August 14, 2024

(CONSUMER BEHAVIOUR AMID RECESSIONS: WHERE DOES THE MONEY GO?)

August 14, 2024

Hello everyone.

Which would you most likely give up if a recession descended upon us?

- Netflix

- Fast food including Chipotle, McDonalds, Burger King, Taco Bell, In-N-Out Burger, Baskin-Robbins, etc

- Your favourite coffee fix

- None of the above

If it was me, and I had to choose one, apart from d) it would be fast food. But then, that would be easy for me, because I don’t eat it in the first place. So, I’m cheating a little in that sense. So, my second pick would be my coffee fix. Again, easy, as I am a tea drinker and prefer to make a pot of tea in the morning or (grab a teabag if I’m in a hurry).

If we are not going to eat out, and are not getting our coffee fixes, then where would our discretionary dollars be going?

Many will find comfort in media options. And Netflix comes to mind here.

How many people have not spent a lazy day binge-watching their favourite series or rewatching old movies?

Netflix may turn out to be a stalwart stock against a backdrop of recessionary dark clouds building up on the horizon. Analysts at J.P. Morgan believe the service provides good value, even with their latest price increases. Capex is expected to come in around $ 17 billion this year, and JPM has an overweight rating on the stock. Their price target of $750 indicates around 18.5% upside potential from Monday’s close. From the beginning of this year, the stock is almost 32% higher.

Following its second-quarter earnings announcement on July 18, Netflix shares are trading only around 2% lower, compared with the S&P 500 which is down around 4% over the same period. Of note, in the second quarter, Netflix reported a 34% yearly increase in its ad-supported memberships, and total memberships topped analysts’ forecasts. JPM analysts regard subscription services like NFLX and SPOT as “being more resilient during periods of macro pressure.”

Netflix is positioned well as it targets 500M+ global (connected TV) households.

Spotify has also been a strong performer this year, with shares up 80% year to date.

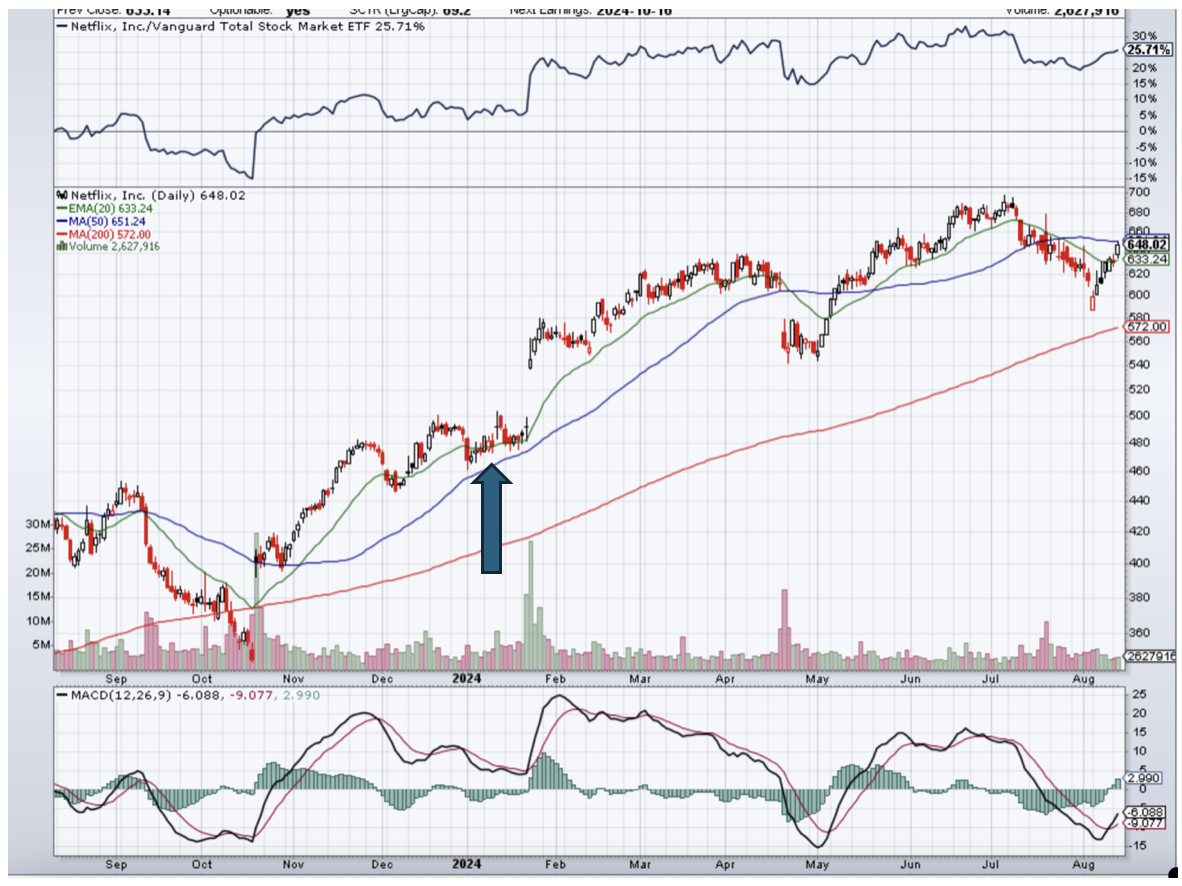

Netflix (NFLX) Daily chart

I recommended Netflix (NFLX) on January 17, 2024, when it was $480.

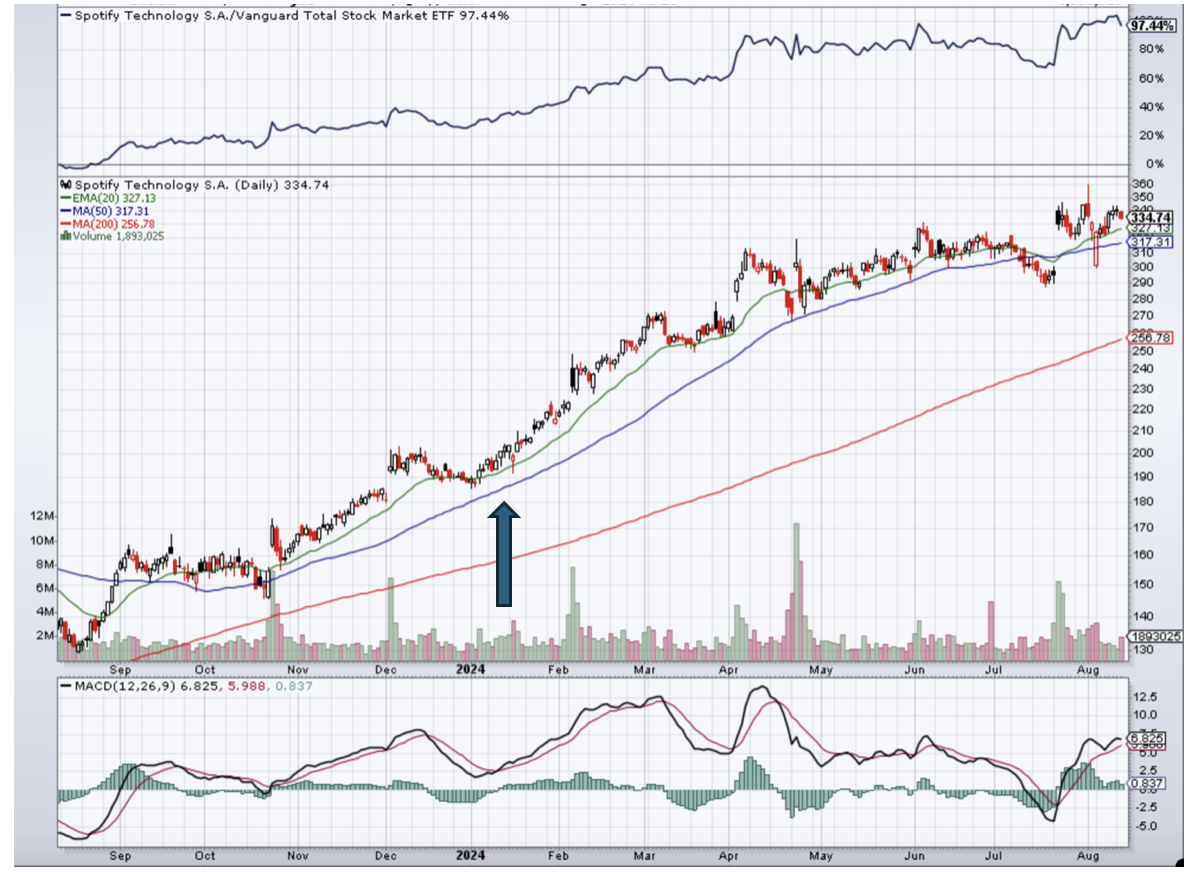

Spotify (SPOT) Daily chart

I recommended Spotify (SPOT) on January 7, 2024, when it was $193.52

I am not suggesting you buy at this time or add weight.

SOMETHING TO THINK ABOUT…

In a recent talk the Private Wealth Group of Wells Fargo Advisors offered comments on investing. Here are a few takeaways.

“What we can learn from history is that people don’t learn from history.”

“All this creates a lot of short-term thinking in the markets. They become focused on what is in the news, and money drives toward these companies and industries, it’s during this time that investment principles are forgotten.”

Their thoughts on the media are interesting. (In the 1980’s, I don’t recall any financial media channels. CNBC was founded on April 17, 1989, two years after the 1987 crash. It was originally the Consumer News and Business Channel, a joint venture between NBC and Cablevision).

Getting back to their ideas…

Tuning out the headlines to stay focused on the long term.

“People get caught up in what’s going on in the news and what the media is talking about. A lot of people are working from home. They have got the TV on. If you watch any of the financial news networks, there’s not that much news every day. They just keep talking about the same thing over and over and over again. And people hear that, and they stick with it and then it becomes real to them, and all their investing principles and history is gone by the wayside.”

QI CORNER

Cheers

Jacquie