April 17, 2023

JOHN’S VISIT TO MUSK’S GIGAFACTORY AND THE TRINITY SITE

Monday, April 17, 2023

Hello everyone.

I hope you are all refreshed after the weekend and ready for another week of trading and expiration on Friday, April 21.

Before I get into my post today, I would like to extend a “get well” note to one of our Concierge subscribers, Linda Constable. She has Covid and is under the weather at present. We are all wishing you a speedy recovery.

Today I am going to dive into John’s Monday newsletter and give you a summary of what’s in store.

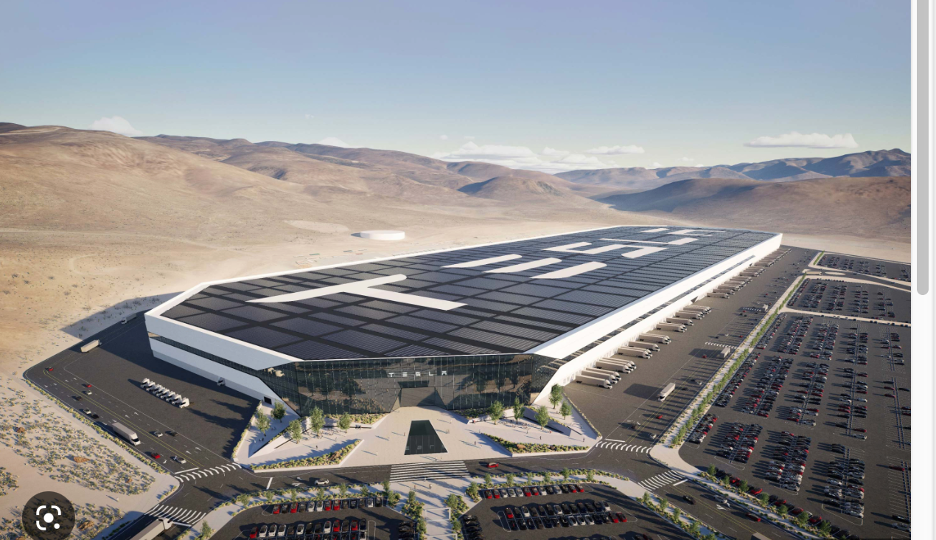

John has recently visited Elon Musk’s Gigafactory, 20 miles east of Reno. To say it is massive would be an understatement. No cameras are allowed after you enter. The factory consists of an army of robots building machines. Human beings make a scant appearance when needed, otherwise, they are barely visible. John shares that the factory occupies about 2 million square feet or about 33 football fields. Japan’s Panasonic, which has the contract to supply the batteries, occupies a substantial part of the factory space. When it is finished it will occupy 6 million square feet, making it the world’s largest building. The facility is energy neutral and runs 24/7.

The state of Nevada will benefit from Musk’s facility. The state has granted Tesla a ten-year tax holiday to start the second phase, which will employ another 5,000. Whole cities are starting to spring up out of nowhere as buildings and businesses spread east from Reno.

Musk is charging ahead to meet his 1.8 million vehicle targets for 2023, up 40% from 2022.

John has reminded us many times, THE FUTURE IS HAPPENING FASTER THAN ANYONE REALISES.

Tesla is really a preview of what will eventuate in the business sphere and in our everyday lives. AI/automation trend is moving rapidly, and the consequence will be an eventual tripling of the value of companies that embrace these trends and wipe out those that don’t.

ALL companies are AI plays, John says. This is largely behind his DOW 240,000 in a decade prediction. John reminds us that Microsoft brought out its office in 1990 and it instantly made ALL companies more valuable as they adopted it. The Dow Average soared by 20 times from $600 to $12,000. It will be a similar story with AI.

John argues that a 20-fold return from here takes the Dow Average from $34,000 to $680,000, except that it will happen much faster as technology is hyper-accelerating. Therefore, John thinks that DOW 240,000 looks like an easy target.

If you think John has been taking a substance no one knows about and is exaggerating these numbers, think about these headlines for a moment.

FedEx (FDX) fires 86,000 drivers, who will be replaced by robots.

Uber (UBER) is replacing its 5 million drivers with autonomous drivers to increase reliability & cut costs.

Dentists adopting AI to read X-rays are catching 12% of cavities they miss, thereby increasing fillings and increasing profits.

In five years’ time, John says that companies like Microsoft’s (MSFT) Chat GPT and Alphabet’s (GOOGL) DeepMind Technologies will be spun off and sold at enormous multiples to the public.

The roaring 20s, will be a part of our lifetime with technological advancements providing the juice. All asset classes will rocket in value – including stocks, bonds, commodities, precious metals, energy, and real estate.

The 2020s is the genesis of AI and robots.

Start lining up those stocks to buy because in five to ten years you will be sitting on a very rewarding basket of stocks.

John’s 2023 year-to-date performance is now at +49.57%. His average annualized return is up to 48.51%.

John took profits on his JPM trade after it posted fantastic earnings. He rolled that into a Boeing (BA) trade. He also took profits in his April bond long (TLT) and rolled it into a May bond long. He will run his remaining April long positions in (TSLA), (BAC), (C), (IBKR), (MS), (FCX) into the Friday, April 21 expiration.

I hope you all had at least one of those positions.

John’s life is full of great stories. His visit to the Trinity site at the White Sands Missile Test Range is just one of them. This was where the first atomic bomb was exploded on July 16, 1945. He tells us that the 20-kiloton explosion set off burglar alarms for 200 miles and was double to ten times the expected yield.

Uranium plays like Cameco ((CCJ), NextGen Energy (NXE), Uranium Energy (UEC), and Energy Fuels (UUUU) are great long-term plays. John tells us that uranium is being described as a carbon-free energy source needed to replace oil.

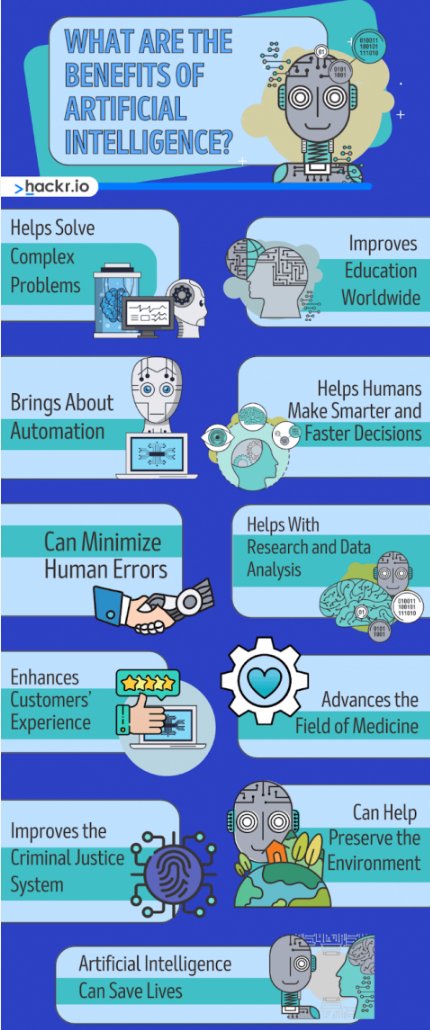

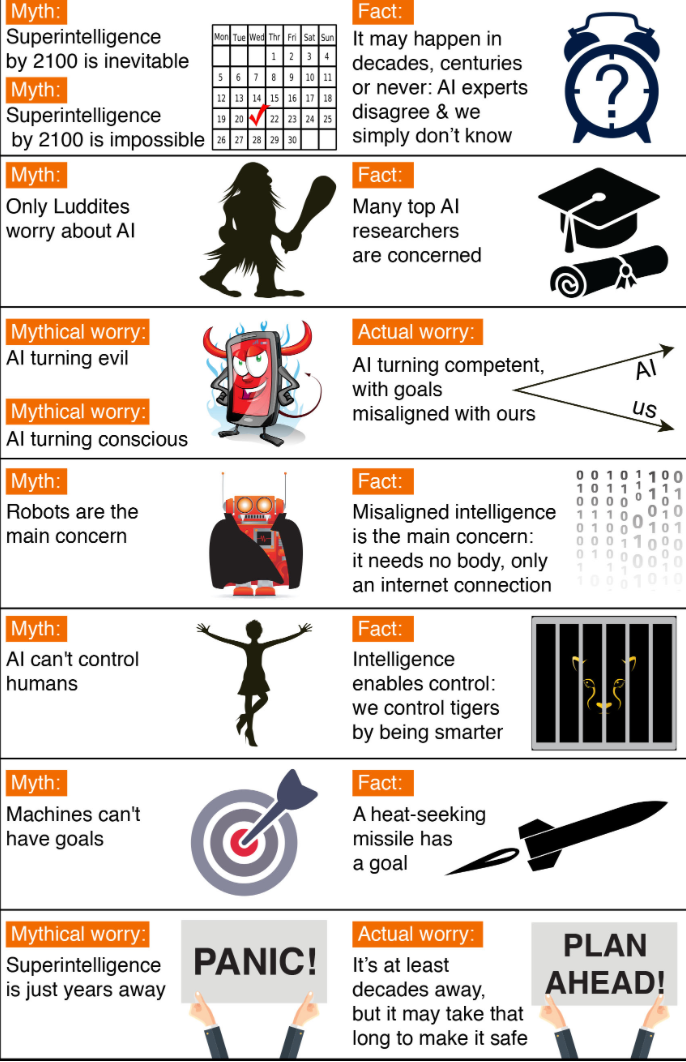

I’ll leave you today with some myths and facts about AI. There is a healthy debate going on and analysts don’t agree on all aspects of AI.

Have a wonderful week.

Stay healthy.

Cheers,

Jacque