Africa Adopts

The Central African Republic has adopted bitcoin as legal tender which makes it the second country to absorb it as the official state currency after Central American country El Salvador.

Lawmakers unanimously adopted a bill that made bitcoin legal tender alongside the CFA franc and legalized the use of cryptocurrencies.

This makes The CAR the first African nation to use Bitcoin as their national currency.

Many Bitcoin deniers proclaimed insanity when El Salvador adopted Bitcoin as the national currency and to be frank, the experiment hasn’t gone as smoothly as it could have.

Many merchants still prefer hard US dollar bills to Bitcoin, but I would argue, that there are growing pains to go along with it.

There is honestly no playbook for this type of visionary legislation.

The landlocked state is one of the planet's poorest and most troubled nations, with an economy that is heavily dependent on mining.

The introduction was heavily criticized by the International Monetary Fund (IMF).

It warned of "large risks associated with the use of bitcoin on financial stability, financial integrity, and consumer protection" and with issuing bitcoin-backed bonds.

CAR has made this drastic decision in an aggressive way to attract venture capitalists and hedge funds.

For all those investors who have the privilege of spending dollars and euros, not everyone is from a country where they trust their own currency.

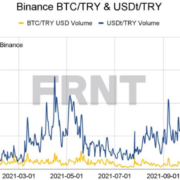

Just look at the Turkish lira.

I have some friends who bought luxury seaside villas in Ankara, Turkey because they thought that it was a guaranteed asset appreciation tool along with the added benefit of being able to take vacations to a gorgeous seaside resort.

In hindsight, the investment has been an utter failure.

Since they bought the property, the local currency has depreciated by 400% meaning they could have waited today and used only 25% of what they paid a few years ago.

I don’t want to sound arrogant, but much of the world still measures their wealth in US dollars and if a country has no access to US dollars in real-time, then why not adopt Bitcoin as an alternative?

Bitcoin is a guaranteed better store of value than the Central African Republic Franc and it is not even close.

Some of the emerging currencies have depreciated by 500% or 600% like the Turkish Lira or the Kazakh Tenge.

Bitcoin will definitely outperform the bulk of these marginal fiat regimes.

In fact, most people have never even heard of these sub-Saharan African republics.

Many are landlocked and are limited economically.

So I would argue that from a risk reward basis, it’s a great bet to make considering their local currency is worth less than the money it is printed on.

Not only that, I would fully expect other poor African countries like Botswana, Eritrea, South Sudan, and Chad to ship on the Bitcoin wagon as well.

The Central African Republic, which has gold and diamond reserves, is one of the world’s poorest nations. Years of violent conflict and a political crisis in the lead-up to presidential elections in December 2020 have had a severe impact on the economy and damaged relations with its international partners, leading to delays in the distribution of aid and some partners suspending budget support.

For many of these countries wrenched by years of war and strife, one might argue that Bitcoin could represent a beacon of financial stability along with a massive incentive to join the internet which only 11% of CAR citizens can claim.

Why not hit 2 birds with one stone.

Like Chinese citizens jumped from cash, bypassed plastic credit cards, to deploy a digital payment system on their smartphone called Wepay.

Why not go from the CAR Franc and skip any sort of solid fiat currency and go straight to Bitcoin.

Many sovereign countries without access to strong fiat currencies are coming to the same conclusion that it’s foundational to go the Bitcoin route than presiding over a currency that nobody in the world has ever heard about and wouldn’t touch with a 10-foot pole.

Welcome CAR to the Bitcoin club.

In 10 years, there will be a paradigm shift in which the consolidation of currencies will most likely leave us with a handful of Western currencies, the Chinese yuan, Russian Ruble, and crypto.