April 12, 2024

(DATA WILL BE KEY IN THE MONTHS AHEAD AS THE FED LOOKS TO START CUTTING RATES)

April 12, 2024

Hello everyone,

Investors are learning to balance on a moving train.

Earnings are strong.

The economy is strong.

But inflation remains stubbornly high.

We know that cyclical stocks perform best when the economy turns up, such as energy, materials, and hospitality.

Energy has been the second-best performer among S&P sectors year to date, up 17%. Communication services, led by a big move in Meta, has been the leader, up 18%.

Other potential beneficiaries of higher rates with a strong economy are defensive stocks, which tend to be less interest rate-sensitive, such as Kroger or Walmart.

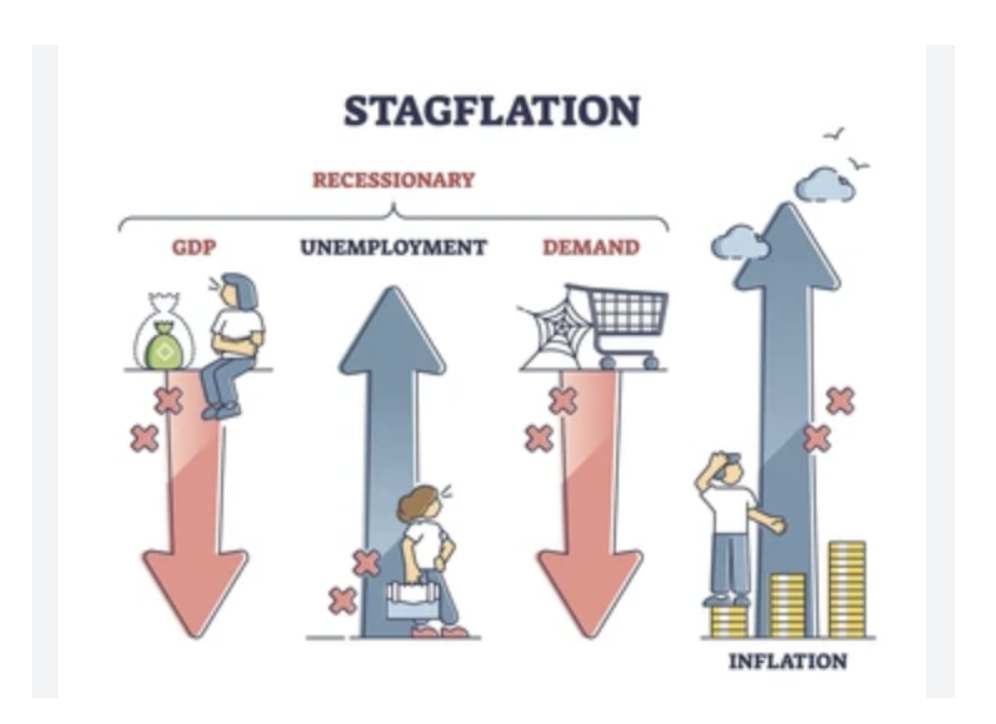

But if the bottom starts to fall out of the jobs market, the narrative changes quickly. A weaker job market with high inflation may well lead to stagflation – which markets would find distasteful. The S&P 500, which closed Wednesday at 5,160 could well slide down the elevator shaft rather quickly and we could see the market in the mid-4,000’s.

The key here is a strong economy, which will help prop up earnings. The next three to six months will be very important in terms of earnings results, and employment numbers.

The growing value of assets that can’t be confiscated.

Gold and Bitcoin’s value derives from their non-confiscatability by inflation, by bank failure, and - in the case of Bitcoin – by state expropriation.

Bitcoin can’t be confiscated by inflation because of its controlled supply, while the failure of banks and other financial institutions wouldn’t lead to the custody of an investor’s crypto assets.

Even a government banning Bitcoin wouldn’t lead to its confiscation, because a global network of bitcoin holders remains.

The Bitcoin price may well rise beyond $100k as the market value for non-confiscatability grows substantially and Bitcoin’s share of this market grows substantially.

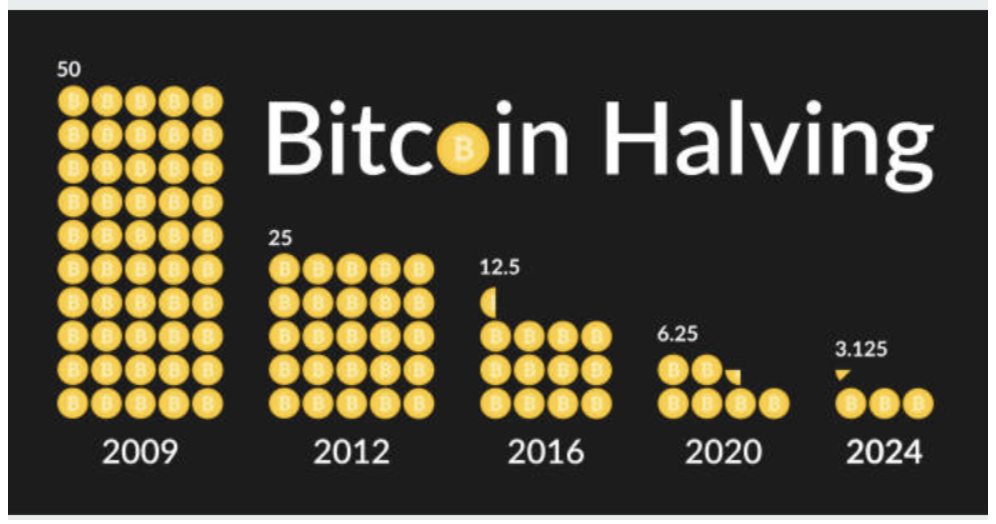

Bitcoin hit a new high above $73,000 on March 14, rising more than 70% this year. The introduction of the U.S. spot bitcoin ETFs this year and the tightening bitcoin supply ahead of the late April “halving” have driven the price of the cryptocurrency up.

Meanwhile, gold has also hit record highs. It is presently sitting at around $2384.68. Bullion is considered by some investors as a hedge against inflation and geopolitical uncertainties.

Both Bullion and Bitcoin are becoming increasingly valuable in both Western and emerging nations.

Cheers,

Jacquie