Another One Bites The Dust

FTX cryptocurrency exchange CEO Sam Bankman-Fried said he has more than $2 billion to backstop crypto industry if needed.

That’s a scary statement to issue that most likely assumes the worst scenarios are coming true for his beloved digital gold.

By the way, $2 billion is peanuts considering this industry used to be worth over $1 trillion just a little bit ago.

Not sure if his token $2 billion would make a dent at all, however, it might save a company or 2 if that is what Bankman-Fried is aiming for.

This small sum will do nothing if systemic risk goes from bad to worse and the industry falls apart which would happen if bitcoin dropped to $2,000 per coin.

Perhaps if he could scrounge up an extra $1 trillion or so to buy out the whole crypto industry then we would be in business – literally.

We need to look at the situation with more critical thinking than wishful.

The FTX CEO also said the worst appears to be over for the liquidity crunch in the cryptocurrency industry.

That could possibly be a sneaky way to say that the worst is yet to come.

Why would Bankman-Fried think the liquidity crunch will stop on a dime?

Isn’t that odd?

Well, of course, he has skin in the game, so his words are empty. It’s like a real estate agent telling someone they should buy a house.

Last time I checked, crypto was supposed to be a great hedge to hyperinflation and that has failed miserably.

Little did he know, Central Bank Governor Jerome Powell, in the Fed minutes revealed yesterday, say that the Fed is prepared to act more aggressively to tame inflation with bold rate rises.

If there are more rate rises which the Fed forecast implies, the Fed Fund’s rate is going to 3.75% by 2023, then crypto will be worth even less than it is today if the same dynamics and price behavior hold true.

The dynamics that were working for crypto during the bull cycle and are now working against them.

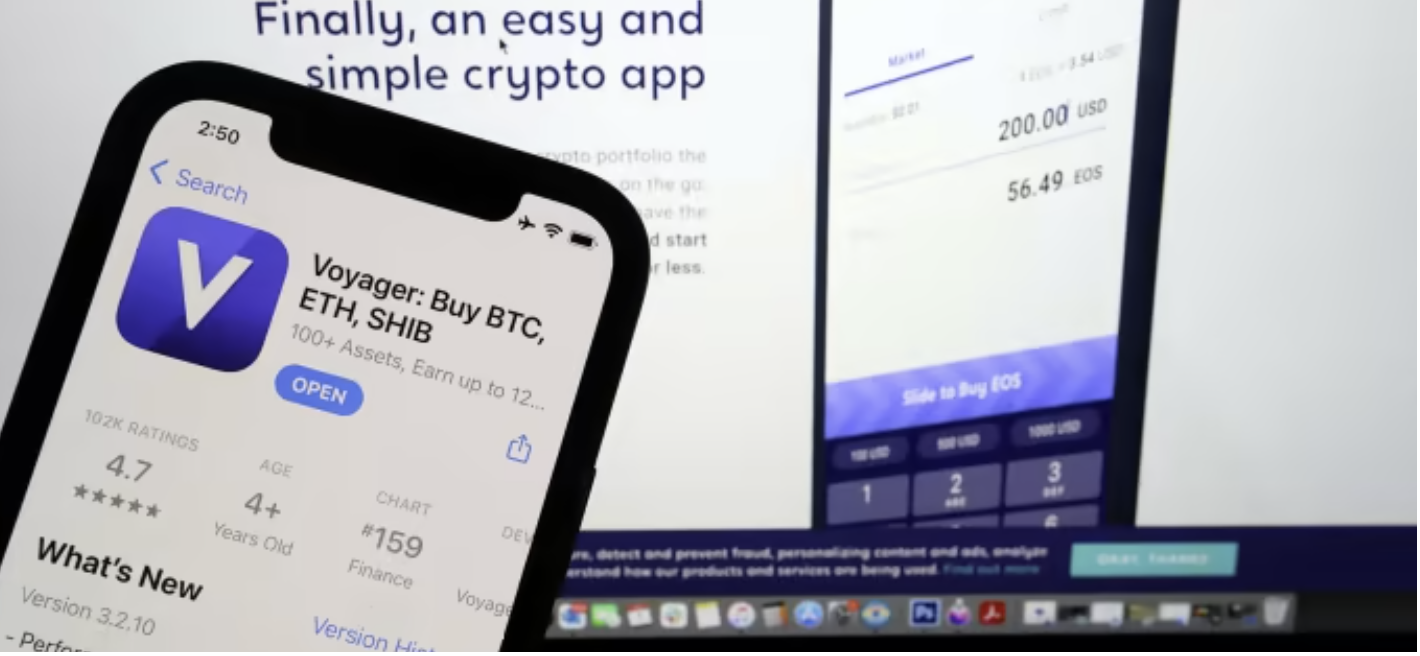

No doubt Bankman-Fried’s comments had to do with the timing of the newest bankruptcy in the industry of crypto brokerage Voyager Digital (VYGVF).

The trust in crypto infrastructure sinks yet again.

Account holders at now-bankrupt Voyager Digital shouldn’t expect to get all their crypto back as the company restructures.

The crypto brokerage and lender filed for Chapter 11 bankruptcy, creating unresolved legal questions about how digital assets will interact with US insolvency law.

Voyager appears to plan to just walk away from their obligation to return capital to account users.

The company’s plan to exit bankruptcy plainly says it expects account holders to be “impaired” by the Chapter 11 process, meaning they won’t be getting back exactly what they’re owed.

This could be the straw that breaks the camel’s back.

Legally, decentralization could be a farce and if Voyager is able to walk, it means Voyager and its platform is even more centralized than crypto industry’s criticism of fiat currency.

At least fiat currency on exchanges is insured and account holders get their money back in full upon bankruptcy.

Sure, the price of bitcoin is up incrementally today, but the industries’ health couldn’t be at a lower ebb.

There is a high probability that bitcoin will touch $12,000 first before it goes back to $30,000.