April 10, 2024

(INVESTORS ARE SPINNING ON EMPTY AS THEY COME TO GRIPS WITH ECONOMIC DATA)

April 10, 2024

Hello everyone,

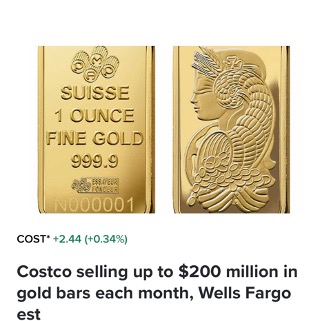

Have you invested in Gold Bars? Look who is selling them.

But I’m sure your portfolio already has quality gold and silver stocks. Right?

Let’s pause for a moment and consider where we are.

I’m not speaking philosophically.

I’m talking about where we are in the economic cycle, by using an analogy of washing machine cycles.

Let me briefly explain.

For the last few years, we have been in the wash cycle, and that cycle was definitely not the one we use for Delicates or Woollens.

We have been washed up, rinsed, tossed around, and radically tested.

There was great cost and disruption associated with this cycle, so the world saw a flush of funds and then an acceleration of costs – inflation.

We are moving into the spin cycle now, where everything seems chaotic, and you can’t seem to get your bearings or make sense of the world. Disconcerting, to say the least.

How long will the spin cycle last? – not sure yet.

Markets have rebalanced. While the tech sector is resting, energy, commodities, and the metals have taken centre stage and have risen steadily.

Jamie Dimon, CEO of J.P. Morgan commented recently on the economic outlook and emphasised the need for investors to stay overweight on commodities with a focus on energy to hedge against inflation as he believes interest rate cuts may arrive much later than originally forecast.

According to Marko Kolanovic, J.P. Morgan’s chief market strategist “we are not out of the woods yet on inflation, and the current backdrop of above-trend growth raises the risk that inflation will re-emerge as a problem for both central banks and markets.”

In recent months, inflation has risen in both the U.S. and Western Europe, most particularly in the services sector. Due to stronger economic growth, JPMorgan has revised its global growth upward by 0.5% in the first half of this year.

The investment bank now expects the Fed to start cutting interest rates in July – and right now it still sees 75 basis points of cuts through year-end.

However, this forecast is tied to data related to growth and inflation and so the Fed could easily pull back from pulling the trigger on the expected number of rate cuts. And it is a possibility we may not get any at all.

The crude rally is impacting the global economy at the same time as the conflict in the Red Sea disrupts shipping and demand puts upward pressure on prices.

JPMorgan expects Brent prices could rise to $100 a barrel by September.

Why?

Russia is slashing production and Ukraine is escalating drone attacks against Russia’s energy infrastructure.

Ukraine has hit 18 Russian oil refineries so far with a total annual capacity of 3.9 million barrels per day. An estimated 670,000 barrels per day of Russian refining capacity is currently shuttered, according to JPMorgan. What this means is that Ukraine’s attacks could force Russia to cut production further and ban gasoline exports.

The U.S. could act here and become a fall-back measure by tapping the strategic petroleum reserve as a countermeasure if the situation escalates and deteriorates further.

Interesting times, to say the least.

Cheers,

Jacquie