Treasury For The Bitcoin Age

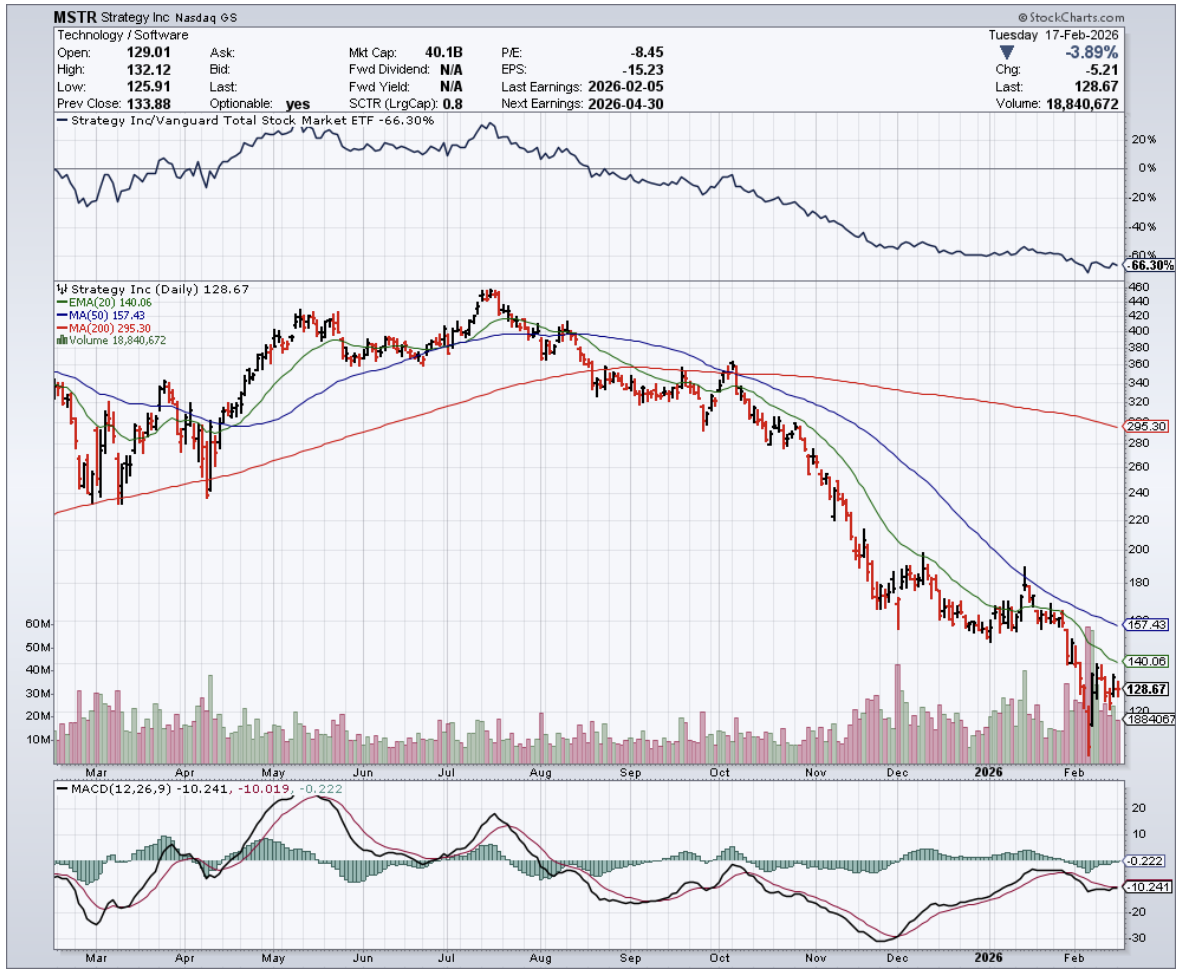

Strategy's (MSTR) carrying $8.2 billion in debt, most of it convertible, with $2.25 billion in cash reserves and over 714,000 Bitcoin (BTC) on the balance sheet.

The CEO says Bitcoin would need to drop to $8,000 and sit there for five years before they'd have a real problem.

The bears say this is a leveraged disaster waiting to implode. The bulls say it's genius financial engineering. I say the numbers tell a more interesting story than either camp wants to admit.

The company started life as a business intelligence software firm. That business still exists, quietly generating revenue in the background, but nobody's pricing MSTR on software fundamentals anymore.

Michael Saylor transformed the company into a publicly traded Bitcoin treasury, and the stock now trades purely on Bitcoin exposure.

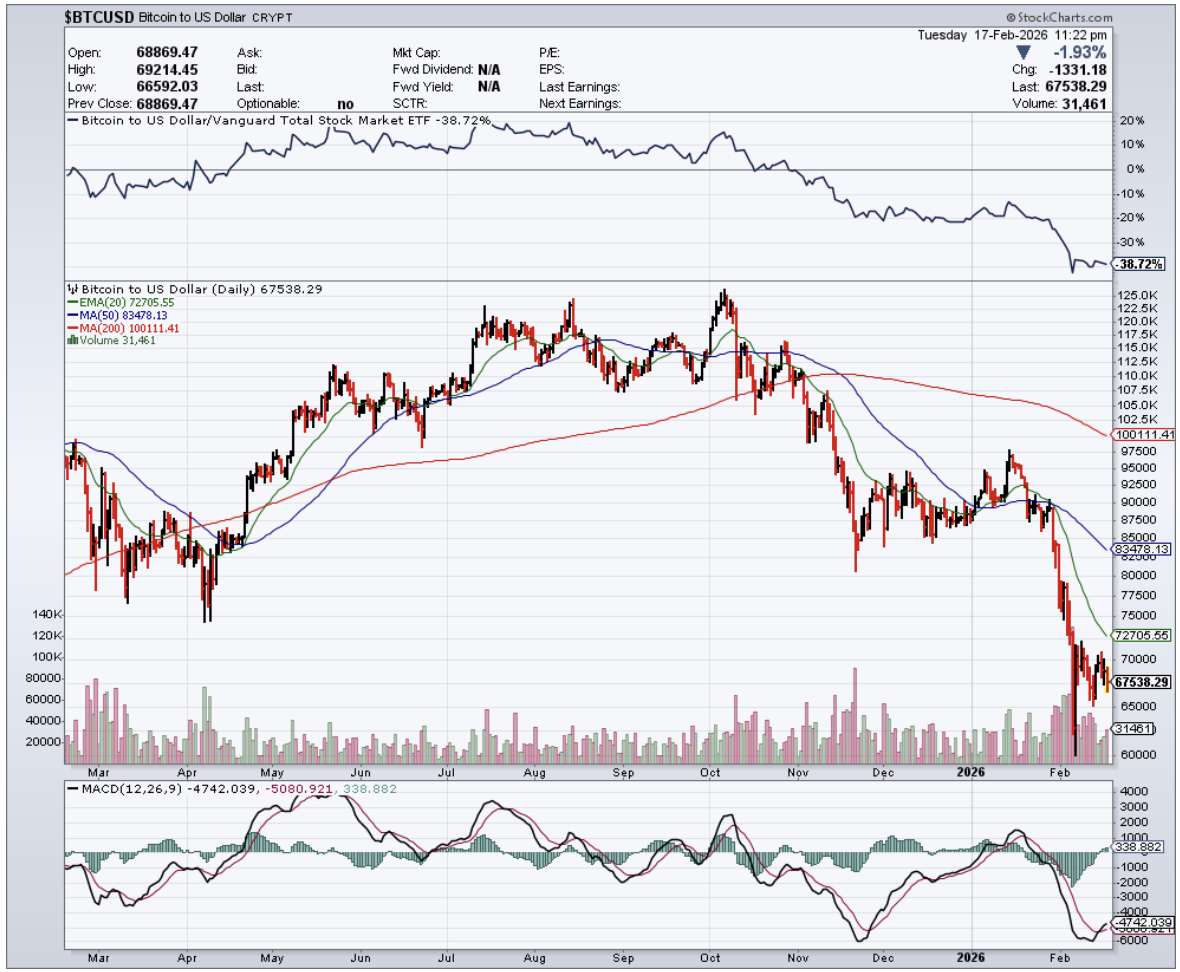

When Bitcoin rises, MSTR typically outperforms. When Bitcoin falls, MSTR drops harder. That's the whole trade - leveraged upside and amplified downside.

Three metrics cut through the noise better than any price chart.

Forced liquidations show you when leveraged positions are getting washed out beyond fundamental value.

Long-term holder behavior reveals whether Bitcoin believers are actually holding or quietly heading for exits.

Bitcoin ETF flows tell you when institutional money managers think the worst is over.

I track all three because they separate actual risk from perceived panic.

Forced liquidations matter because MSTR's leverage amplifies Bitcoin moves in both directions. When Bitcoin drops sharply, margin calls force leveraged traders to sell, creating declines beyond fundamentals.

November 2025 and mid-January through early February 2026 saw forced liquidations soar, bringing steep dives exceeding normal corrections. MSTR's share price reflects these exaggerated moves.

Long-term holder data provides the second metric. As of February 10, holders with Bitcoin for over ten years control 17.2% of the supply. Combined holders from 1 to 10 years account for another 30.8%.

Nearly half the Bitcoin supply is held by people who've demonstrated multi-year conviction. These holders don't contribute to volatility - newer entrants trading Bitcoin as one asset class among many create the price swings.

Bitcoin ETF flows round out the picture. From January 16 through early February, outflows far surpassed inflows. Since February 6, inflows have consistently exceeded outflows. If that continues, it signals fund managers believe the worst may be over.

The debt structure deserves a closer look. Most of the $8.2 billion is convertible notes with no collateral requirements and no forced liquidation risk.

The company holds $2.25 billion in cash, providing roughly 2.5 years of dividend coverage for preferred shares.

CEO Phong Le said Bitcoin would need to stay at $8,000 through 2032 before debt coverage becomes a problem. Saylor said if issues arise, they'd refinance.

Whether that's possible in a distressed scenario is unknowable, but it's at least 6 years away under pessimistic assumptions.

The preferred stock structure adds complexity. MSTR issued multiple classes paying 8% to 11.25% dividends.

As the company pays these, the $2.25 billion cash reserve depletes. When that happens, they'll likely issue more common shares, creating predictable dilution that investors can model.

Between 2023 and early 2024, you could write "AI" in a presentation and ride the thematic wave.

Bitcoin-exposed stocks traded with roughly 80% correlation - buy any name, and you get the same trade. That correlation dropped to approximately 20%.

The market stopped treating Bitcoin plays as a basket and started differentiating between companies that can actually monetize exposure versus companies just burning cash.

MSTR's getting repriced as investors figure out whether leveraged Bitcoin accumulation with convertible debt makes sense.

I'm bullish on both Bitcoin and MSTR.

The leveraged structure means MSTR outperforms Bitcoin on the upside. The debt structure is more defensible than bears claim, and the runway extends further than most investors realize.

MSTR trades as a binary bet.

You either believe Bitcoin appreciates over time despite volatility, or you think the growth trajectory is unsustainable, and this is capital looking for a place to die.

There's no middle ground.

The emotional intensity around both Bitcoin and MSTR tells me most investors are making decisions based on where they bought rather than what the balance sheet shows.

The framework for navigating this is pretty straightforward.

Track forced liquidations to identify when price moves exceed fundamentals. Watch long-term holder behavior to gauge conviction among true believers.

Monitor ETF flows for signs that institutional money thinks we've seen the worst. Free cash flow, leverage structure, and whether the company's actually accumulating Bitcoin per share (not just in absolute terms) round out the analysis.

Companies selling stock during panic create some of the best buying opportunities of the decade, provided the balance sheet can survive to benefit.

MSTR's balance sheet suggests more runway than the disaster scenarios imply. Whether Bitcoin hits $8,000 and sits there for five years remains to be seen.

But if you're waiting for that scenario to invest, you've already made your bet.