 16 days.

I am therefore selling the iShares Barclays 20+ Year Treasury Bond Fund (TLT) May 2022 $127-$130 in-the-money vertical Bear Put spread at $2.98 or best

By coming out here you get to take home $1,520 or 14.61% in 16 trading days. Well done and on to the next trade.

I shall mourn this development as the loss of a close relative, particularly a rich uncle who writes me a check once a month, as selling short bonds and betting that interest rates will rise has been a huge moneymaker for me for years.

Since November we have captured an eye-popping $42 points of downside in the United States Treasury Bond Fund (TLT). In two years, we have seized a mind-blowing $67 points. Don’t thank me, I’m just doing what you paid me to do.

While Trump was president the national debt exploded by $4 trillion, a dream come true for bond short sellers. Trump spent a lifetime sticking lenders with hefty bills and the US government is no exception.

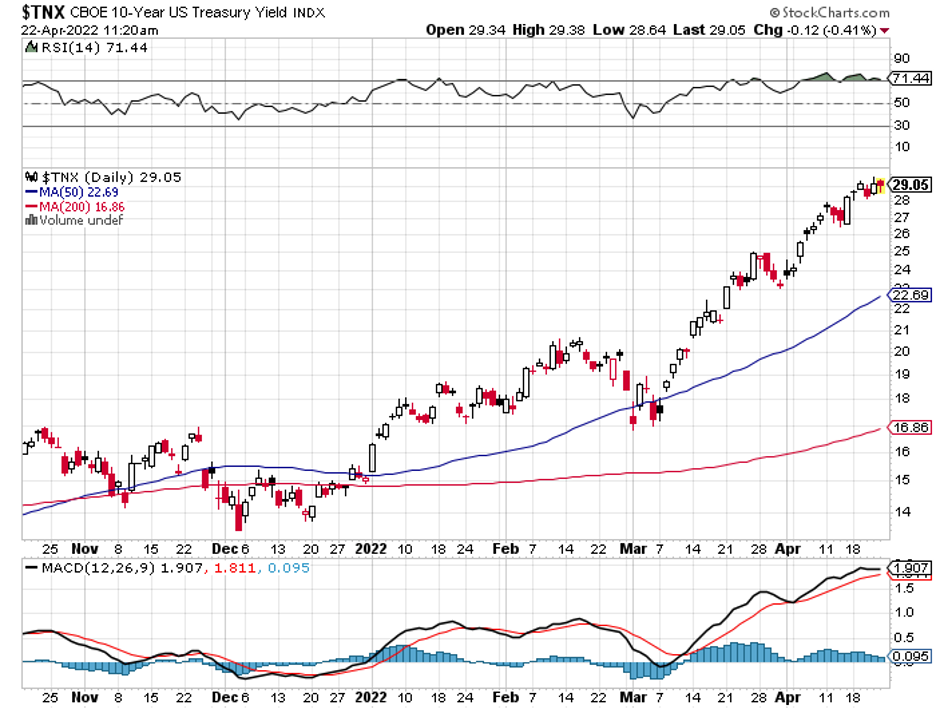

But all good things must come to an end. Since Biden became president, the annual budget deficit has vaporized, from $3.1 trillion in Trump's final year to a mere $360 billion for the first seven months of fiscal 2022, and we could approach zero by yearend.

An exploding economy and record employment have sent tax revenues soaring. The unemployment rate has shrunk from 25% t0 3.6%. And taxpayers still had to pay a gigantic bill for last year’s monster capital gains in the stock market.

Covid spending, in the hundreds of billions last year, has been whittled down to near nothing. Biden has also been unable to get many spending bills through the Senate, where he lacks a clear majority.

Pare down government spending in a major way and you get new support for the bond market, the first since Clinton balanced the budget in 1999. Some investors are wondering if the 3.12% peak for the ten-year US Treasury bond seen last week could even be the top for this cycle. With the futures market already pricing in a 200 basis points in rate hikes this year, it’s entirely plausible.

I think we may have a shot at a 3.50% yield by next year. That equates to a (TLT) of around $100. But let’s face it, we are approaching the tag ends of this trade. Time to find better fish to fry. NVIDIA (NVDA) at $120 or Apple (AAPL) at $135 anyone?

We are seeing the same scenario play out at the state level. California saw a staggering $75 billion surplus last year. Among the luxuries Sacramento is considering are gas tax rebates for California drivers, undergrounding 20,000 miles of powerlines to prevent wildfires, and construction of a second transbay BART line.

Of course, all of this surplus wealth is temporary, as it always is. But “Laissez le bon temps roller.”

This was a bet that the (TLT) would not rise above $127.00 by the May 20 options expiration in 20 trading days.

Here are the specific trades you need to close out this position:

Buy 40 May 2022 (TLT) $130 puts at………….………$14.00

Sell short 40 May 2022 (TLT) $127 puts at………..…$11.02

Net Proceeds:………………………….……….…….....….....$2.98

Profit: $2.98 - $2.60 = $0.38

(40 X 100 X $0.38) = $1,520 or 14.61% in 16 trading days.

The Fat Lady is Singing for the Bond Market

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.