AI Alert - (UNG) December 26, 2023 - BUY LEAPS

When John identifies a strategic exit point, he will send you an alert with specific trade information as to what security to sell, when to sell it, and at what price. Most often, it will be to TAKE PROFITS, but, on rare occasions, it will be to exercise a STOP LOSS at a predetermined price to adhere to strict risk management discipline.

AI ALERT - (UNG) - BUY LEAPS

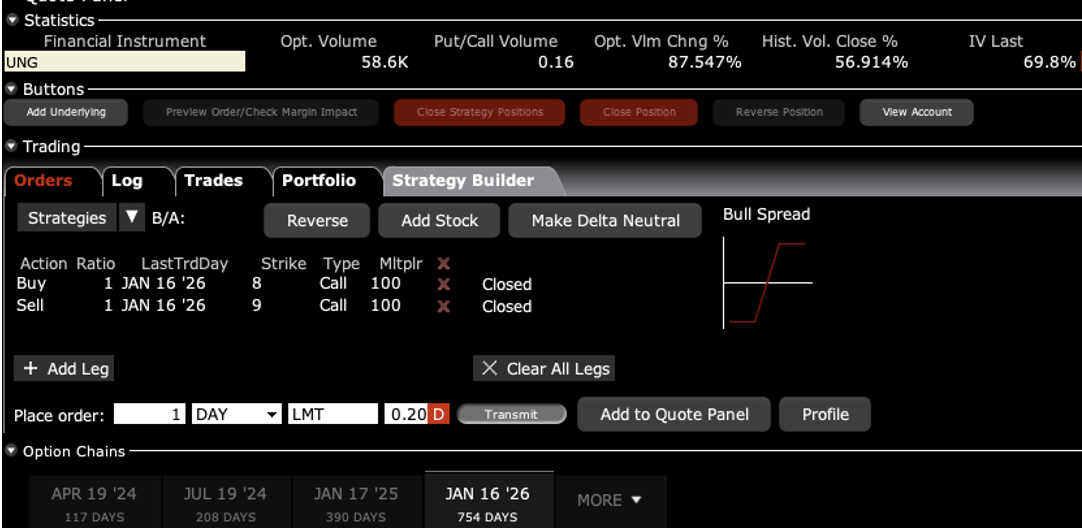

BUY the United States Natural Gas Fund (UNG) January 2026 $8-$9 deep out-of-the-money vertical Bull Call debit spread LEAPS for $0.20 or best

Opening Trade

12-26-2023

expiration date: January 16, 2026

Number of Contracts = 1 contract

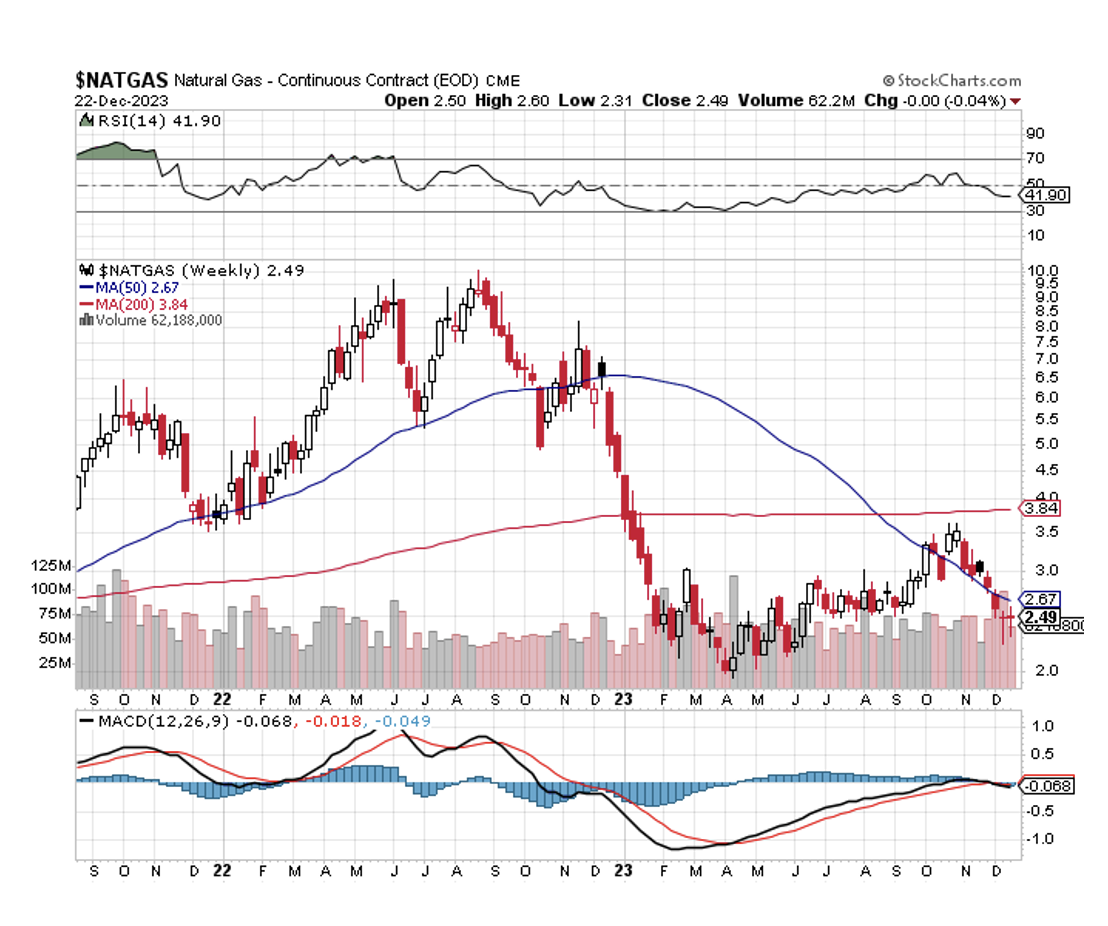

The really big energy play for 2024 will be in natural gas (UNG), which was absolutely slaughtered in 2023, plunging 68.3% from $6.00 to $1.90 per one MM BTU.

The problem here was not a shortage of demand because China would take all we could deliver. It was in our inability to deliver, hobbled by the lack of gasification facilities needed to export. The Freeport McMoRan export facility in Quintana, TX even blew up.

Natural gas (CH4) is now down so much that you have to buy it even if you hate it.

The play here is that in 2024 a number of new export facilities come online and the damaged ones repaired. That should send prices soaring. Natural gas prices now at a throw-away $2.00 per MM BTU could make it to $8.00 in the next 12 months. That takes the (UNG) from $5.00 to $15.00 (because of the contango).

That means right now you have to buy the United States Natural Gas Fund (UNG) on January 16, 2026 $8-$9 deep out-of-the-money vertical Bull Call debit spread LEAPS at $0.20 or best.

The much-predicted nuclear winter in Europe never showed. Instead, the continent enjoyed one of the warmest winters on record, with some ski resorts completely devoid of snow.

To save Europe’s bacon, the US government ordered the diversion of dozens of natural gas carriers from China to Europe. The Middle East also ramped up its gas exports.

It worked.

Now, we have recession fears. Storage in both Europe and the US is near all-time highs.

What happens next is that Covid burns out in China, allowing the economy to recover and sending the demand for natural gas through the roof.

That screeching sound you hear is natural gas wells being shut down, which happens every time we approach the $2.00 price in gas. That is sowing the seeds of the next shortage. That sets up an easy triple for gas from here.

While the chance of winning a real lottery is something like a million to one, this one is more like 10:1 in your favor. And the payoff is 300% in little more than two years. That is the probability that (UNG) shares will rise over the next 25 months.

I have been through a half dozen energy cycles in my lifetime, and I can see another one starting up.

Don’t pay more than $0.35 or you’ll be chasing on a risk/reward basis.

I think all carbon energy sources eventually go to zero over the next 20 years as they are replaced by alternatives, but we will have several doubles in price on the way there. This is one of those doubles.

But don’t ask me. I only drilled for natural gas in Texas and Colorado for five years in the late 1990s using a revolutionary new technology called “fracking.” I moved on after making a fortune, buying gas for $2 and selling it for $6 or $7.

To learn more about the United States Natural Gas Fund (UNG, please click here.

Please note that these options are illiquid, and it may take some work to get in or out. Executing these trades is more an art than a science.

Let’s say the United States Natural Gas Fund (UNG) January 16, 2026 $8-$9 deep out-of-the-money vertical Bull Call debit spread LEAPS are showing a bid offer spread of 15-30 cents, which is common.

Enter an order for one contract at $0.15, another for $0.20, another for $0.25, and so on. Eventually, you will enter a price that gets filled immediately. That is the real price. Then enter an order for your full position at that real price.

A lot of people ask me about the appropriate size. Remember, if the (UNG) does NOT rise by 78.57% to $9.00 in 25 months, the value of your investment goes to zero.

If by chance (UNG) rises quickly, which it might, you don’t have to wait the full two years. You can take profits at any time.

You never should have a position that is so big that you can’t sleep at night, or worse, need to call John Thomas asking if you should sell at a market bottom.

Keep in mind that (UNG) has a substantial “contango” of 35% a year to overcome. That means the futures one year out are selling at a 35% discount. So, natural gas has to rise by 35% in a year just for the (UNG) to break even. The contango covers gas storage charges and the cost of carry for borrowed money.

Notice that the day-to-day volatility of LEAPS prices is minuscule since the time value is so great. This means that the day-to-day moves in your P&L will be small.

It also means you can buy your position over the course of a month just entering new orders every day. I know this can be tedious but getting screwed by overpaying for a position is even more tedious.

Look at the math below and you will see that a 78.57% rise in (UNG) shares to $9.00 will generate a 400% profit with this position, such is the wonder of LEAPS. That gives you an implied leverage of 4:1 across the $8-$9 space.

I have done the math here for a single contract. You can adjust your size accordingly.

If you want to get much more aggressive on the natural gas trade, you can buy the ProShares Ultra Natural Gas ETF (BOIL), a 2X long leveraged ETF. Keep in mind that 2X ETFs have much higher costs, wider dealing spreads, and greater tracking errors. This is designed for short-term, or even day trading. (BOIL) is down a staggering 90.67% from its June high.

Only use a limit order. DO NOT USE MARKET ORDERS UNDER ANY CIRCUMSTANCES. Just enter a limit order and work it.

This is a bet that the (UNG) will not fall below $9 by the January 16, 2026 option expiration in 25 months.

Here are the specific trades you need to execute this position:

Buy 1 January 2026 (UNG) $8 call at………….………$1.60

Sell short 1 January 2026 (UNG) $9 call at…….……$1.40

Net Cost:………………………..….………..……….….….....$0.20

Potential Profit: $1.00 - $0.20 = $0.80

(1 X 100 X $0.80) = $80, or 400% in 25 months.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of Interactive Brokers.

If you are uncertain on how to execute an options spread, please watch my training video on “How to Execute a Vertical Bull Call Debit Spread” by clicking here.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep-in-the-money spread trades can be enormous.

Don’t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.