August 14, 2023

(WHAT’S A POTENTIAL $2 TRILLION GREEN FUEL SOURCE – LET’S TAKE A LOOK AT HYDROGEN)

August 14, 2023

Hello everyone,

Hydrogen equities have been tossed about and beaten down in recent months. However, many analysts, believe that this sector remains central to the energy transition and could become a $1 trillion to $2 trillion -size market by 2050.

What deflated hydrogen stocks?

Higher interest rates.

Lack of profitability and improvements in batteries.

To support the hydrogen sector, countries around the world have brought in policies.

Analyst, Neil Beveridge comments that The U.S.’s Inflation Reduction Act and Programs in the European Union and China support the demand case for hydrogen.

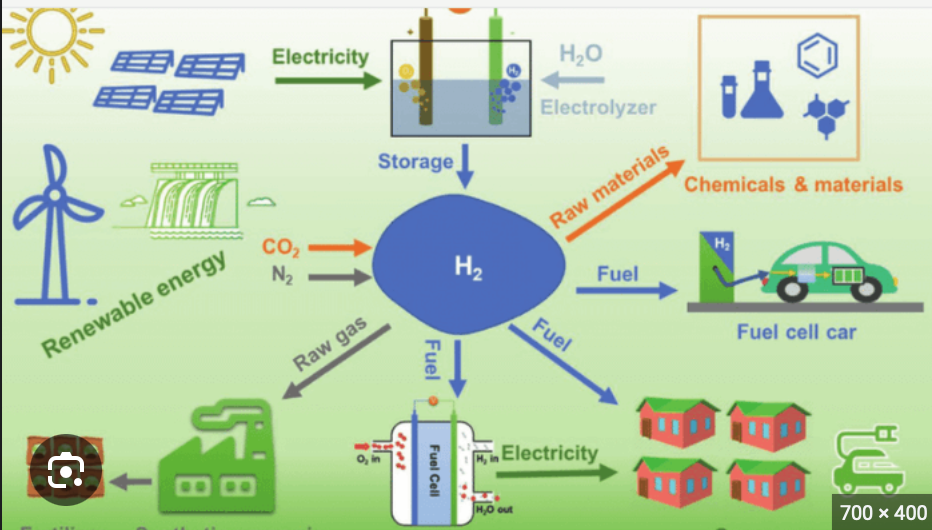

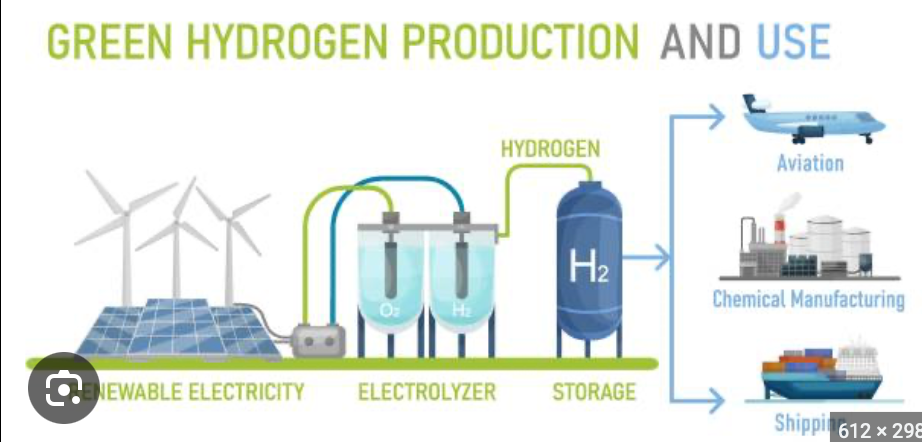

Beveridge goes on to argue that most energy companies believe that hydrogen will play an important part in their business in the future. Importantly, he also points out that there are simply no alternatives in areas such as heavy industry, chemicals, and heavy transport. Green hydrogen, he believes, will be the driver of momentum in the industry. It’s the “cleanest” method of hydrogen production fuelled by renewable energy sources, while blue hydrogen is produced from natural gas mixed with hot steam and a catalyst.

Do we want a fast and cheap solution to decarbonization? – then a mix of green and blue hydrogen could be our answer.

Beveridge notes that over the past year, there has been a 200% increase in blue hydrogen projects announced, amounting to 14 million tons per annum.

Hydrogen demand in the U.S. alone could increase up to 17 million metric tons by 2025 and 63 million metric tons by 2050. The heightened demand will in turn result in rapid growth within the hydrogen generation sector at a compounded annual growth rate (CAGR) of at least 9.2% into 2025, resulting in a forecasted market value of $201 billion.

The hydrogen industry is still in its early stages of development, and growth may not start to show a steady pace until 2025. However, the policies are in place to support this industry and analysts remain optimistic about the future.

TOP HYDROGEN STOCK PICKS

Plug Power stock has fallen more than 27% year to date, but many analysts are arguing that shares could double in value from its present price.

Plug Power is targeting $3 billion in revenue by 2025 and $5 billion by 2026 and has firm plans in place in terms of electrolyser deliveries in the U.S.

Why Plug matters!

PLUG’s key hydrogen product and solution offerings currently include the following:

- GenDrive – A hydrogen-fueled polymer electrolyte membrane (“PEM”) fuel cell system used in powering material-handling industrial vehicles, including electric forklifts, Automated Guided Vehicles, and ground support equipment.

- GenFuel – A liquid hydrogen fueling delivery, generation, storage, and dispensing system that could be installed on client-site to facility refueling of hydrogen fuel cells.

- GenSure – A stationary fuel cell solution that supports the power requirements of the telecommunications and utility sectors; examples of GenSure applications include serving as backup power generators for data centers and power grids.

- ProGen – A fuel cell engine technology currently used in mobility and stationary fuel cell systems, as well as engines in electric delivery vans.

- GenFuel Electrolyzes – A modular and scalable hydrogen generator that splits water using renewable energy inputs, such as solar or wind power, into green hydrogen and oxygen through a process called “electrolysis.”

- GenCare – An internet-of-things-based maintenance and on-site servicing program for the GenDrive, GenSure, GenFuel, and ProGen systems

- GenKey – A vertically integrated turnkey solution that bundles PLUG’s product and service offerings based on customer needs.

Bloom Energy is another U.S.-based hydrogen company. The stock has declined 21.3% year to date. Many analysts forecast that the shares could rally 73% over the next 12 months.

Doosan Fuel Cells is a hydrogen company based in South Korea. It trades in the U.S. through over-the-counter securities. It is a leader in developing the technology used for fuel cells in stationary power. Bernstein points out that the stationary power market is forecasted to grow 75% in 2023 on a year-over-year basis.

The next five to ten years will be an opportune time for the hydrogen industry. PLUG has an established reputation in the industry and advanced technology as well as an impressive list of customers (e.g., Amazon, (AMZN) Walmart (WMT), and The Home Depot (HD). The transition to alternative energies should see this industry boom in the decades ahead.

Please note that I am not making any recommendation to buy any of the shares here. I am simply sharing analysts’ views on the top stocks in this industry with an eye on what could happen in the future. The industry looks promising, and prices of these top stocks look attractive. Any purchase of a parcel of shares in this industry would be done with a long-term perspective.

Wishing you all a great week.

Cheers,

Jacquie