Trade Alert - (SVXY) April 10, 2025 - BUY

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

Trade Alert - (SVXY) – BUY

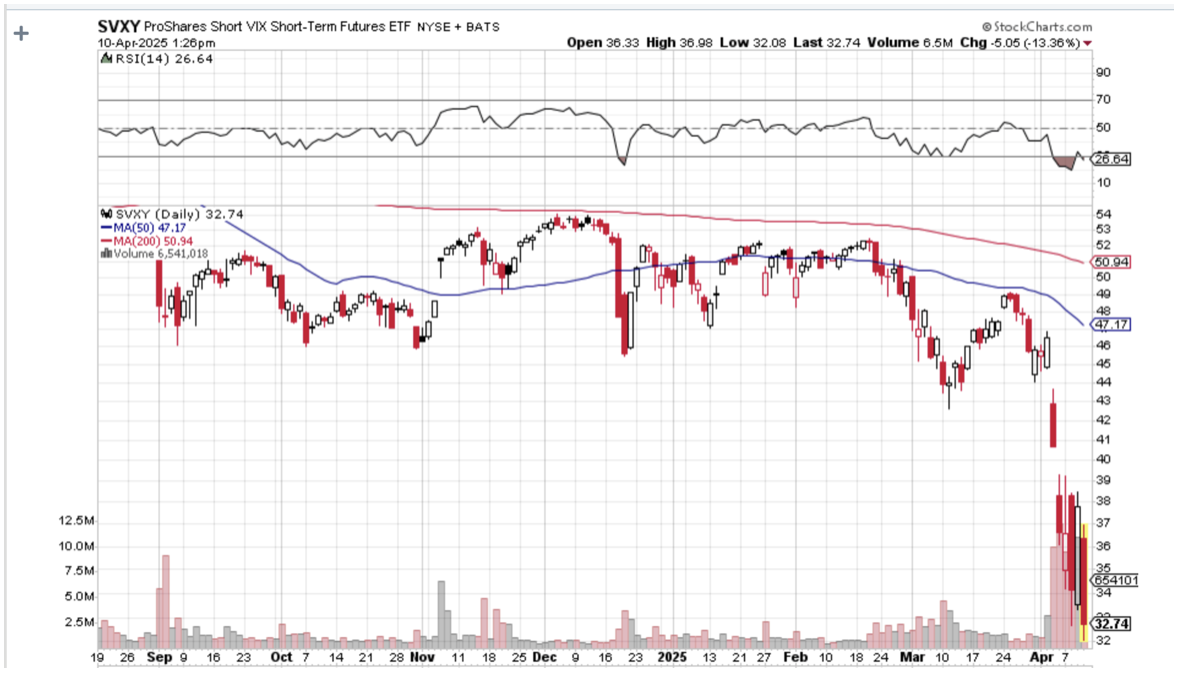

BUY the ProShares Short Vix Short Term Futures ETN (SVXY) at $32.74 or best

Opening Trade – MARKET ORDER

4-10-2025

expiration date: none

Number of Shares = 300 shares

Unusual markets create unusual trades.

This is a rare case where time decay works in your favor. For example, cash S&P 500 closed on Thursday at $524.58. The two-month June futures closed at $552.80, a premium of $28.22, or 5.37%. Factor this in over a year and the short (SVXY) has a built in 32.27% tilt in your favor less costs.

I have seen the Volatility Index ($VIX) trade over $50 only a handful of times since it was created in 1993. Spikes above here are measures in only days, if not hours, like during the 1998 Long Term Capital Management bankruptcy, the 2008-9 Great Recession, the 2020 Pandemic, and the August 2024 Yen Carry Trade Unwind.

If the (SVXY) falls from your initial purchase, buy more and average down. The ($VIX) always goes down.

The Proshares Short Vix Short Term Futures ETN (SVXY) is an exchange-traded fund that sells short futures in the ($VIX). You can buy shares in it like any ETF. There is no expiration date.

All yesterday’s tariff postponement did was move us out of the frying pan into the fire. It extends uncertainly for another 90 days, which means that companies will be sitting on their hands. It simply moved tariffs from Europe to China. The $2 trillion tax increase on the American economy still stands.

The bond market (TLT) agrees with me, going into free fall once again and putting a global financial crisis back on the table.

The ($VIX) has a huge contango and carrying costs, which makes it a great short play. This is what most professionals in this market do.

The Mad Hedge AI Market Timing Index at a lowly 8 also shows that the timing for a short ($VIX) play is great.

I am therefore buying the Proshares Short Vix Short Term Futures ETN (SVXY) at $32.74 or best.

Don’t pay more than $35.00 or you’ll be chasing on a risk/reward basis.

ONLY ENTER MARKET ORDERS AS THE MOMENT-TO-MOMENT VOLATILITY IS TOO GREAT TO USE A LIMIT ORDER

If you don’t want to sit in front of a screen all day, simply enter a spread of Good-Until-Cancelled orders overnight, like $32.70, $32.80, $32.90, $33.00, and $33.10. You should get done on some or all of these.

The S&P 500 VIX Short-Term Futures Index measures the returns of a portfolio of monthly VIX futures contracts that roll positions from first-month contracts into second-month contracts on a daily basis. The index maintains a weighted average of one month to expiration.

VIX futures contracts price the market's view of the value of the CBOE Volatility Index ($VIX) on the expiration dates of such futures contracts. The VIX measures the expected volatility of the S&P 500 over the next 30 days and is calculated based on the price of a constantly changing portfolio of options on the S&P 500. The VIX is not directly investable.

Unlike other asset classes that have tended to increase in price over long periods of time, the level of the VIX has tended to revert to a long-term average over time. As such, any gains from investments in VIX futures contracts may be constrained and subject to unexpected reversals as the VIX reverts to its long-term average. VIX futures indexes have historically reflected significant costs associated with rolling VIX futures contracts on a daily basis. These costs can consistently reduce returns over time. VIX futures indexes can be highly volatile.

To learn more about the Proshares Short Vix Short Term Futures ETN, please visit their website at https://www.proshares.com/our-etfs/strategic/svxy

This is a bet that the (SVX) will rise above $32.74 sometime in the next month.

Here are the specific trades you need to execute this position:

Buy 300 shares of the (SVXY) at………….………$32.74

Potential Profit: a $1.00 rise in the (SVXY) produces a $300 profit

If you are uncertain about how to execute an options spread, please watch my training video by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Keep in mind that these are ballpark prices at best. After the alerts go out, prices can be all over the map.