April 14, 2025

(VOLATILITY IS A WELCOME CREATOR OF OPPORTUNITY)

April 14, 2025

Hello everyone

WEEK AHEAD CALENDAR

Monday, April 14

12:00 p.m. US Fed Speakers

Earnings: Goldman Sachs, M&T Bank

Tuesday, April 15

8:30 a.m. Export Price Index (March)

8:30 a.m. Import Price Index (March)

8:30 a.m. Empire State Index (April)

8:30 a.m. Canada Inflation Rate

Previous: 2.6%

Forecast: 2.8%

Earnings: J.B. Hunt Transport Services, United Airlines, Omnicom Group, Citigroup, Bank of America, PNC Financial Services Group, Johnson & Johnson

Wednesday, April 16

8:30 a.m. Retail Sales (March)

9:15 a.m. Capacity Utilization (March)

9:15 a.m. Industrial Production (March)

9:15 a.m. Manufacturing Production (March)

9:45 a.m. Canada Rate Decision

Previous: 2.75%

Forecast: 2.75%

10:00 a.m. Business Inventories (February)

10:00 a.m. NAHB Housing Market (April)

Earnings: Kinder Morgan, CSX, Travelers, U.S. Bancorp, Citizens Financial Group, Prologis, Abbott Laboratories, Progressive

Thursday, April 17

8:15 a.m. ECB Rate Decision

Previous: 2.5%

Forecast: 2.25%

8:30 a.m. Continuing Jobless Claims (04/05)

8:30 a.m. Housing Starts (March)

8:30 a.m. Initial Claims (04/12)

8:30 a.m. Philadelphia Fed Index (April)

Earnings: Netflix, Truist Financial, State Street, American Express, Snap-On, KeyCorp, Fifth Third Bancorp, Regions Financial, United Health Group, Charles Schwab, Huntington Bancshares, D.R. Horton, Marsh & McLennan Cos.

Friday, April 18

NYSE closed for Good Friday holiday.

Volatility – Make It Thy Friend

Are you enjoying The Ride?

Volatility is expected to continue into this week.

Uncertainty is the dark cloud hanging over the world due to the Trump administration’s constant policy backflips and sidesteps over trade tariffs – from day to day we are uncertain which countries are exempt, or pay a lower tariff, which goods are exempt and how long the pause will be on tariffs and how long tariffs will be enforced.

It's all very chaotic and leaves companies completely undone in trying to understand their position in relation to earnings in the future.

It’s futile currently; there is no firm ground anywhere.

But this volatility can create valuable opportunities.

Stocks are on sale. And the markdowns will be here for a while – but not forever.

The latest change to Trump’s trade tariffs circles around electronics imported from China – iPhones, computers, and computer chips have been temporarily exempted from tariffs. We don’t know how long this will last. But tech stocks are expected to surge when the market opens on Monday.

It's interesting to note the resilience of Bitcoin, which has held up remarkably well during the tumultuous movements that have taken place on global markets. It’s now being seen as a hedge and a distinct asset class.

MARKET UPDATE

S&P500

The index has bounced nicely from the April 7 low at 4835. Though this market is obviously oversold, there is still no evidence of even a shorter-term low in place. And this suggests weakness back toward the 4800-support area.

Resistance: $5480/$5595

Support: $5110/$4915

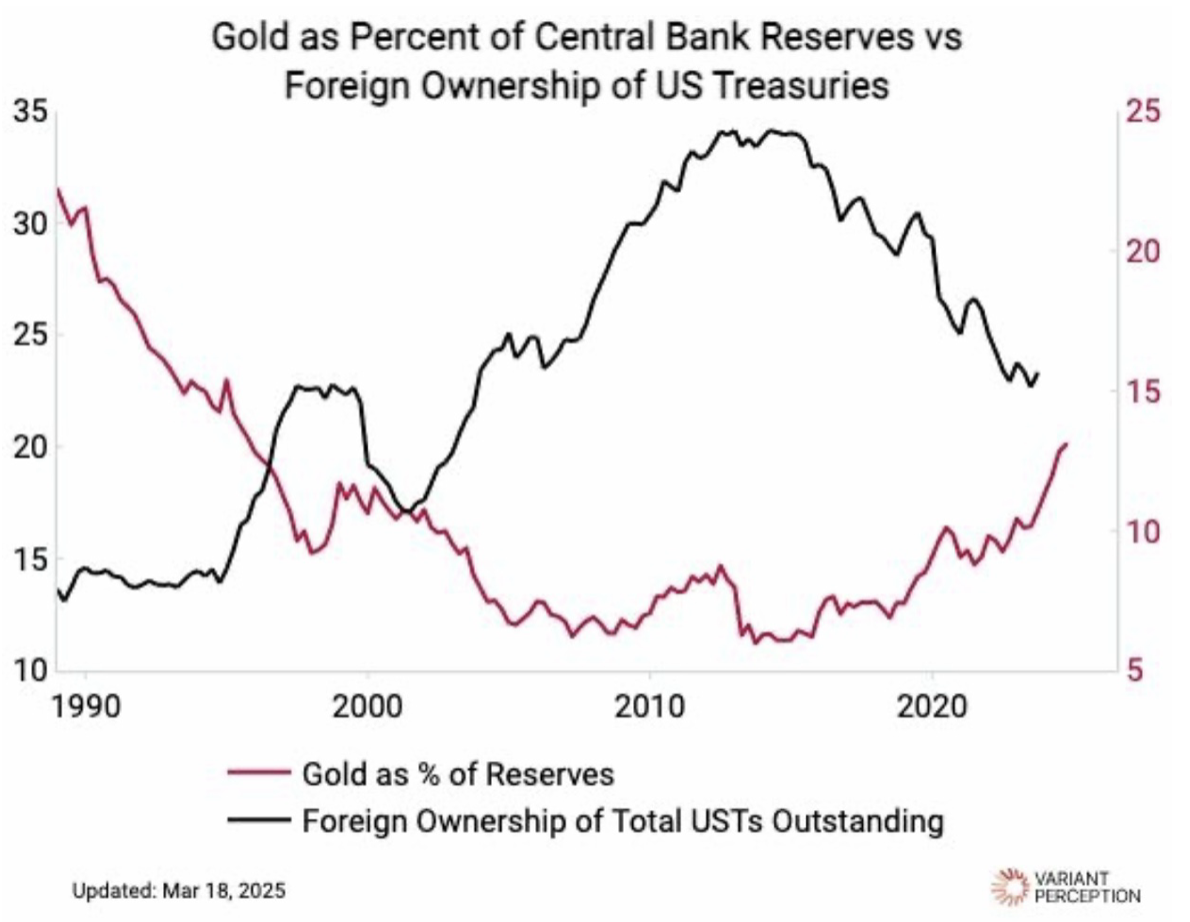

GOLD

Gold has rallied to another all-time high, reaching $3245. There is no confirmation of a top yet, but the market is certainly overbought, raising risk.

Resistance: $3240

Support: $$3160/$3100/$2975

BITCOIN

Bitcoin did push down into the low $70’s before quickly bouncing. Eventual new highs are favoured. Basing takes time and even though we have seen a nice move up, there is still a risk more basing will take place, and we may even see a slight new low before a more significant upside is seen.

Resistance: $85.3/$85.8 (If we can close above these levels – a final low may be in place).

Further resistance levels above include $ 88.6/$ 88.6/$92.1

Support: $79.5/$74.4/$73.3

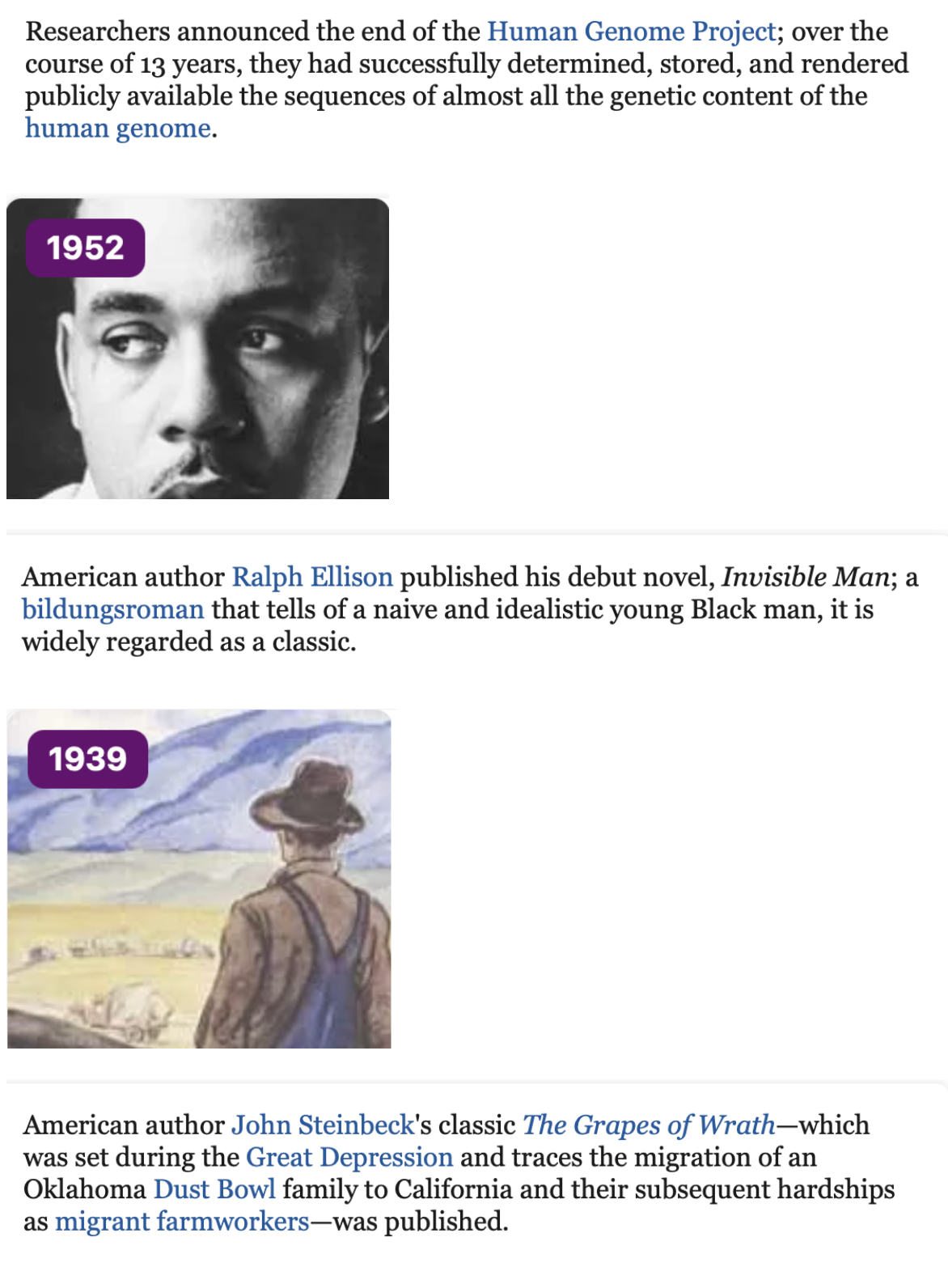

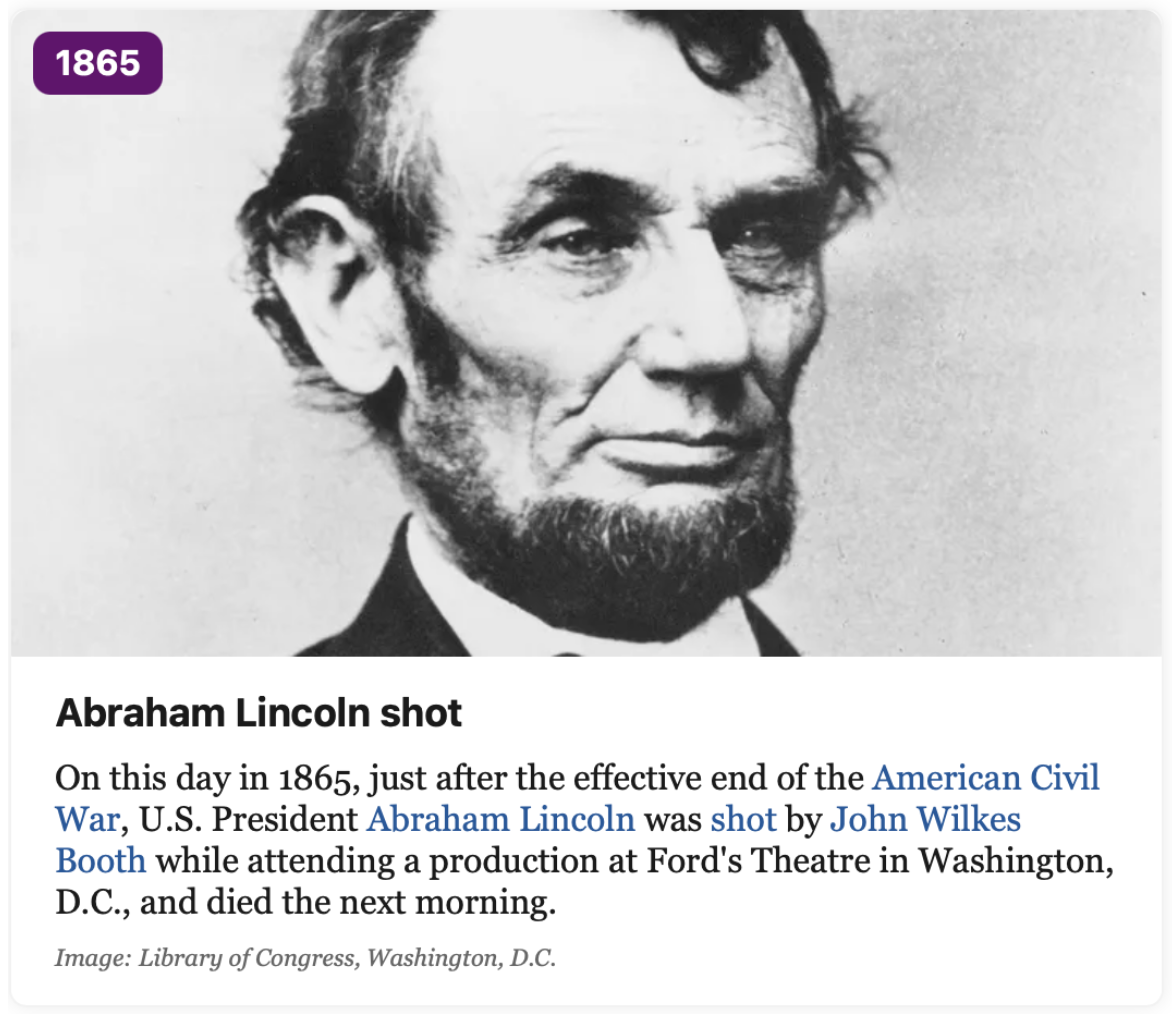

HISTORY CORNER

On April 14

SOMETHING TO THINK ABOUT

Mohamed El-Erian expresses the notion that Economic and Market Stability Hinges on These Questions

- Are the “wins” from gaining concessions from the more than 70 countries eager to negotiate with the US sufficient to calm markets and restore the economy’s footing?

- Are there pathways to constructive negotiations between China and the US that do not involve a significant loss of face for either party?

- Can the administration and the Fed signal the existence of credible bazooka-style circuit breakers that would be quickly activated with limited collateral damage should financial markets malfunction?

- How much patience will holders of American assets, particularly foreign holders, have in the face of the threat of Chinese selling?

- How much of the damage to America’s global standing and reputation is already too close to the line that separates worrisome from irreversible?

- How hard is it to persuade US households and companies to maintain their spending during such a time of heightened uncertainty?

- How quickly can the US counter China’s stepped-up efforts to present itself to other countries as a responsible and dependable partner for trade, technology, institutional collaboration, and, eventually, a collective payments system?

American policymakers need satisfactory answers to these questions if they are to successfully navigate the Trump administration on its desired path.

Trump’s goals –

Fairer trading system

More enabled private sector

A slimmed down and more efficient public system

A more favourable debt dynamic

“The stock market is the only market where things go on sale and all the customers run out of the store.”

Cullen Roche

Cheers

Jacquie