A Drug Kingpin Hiding In Plain Sight

Have you ever thought about big pharma stocks as potential goldmines? I mean, we usually don’t gossip about the likes of AbbVie (ABBV) over lunch, but maybe we should.

After all, those unassuming pharma giants could be hiding some serious potential for your portfolio. Let's dive into whether investing in AbbVie might just be your ticket to millionaire status.

Admittedly, AbbVie isn’t your typical headline grabber unless it’s about their next big thing in medicine. They’ve got a real knack for plucking the right strings in R&D, which not only keeps them competitive but also paves the way for massive returns.

Case in point: Humira. This blockbuster drug treats everything from arthritis to psoriasis and even though it’s facing generic competition left and right, it still bagged $14.4 billion in sales in 2023. That's no small potatoes, considering it’s a chunk of AbbVie's hefty $54.3 billion revenue.

So how does AbbVie keep the Humira money train rolling? They play smart with pricing and patents, and they've got a backup band ready with new drugs like Skyrizi and Rinvoq. These two are set to take over the stage with projected sales hitting a sweet tune of $27 billion by 2027.

And let me tell you, the transition from Humira to these newcomers is like swapping an old favorite band’s vinyl for their latest digital remix — just as good, if not better.

But here’s the deal. AbbVie isn’t just remixing their old hits. They’re producing whole new albums. With every new drug approval, they’re not simply aiming to keep up — they’re looking to lead the charts. And with their pipeline promising a few more blockbusters, it looks like AbbVie could keep the record-topping releases coming.

Take their recent shopping spree for example: snapping up Cerevel for a cool $8.7 billion. This isn’t some random acquisition. It’s a strategic move that bolsters AbbVie's impressive neurology treatment portfolio.

Cerevel is close to getting approval for a new schizophrenia drug, a game-changer that could redefine how we treat this debilitating disorder. Traditional medications often have harsh side effects, but Cerevel's new class of drugs shows promise in minimizing those risks. Think of it as a gentler approach that still packs a punch.

And there's serious money in this space. The neurological market is huge – around $3.82 billion – and growing fast.

Once Cerevel gets its FDA nod, I'm projecting revenues of around $200 million by 2025, and that's just scratching the surface. They could grab a hefty 2% market share by 2028.

But their ambition doesn't stop there. AbbVie wasn't content with just rocking the neurology charts. They also went and snagged ImmunoGen earlier this year for a whopping $10.1 billion, marking their entry into the lucrative battle against solid tumors.

ImmunoGen has this cutting-edge technology called antibody-drug conjugates (ADCs) – it's like guided missiles that pinpoint cancer cells while leaving healthy ones unharmed.

Their drug, Elahere, already got the green light last year for ovarian cancer and raked in a cool $246 million in just nine months. And that's just the start.

The ovarian cancer market is a beast, valued at $4.35 billion and growing rapidly. I predict Elahere's sales could skyrocket to $1.6 billion by 2028.

Now, let’s talk dividends because who doesn’t like a good payout?

AbbVie’s rocking a forward-dividend yield of 3.4%, and they've been increasing their dividends for decades. It’s like getting a steady rhythm of cash that just keeps getting louder.

And don’t forget about the share buybacks. AbbVie bought back nearly $2 billion of its own stock in 2023. That’s a lot of faith in their future hits and a sign that they’re betting big on their own success.

So, sure, AbbVie isn’t going to make you a millionaire overnight — it’s not a lottery ticket. But if you’re in the game for the long haul, this stock could be a key player in your wealth-building lineup.

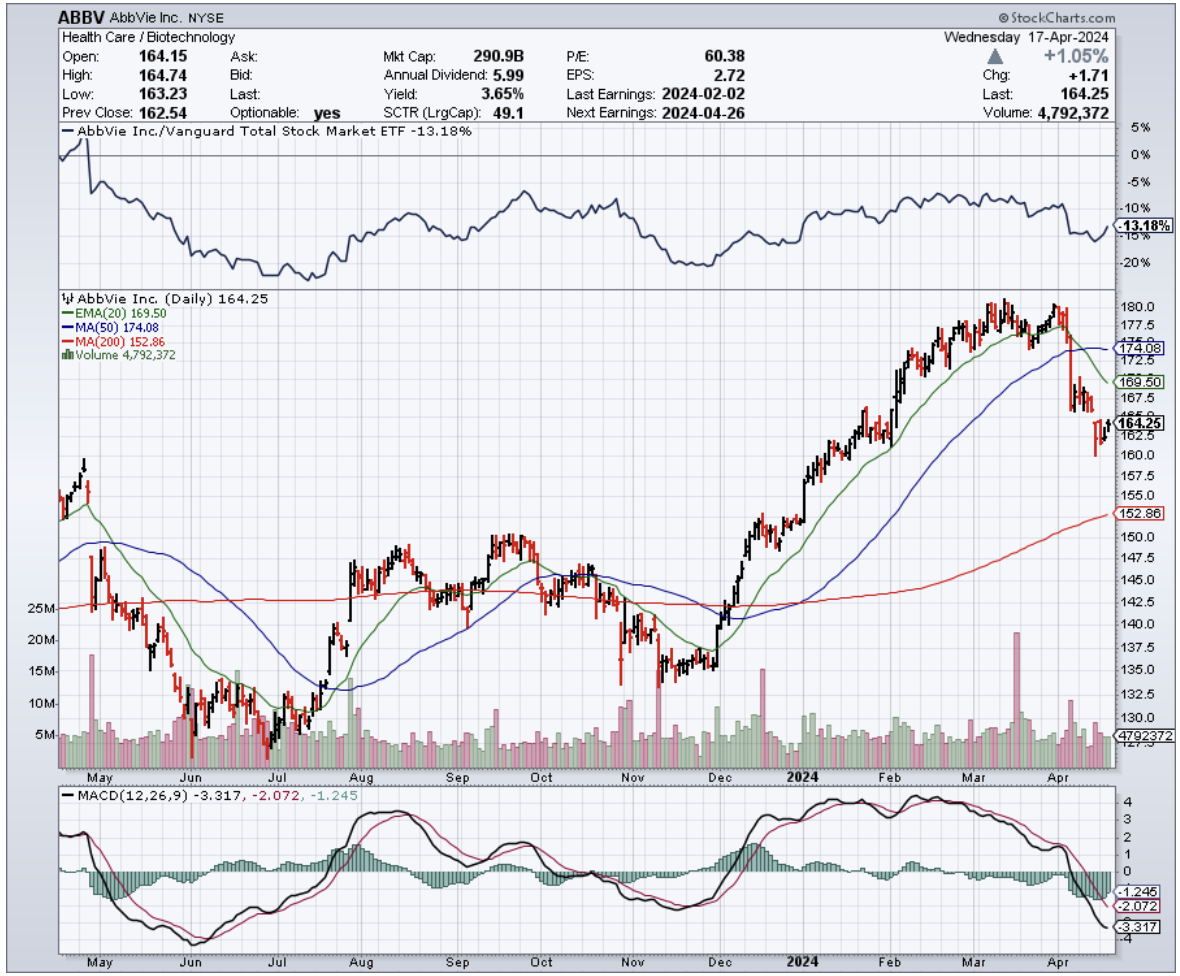

With a solid track record, a pipeline full of potential, and a strategy that’s clearly focused on growth, AbbVie is looking like a pretty smart pick. I suggest you buy the dip.