GEEKING OUT WITH AI GIANTS

(NVDA), (GOOGL), (MSFT), (AMZN), (PLTR), (PATH), (EVLV)

Just the other day, a line of eager folks snaked around the Nvidia Corp.’s (NVDA) tech conference like it’s Black Friday and the last PS5 is on the line. And let me tell you, the excitement is palpable.

After all, this isn’t just any tech talk. This is a “rock band reunion” of sorts of the masterminds behind the 2017 research paper that sparked the AI revolution we're experiencing today.

Nvidia's CEO, Jensen Huang, sporting his signature black leather jacket, takes the stage to moderate a panel featuring seven out of the eight authors of "Attention Is All You Need."

This groundbreaking paper, written while they all worked at Google (GOOGL), introduced the concept of transformers – the very technology that powers OpenAI's GPT-4 and Nvidia's booming chip sales.

As Huang playfully chided the stragglers finding their seats ("C'mon you guys, hurry up, I'm going to start!"), the anticipation in the room was electric. The panelists – Ashish Vaswani, Noam Shazeer, Aidan Gomez, Lukasz Kaiser, Illia Polosukhin, Jakob Uszkoreit, and Llion Jones – shared fascinating insights into the origins and impact of their work.

Polosukhin, now co-founder of NEAR Protocol, explained that the paper stemmed from efforts to improve machine-aided answering of users' questions. Google needed lightning-fast answers, and existing models simply couldn't keep up.

Jones, co-founder and CTO at Sakana AI, revealed that while they aimed to create technology that could generalize across a wide range of tasks, even they were surprised by how well it performed.

Interestingly, most of these brilliant minds left Google to start their own AI ventures. They realized that to truly harness the potential of their groundbreaking technology, they needed to step outside the confines of the lab.

As Vaswani, co-founder of Essential AI, put it, "You couldn't make these models smarter in the vacuum of a lab."

The interactions between Huang and the panel made one thing crystal clear: while Huang expressed gratitude for their technological contributions, these researchers-turned-entrepreneurs need him as much as he needs them.

Shazeer, co-founder and CEO at Character.ai, even joked, "Thank God for giving us this incredible technology, and thank Jensen." He might have been exaggerating, but then again, maybe not.

The sheer number of people lining up for this tech talk underscores the potential of AI.

Remember when "the cloud" first entered the tech lexicon? It was a game-changer, driving massive growth for companies like Microsoft (MSFT) and Amazon (AMZN).

But now, with the explosive demand for AI, it looks like the cloud might just be a warm-up act. Some even say it will be as transformative as the internet itself.

The numbers speak for themselves. The AI market is projected to skyrocket from $300 billion this year to over $1.8 trillion by 2030. That's a sixfold increase. Aside from the obvious names like Nvidia, there are a handful of companies positioned to ride this wave of growth.

First, we have Palantir (PLTR), a popular stock that's earning its hype. Their platforms for the private sector and governments leverage AI to optimize decision-making.

With their newest product, Artificial Intelligence Platform (AIP), they're making waves in both defense and commercial sectors.

Palantir's commercial revenue grew an impressive 32% year-over-year in Q4 2023, and they've been GAAP profitable for five straight quarters – no small feat for a high-growth tech company.

Next, let's talk about UiPath (PATH) and the magic of robotic process automation (RPA). Imagine automating all those tedious, time-consuming tasks that eat up your day.

That's what UiPath does for its 10,800+ customers, freeing them up to focus on higher-level tasks.

With $1.4 billion in annual recurring revenue and a rock-solid balance sheet, UiPath is poised for success in this fragmented but promising industry.

As for the more adventurous investors out there, Evolv Technologies (EVLV) is worth a look.

Their AI-powered detectors are shaking up security at venues like stadiums and schools. No more emptying pockets and waiting in long lines – Evolv's technology can screen multiple people at once, identifying potential threats with impressive accuracy.

With a reasonable valuation and explosive growth, Evolv could be a game-changer.

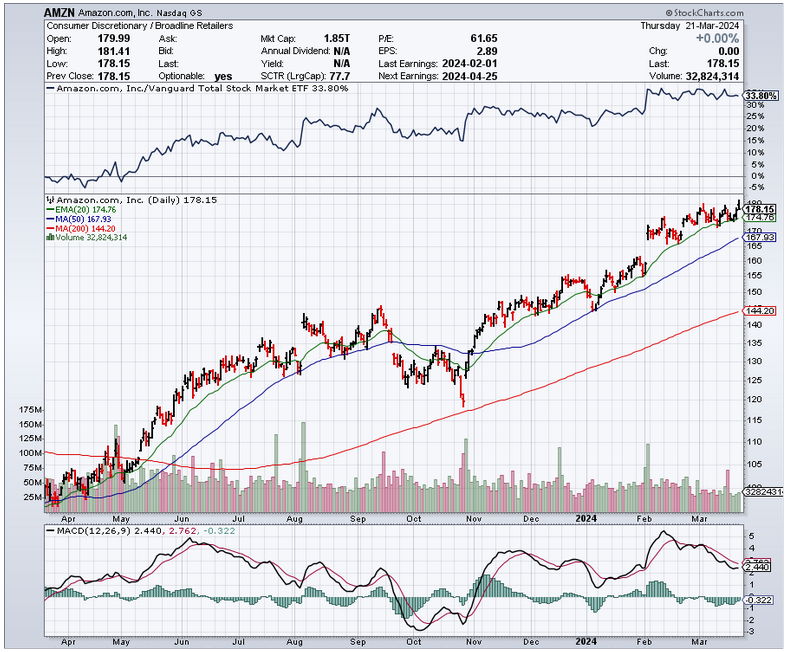

And of course, we can't forget about Amazon. While they're known for their online marketplace, their AWS cloud division is the world's leading cloud service provider.

As AI software requires massive amounts of data processing, much of which will happen in the cloud, Amazon is perfectly positioned to benefit from the AI boom.

The potential of AI is truly staggering. Just as the cloud transformed the tech landscape, AI is set to do the same – but on an even grander scale. From healthcare and finance to transportation and entertainment, no sector will be left untouched by the power of artificial intelligence.

I suggest you add the companies above to your watchlist. This AI revolution is picking up steam, and you want to be in the game, not watching from the bleachers.