August 2, 2023

(INVESTING IN SILVER IS A SMART MOVE FOR THE LONG TERM)

August 2, 2023

Hello everyone,

Let’s look at Silver today.

Silver is one of the many precious metals you can invest in, particularly when you are looking for long-term growth.

Silver isn't just a metal to collect and stow away for the future. It has endless real-life uses, and with those uses — and future, yet undiscovered ones — comes the potential for growth.

Silver is not only a precious metal but also an industrial metal. Silver is used in medical applications, solar panels, batteries, nuclear reactors, semiconductors, touch screens, and more.

It's also a large component in electric vehicles, which have jumped in production and popularity in recent years. By 2025, The Silver Institute estimates that 90 million ounces of silver will be needed for vehicle production.

It's smart to invest in silver if you have the patience to hold it for the long term. With a growing commitment to green infrastructure, clean alternative energy sources, and anticipated growth of EVs, we should only expect the demand for silver to grow from here.

How to invest in silver

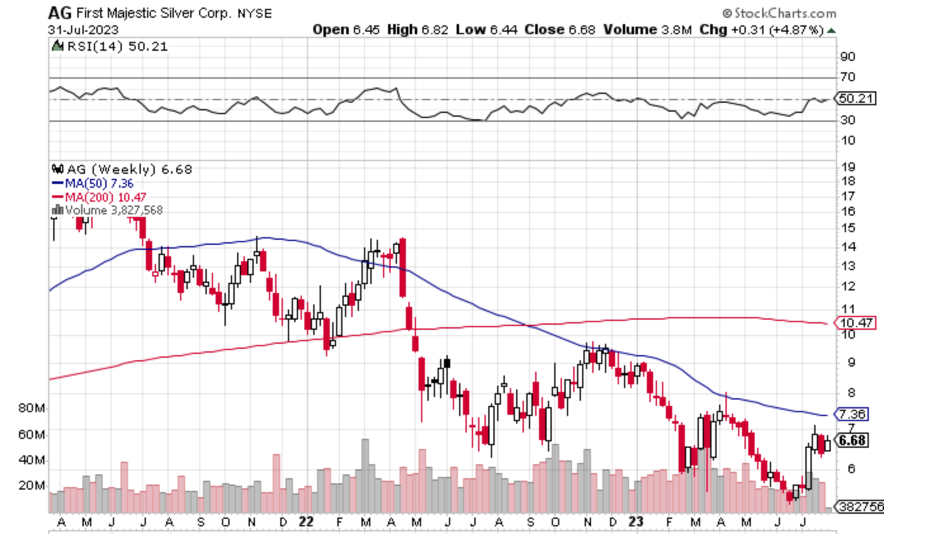

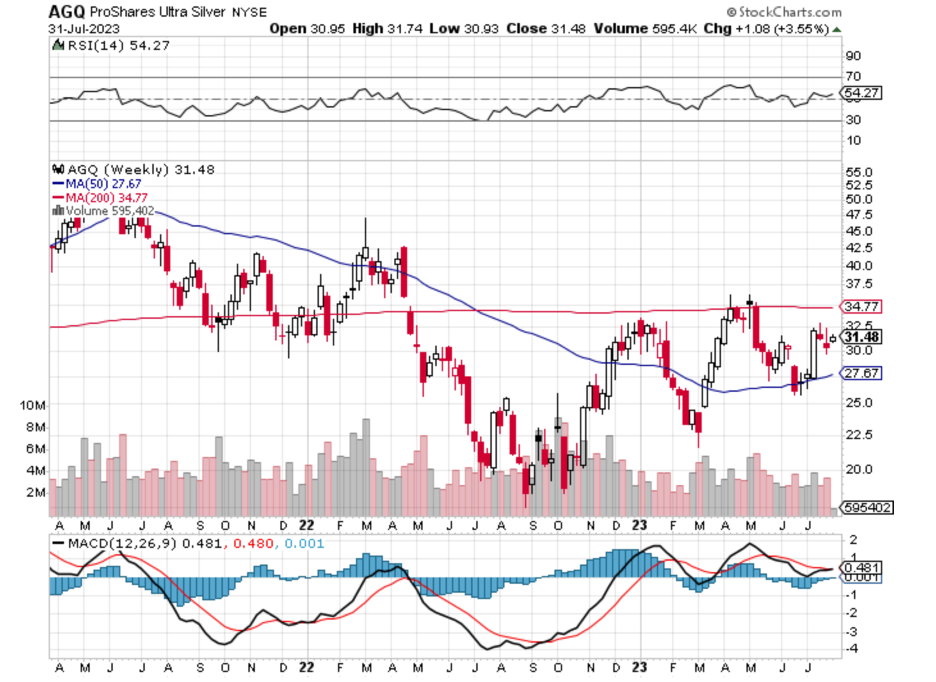

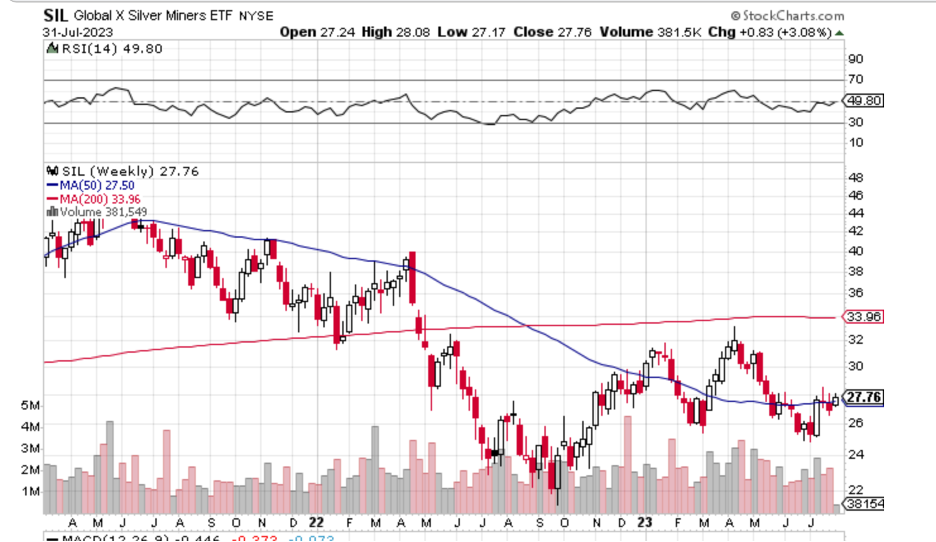

There are many ways to invest in silver. You can purchase silver coins and bullion (just remember you need somewhere to store it). You can also buy stocks in silver mining companies or invest in silver ETFs. Examples of silver stocks and ETFs include WPM (Wheaton Precious Metals), SLV (iShares Silver Trust ETF), SIL (Global X Silver Miners), AGQ (ProShares Ultra Silver), NEM (Newmont Corporation), SVM (Silvercorp Metals), AG (First Majestic Silver Corp.)

You can also open a silver IRA, which allows you to use silver to build your wealth for retirement. These are specialized retirement accounts that must be managed by an IRS-approved custodian. You can only purchase certain coins and bouillon, and they must be stored in an official depository. (There are also gold IRAs if you're interested in investing in gold).

Invest in Silver if you are comfortable with some risk and volatility.

Silver is generally seen as a safe investment, but its value ebbs and flows more than gold does.

In the last year, silver prices have gone as low as $17 an ounce to nearly $26 an ounce. Over the last decade, silver has vacillated even more. Its lowest price was just under $14 per ounce, while it cost almost $28 per ounce at its peak. That's a peak-to-trough difference of 101%.

Still, the volatility can be worth it — at least for investors with patience and good timing.

Invest in Silver if you want to diversify your portfolio.

Silver is also a smart way to diversify your portfolio and offset your exposure to other, riskier assets, such as stocks.

"It can be smart to invest in silver when you're seeking diversification or when you expect inflation or economic turmoil," says Nick Ganesh, manager at Endeavor Metals. "Silver often holds value well under these conditions."

When silver investing isn't wise

Silver can often be a smart investment, but it's not right for everyone.

Don’t invest in Silver if you want a risk-free investment.

One of the biggest silver investment disadvantages is its volatility. While that can often mean big growth, it can mean significant loss if you need to sell at the wrong time.

If you're not prepared to ride out the waves of this volatility, you may want to explore other investment options. If you can ride out the volatility waves, you will do well with Silver in the long term.

Don’t invest in Silver if you're looking for quick returns or dividends.

If quick profits or a regular income stream are what you're looking for, silver won't be of much help.

Silver doesn't provide interest or dividends. So, if you're seeking a steady income stream, other investments might be more suitable. Assets like stocks or bonds may provide better returns.

Don’t invest in Silver if you need easy liquidity.

Silver isn't completely illiquid, but if being able to sell your assets fast and turn them into cash is a priority, it's not the best choice.

Warren Buffett has invested almost 1 billion in Silver. So, if you’re looking for confirmation of the value of Silver as a long-term hold, there it is.

In 10 years’ time, Silver could grow to a minimum value of $150/ounce. If the conditions are right, Silver could reach up to $750/ounce.

Have a great Wednesday.

Cheers,

Jacquie