A Dividend Derby Winner

When you're at a racetrack, eyeing the horses before the big race, you're not just looking for a quick win. You want a stallion that'll keep delivering, race after race.

Well, that's exactly what we're hunting for in the stock market – companies that can keep those dividend payouts growing year after year. And if there's one thoroughbred you won't want to miss, it's Abbott Laboratories (ABT).

This biotech and healthcare giant isn't just keeping pace; it's setting the darned pace. Abbott is dominating the medical devices arena, a sector projected to skyrocket from $518.5 billion in 2023 to a whopping $886.8 billion by 2032. That's a steady 6.3% annual growth rate.

However, Abbott's not content with just one race – they've got their fingers in the lucrative pies of diagnostics and nutritional products, too.

But hold your horses, partner. Abbott isn't some one-trick pony. They've got their fingers in the lucrative pies of diagnostics and nutritional products too. Earlier this year, I gave this stock a thumbs-up, and it's only become more of a hot ticket since.

Fresh off their first-quarter reveal in April, Abbott's core business – think medical devices, diagnostics, and even baby formula – grew organically by an impressive 10.8% year-over-year.

This marks the fifth consecutive quarter of double-digit growth, so we're not just talking about a lucky streak here.

From what I can see, their Medical Devices segment is the real workhorse, surging 14.2% over the previous year. Their FreeStyle Libre device isn't just flying off the shelves, it's practically teleporting, with sales up 23% from last year. And with the FDA's recent green light for innovative products like TriClip and Amulet, Abbott isn't just playing in the major leagues, they're calling the shots.

Their Nutrition sector wasn't a slouch either, pulling in $2.1 billion in sales, a 5.1% increase over last year. Abbott's new Protality shake, launched in January, is specifically designed for those on weight loss journeys, adding another feather to their growth cap. Needless

Even their Diagnostics segment, which saw a dip due to the waning of COVID-19 testing, showed underlying strength in non-COVID testing. Their recent clearance for a concussion diagnostic test proves they're not slowing down on the innovation front.

When it comes to financials, Abbott is built like a brick house. With rock-solid interest coverage and debt servicing capacity, it's no wonder analysts are predicting a steady climb in their earnings. They've got a pipeline of new products and a market that's bouncing back from the pandemic, creating a recipe for success.

And don't even get me started on the dividends. Sure, Abbott's 2.1% yield might seem modest, but it's the growth story that's truly captivating.

Over the past decade, they've seen a staggering 11.4% annual growth in dividends. This ain't no stagnant stock, folks; it's a purebred built for speed.

Of course, no investment is without its bucking broncos. Abbott's still wrestling with the drop-off in pandemic-related revenues, and while their R&D spending is admirable, there's no guarantee those investments will always pay off. And let's not forget the ever-present threat of cyberattacks—a risk for any big player in today's world.

Still, while there might be a few hurdles in the race, Abbott Laboratories is a thoroughbred built for the long haul. With a rock-solid balance sheet, a track record of innovation, and a dividend that's been growing faster than a foal in springtime, this is a stock that's hard to beat.

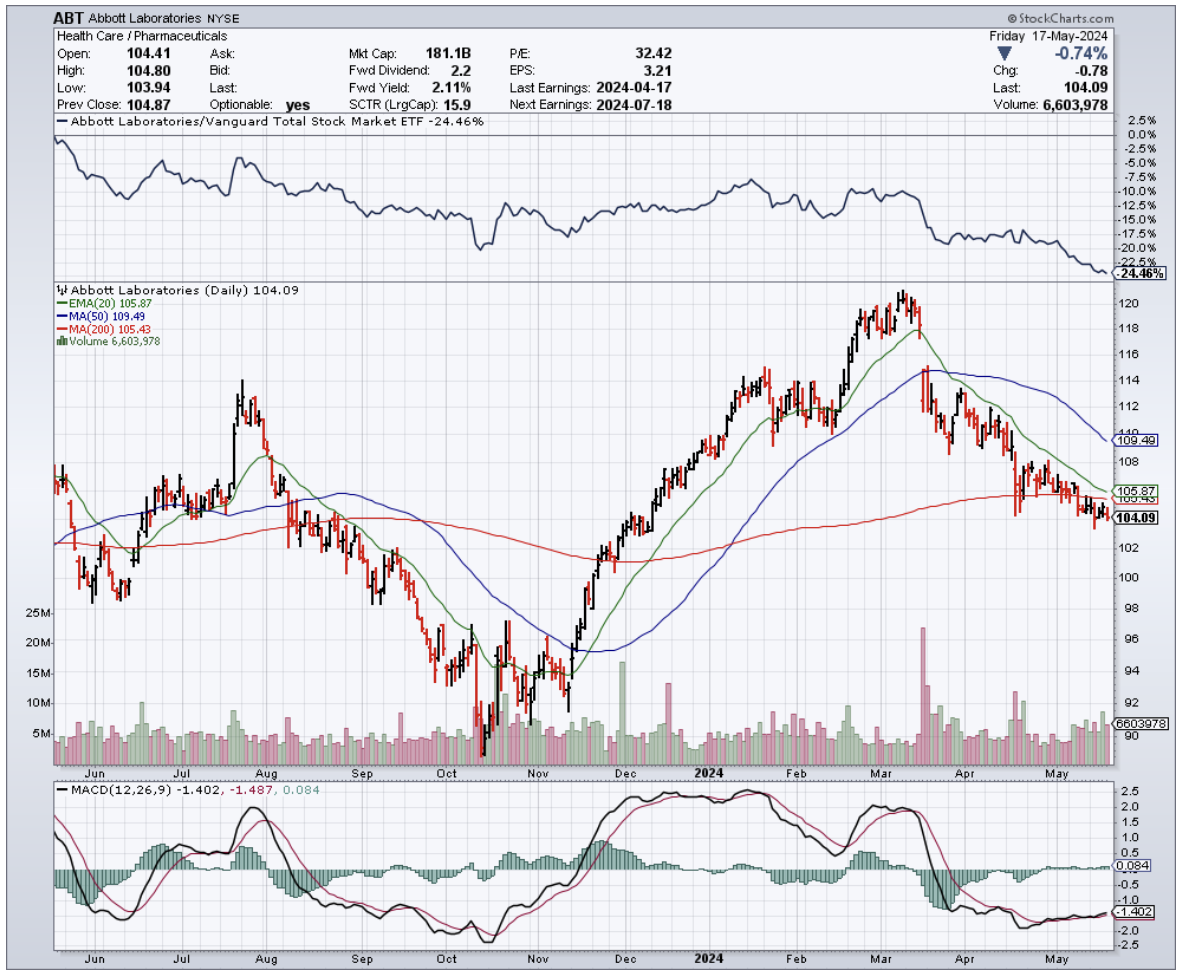

And right now, the odds are in your favor. This company’s shares have been trading at a discount. So if you're ready to saddle up with a dividend growth thoroughbred, it's time to consider adding Abbott Laboratories to your stable. Because when it comes to the dividend derby, this is one horse you'll want to back.