April 3, 2024

(ANALYSTS AND INVESTORS ARE STARTING TO PAY ATTENTION TO THE ENERGY SECTOR)

April 3, 2024

Hello everyone.

The month of April is upon us, and the market environment has turned a little cloudy.

Economic data and heightened geopolitical risks appear to be fuelling the move higher in Oil prices. With the new month, investors have been greeted with escalating tensions in the Middle East with indirect Iranian involvement. OPEC member Iran has blamed Israel for a deadly air strike Monday on its consulate in the Syrian capital of Damascus that reportedly killed seven of its officers.

On Tuesday, Tehran pledged to take revenge for the attack, which was seen as a major escalation in the Israel-Hamas war. It is clear that the potential for direct Iranian involvement in the Israel-Hamas war could ignite a widespread regional conflict with a significant impact on oil supply.

Meanwhile, in Ukraine, we have seen Ukrainian strikes on one of Russia’s largest oil refineries with a drone attack on the highly industrialized Tatarstan region, some 800 miles from the front lines of the conflict. Russia has been hit by many Ukrainian drone strikes in recent months and has sought to escalate its own attacks on Ukraine’s energy infrastructure.

Robert Schein, CIO at Blanke Schein Wealth, believes energy could be the story of the summer. He goes on to comment that energy stock valuations are “really attractive” pointing to multiples that are largely in the low-teens range. Furthermore, he notes that the companies in the space have strong cash flows and balance sheets.

Schein sees this move in oil stocks as the start of a rebound. The Energy Select Sector SPDR Fund (XLE) has added more than 12% in the first quarter of 2024, outperforming the S&P500’s gain of just over 10% during the same period. The fund lost more than 4% in 2023, bucking the broader market’s uptrend. But energy has now started to break out after being “left behind” as Schein puts it.

Schein points out that a rise in crude oil into the mid-$80 price range bodes well for stocks in the sector. “If they’re making money at $70 a barrel, they’re printing money in the $80s and $90s.”

Adding further fuel to the fire of supply chain disruptions is the Port of Baltimore bridge collapse. And that event is on top of the ongoing geopolitical conflicts that have already been providing upward pressure.

Schein argues that most investors are probably underweight on energy. His team has been currently boosting its exposure to the sector. The Energy Select Sector SPDR Fund (XLE) is a diversified way to add weight.

On February 8, 2024, under the newsletter titled “Three Stocks to Buy in 2024,” I recommended Exxon Mobil (XOM) and suggested you buy the stock or buy LEAPS, or do both. The price of (XOM) at the time was $102.20. For those who trade options, I recommended one-year LEAPS out of the money and gave the following suggestions on strike prices: 105/110 or even 110/115 with an expiration of January 17, 2025. (Congrats to you if you invested!) Price of (XOM) stock now is $119.28. I also put out a trade alert to purchase two-year LEAPS in July 2023 on Chevron (CVX).

Schein notes that these large-cap picks can be advantageous during tough times, as the companies typically support their stocks by doing buybacks.

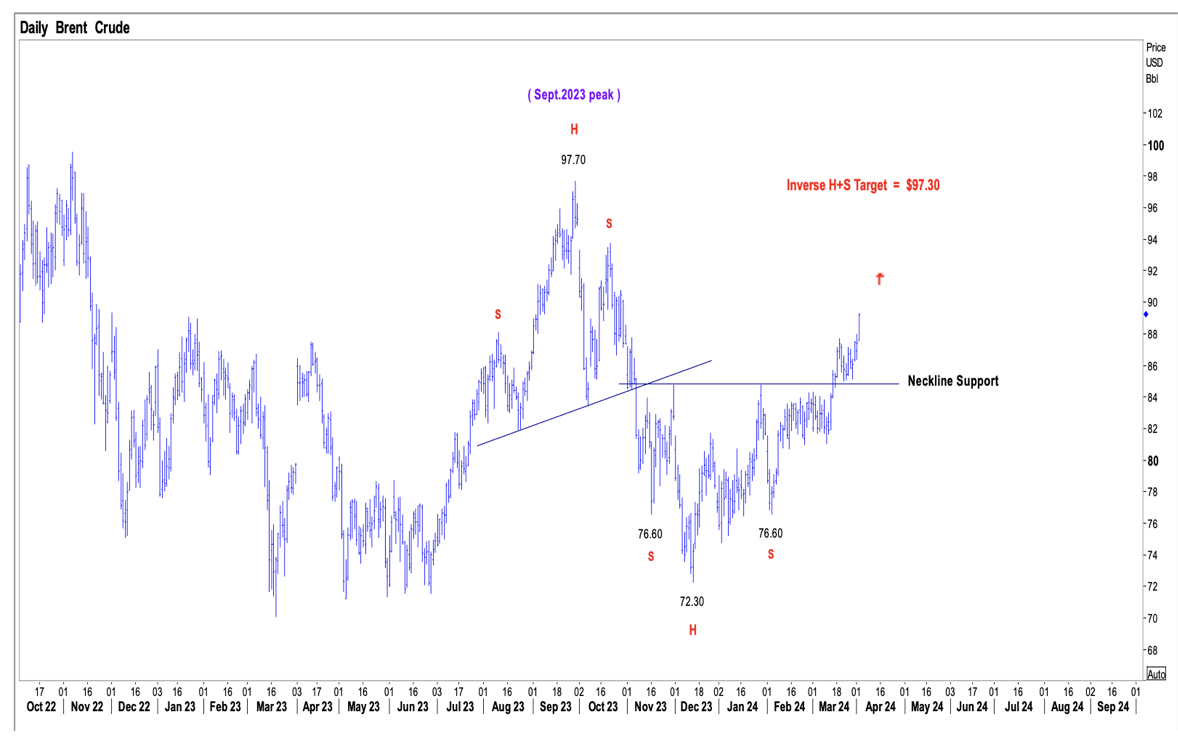

Bullish move underway in Oil.

A Global Chip Supplier that is worthy of attention

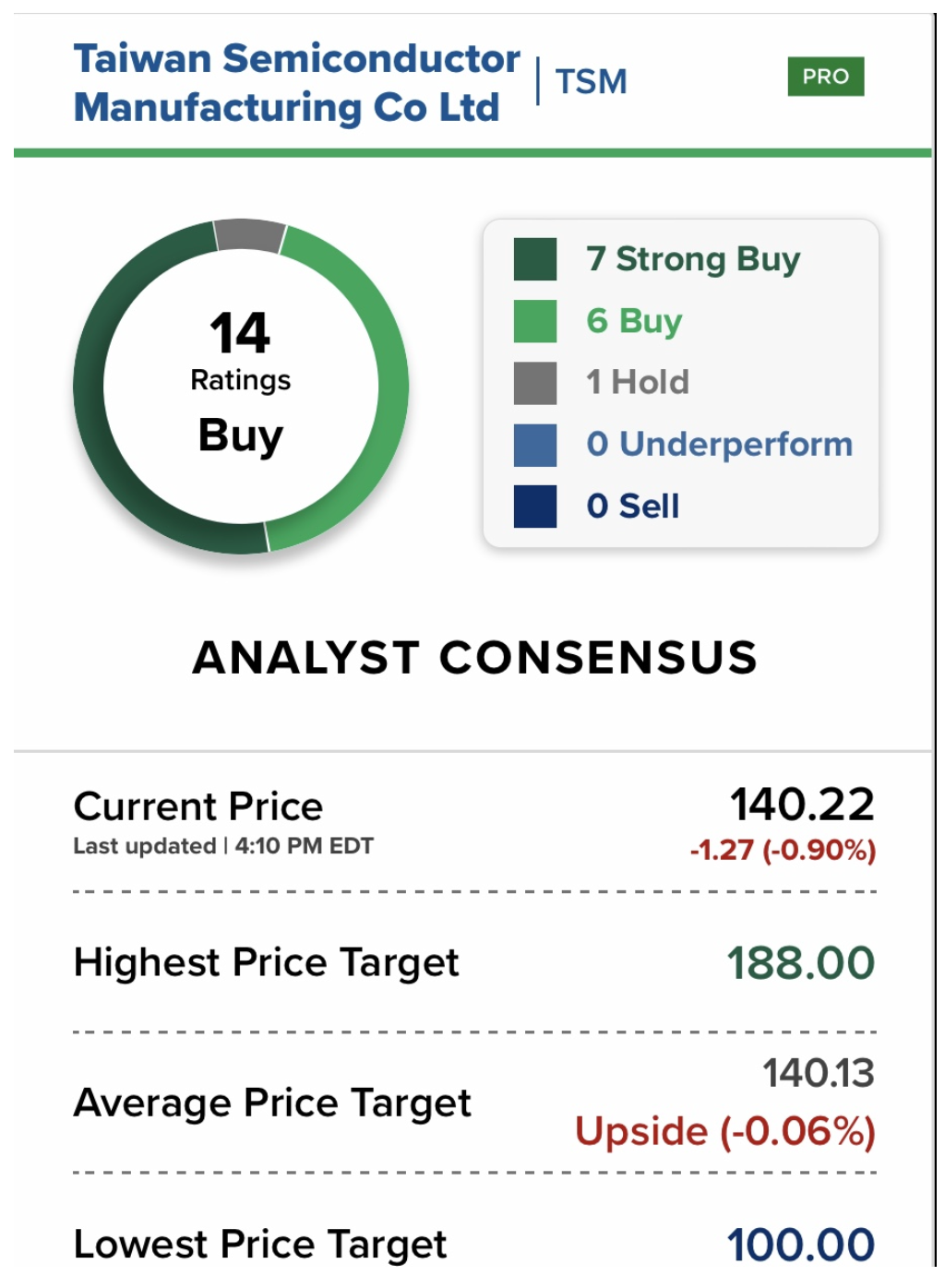

The boom in demand for artificial intelligence is rocketing many technology stocks. However, one in particular is a global chip supplier that manufactures key AI components and is presently undervalued. Taiwan Semiconductor Manufacturing Co Ltd (TSM) ($140.22) is a supplier to chip giants such as Nvidia, Advanced Micro Devices and Qualcomm. Wall Street analysts are arguing that (TSM) could rally another 27%. The stock currently trades at 21 times forward price to earnings versus 31 times for the broader Van Eck Semiconductor Index (SMH).

What’s the reason for the potential rally?

More customers will require leading-edge tools for new AI products. Wall Street analysts including JPMorgan argue that the expectation for strong wafer shipments will see second-quarter revenue up 6%-8% quarter over quarter. Furthermore, the investment bank comments that the overall 2025 demand picture (outside of AI) is also constructive following nearly two years of inventory correction.

Please note, that I am not recommending you buy the stock right now. I am merely drawing your attention to the stock and giving you information, so you can make informed decisions about whether to purchase this stock at any time in the future. Put it on your Watch List.

Cheers,

Jacquie