March 12, 2025

(THE POSSIBILITY OF A U.S. RECESSION IS NOW BEING ACKNOWLEDGED)

March 12, 2025

Hello everyone

The shift is on from bull to bear as the “R” word becomes a discussion topic.

After a few months of me warning everyone about an impending down move/bear market, going against the grain of most professional analysts and all the “talking heads”, Ed Yardeni now comes out and says it is “possible a bear market has already started.”

As recently as February, he said the U.S. economy could go a decade without a recession. In January, he said investors are in a “roaring 2020” market.

The shift in his view comes after the whiplash of back-and-forth changes in trade policy from President Donald Trump, and early signs of economic weakness, and highlighted concerns of a recession, itself defined as two consecutive quarters of economic contraction.

Yardeni points out that Trump is testing the limits of the economy and the markets. His administration’s rapid-fire policy initiatives have been testing every limit imaginable, and so far, there has been a good measure of resiliency, but recession fears are definitely rising.

Trump has gone ahead and done it.

He has introduced 25% tariffs on Australian aluminium and steel. Our Prime Minister described the move as “unfriendly and unjustified” and an “act of economic self-harm.” Europe, also, did not escape similar tariffs. But Europe plans to retaliate with tariffs on U.S. goods.

Australia will not retaliate. But there could be implications down the track. Interestingly, economists say the tariffs have more “bark than bite.”

Trump’s tariffs could take the U.S. on a dangerous journey with unforeseen implications.

Ray Dalio has commented that a severe U.S. supply-demand problem could lead to ‘shocking developments.’ He is focused on the debt issue and believes we could see unexpected developments in terms of how it’s going to be dealt with.

Where to hide and protect your portfolio while Trump wages a tariff trade war.

Within the fixed income market, you can find a source of stability with U.S. Treasury Inflation-Protected Securities (TIPS), which should outperform in both high-inflation and recession environments.

TIPS are sold by the U.S. Treasury with 5-, 10-, and 30-year terms. Unlike traditional government bonds, the principals on TIPS – the amount the government agrees to pay back to the bond holder – can move higher or lower over the maturity term of these instruments. At the end of the term, if the principal is higher than the original agreed rate, the holder gets the increased amount. If the principal is equal to or lower than the original rate, the TIPS holder is paid the original agreed principal.

Corporate credit markets are also an option.

Brian Mangwiro, managing director of global sovereign debt and currencies at Barings, has suggested Investors can focus on sectors less exposed to tariffs such as financials, construction, and defence, and avoid those in the line of fire such as autos and potentially technology.

By now, you should have insurance in place, such as (SDS) or (SH) to cover what you wish to keep in your portfolio.

MY CORNER OF THE WORLD IN PHOTOS AFTER CYCLONE ALFRED

Powerlines down across roads in multiple areas across Brisbane, Gold Coast, and Sunshine Coast and as far inland as Toowoomba (a two-hour drive from the Gold Coast).

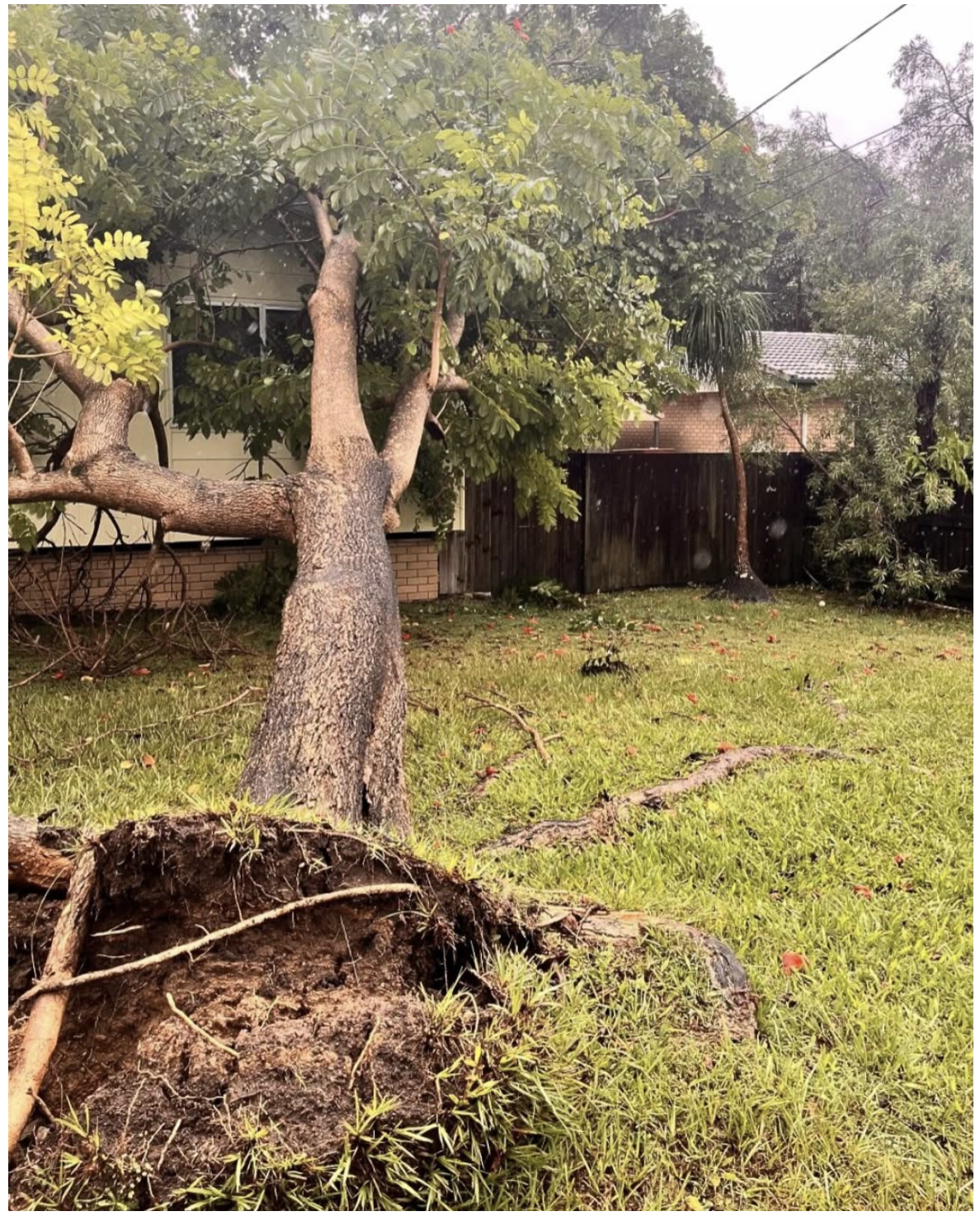

This has been a common sight in every neighbourhood across the Gold Coast. Some people also lost their roofs.

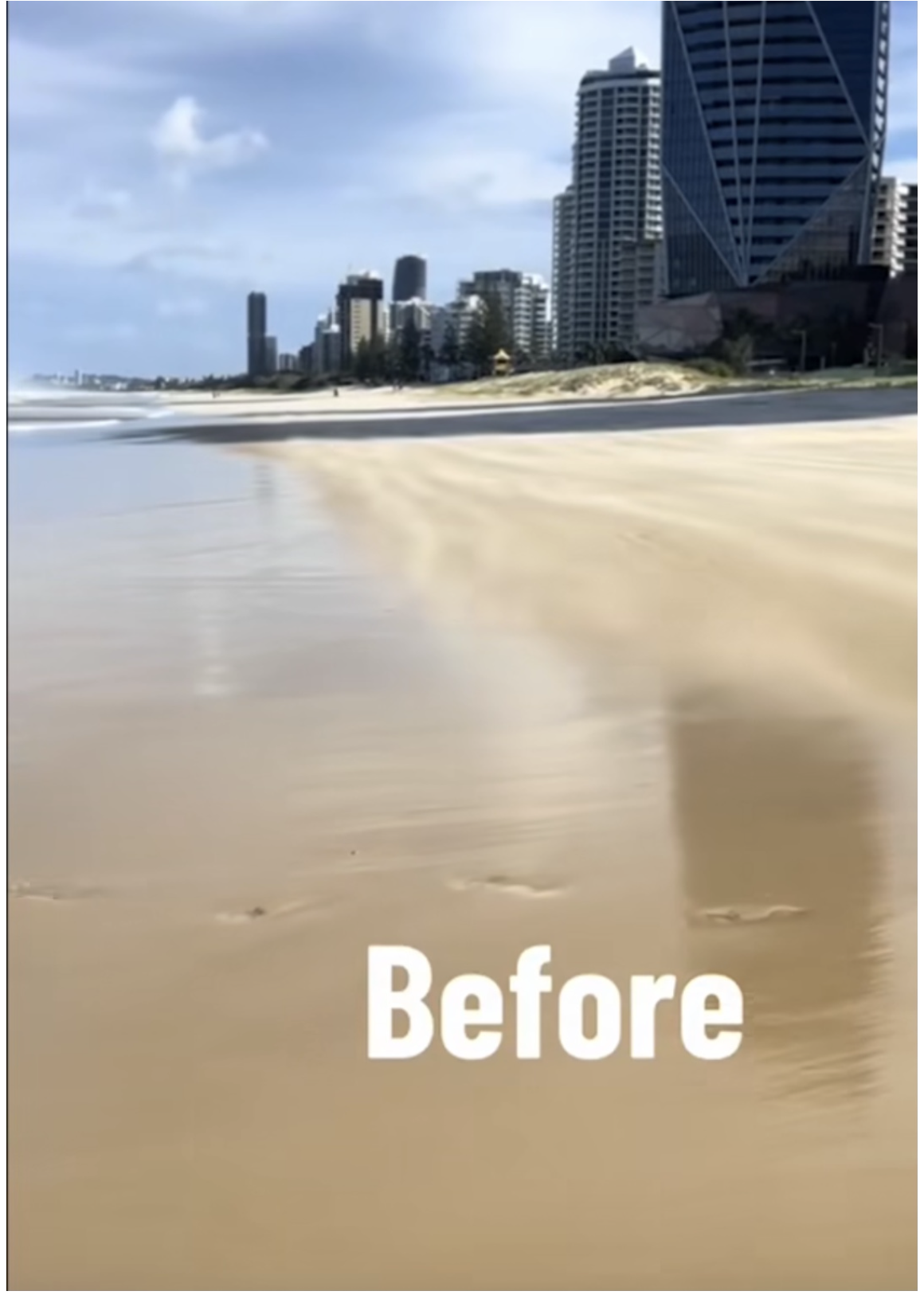

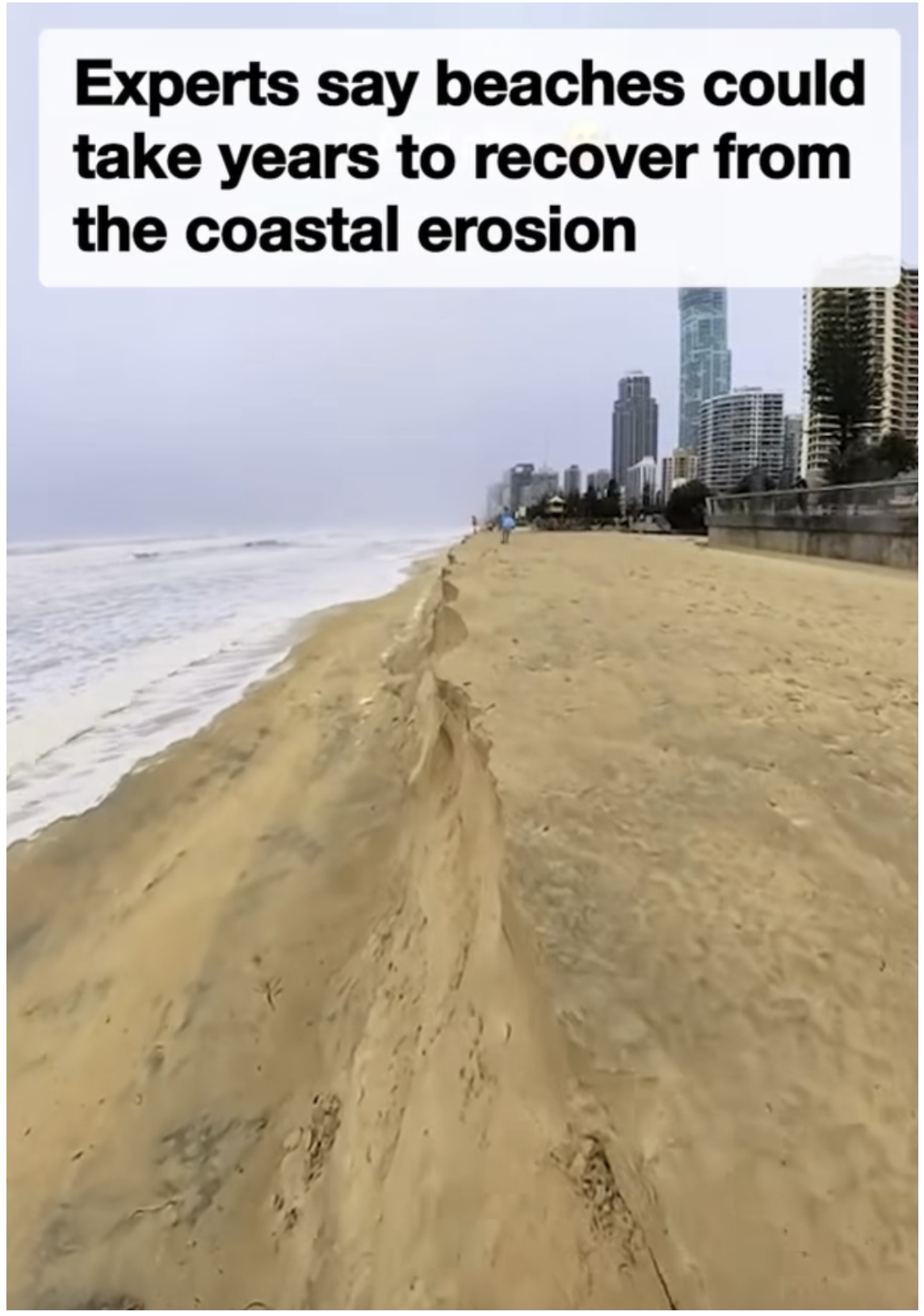

A huge cliff has formed right along the coastline after Cyclone Alfred battered the coast and eroded our beautiful beaches. Millions of cubic metres of sand have been gauged from 500km of coastline.

QI CORNER

SOMETHING TO THINK ABOUT

Cheers

Jacquie