August 2, 2024

(WHAT IS REALLY CHURNING THE MARKET)

August 2, 2024

Hello everyone,

Is the economy slowing much faster than most realize?

Let’s check out the ISM data.

(ISM) Institute for Supply Management

The ISM manufacturing index, also known as the purchasing managers’ index (PMI) is a monthly indicator of economic activity based on a survey. The Purchasing Managers’ Index (PMI) is an indicator of economic health for manufacturing and service sectors.

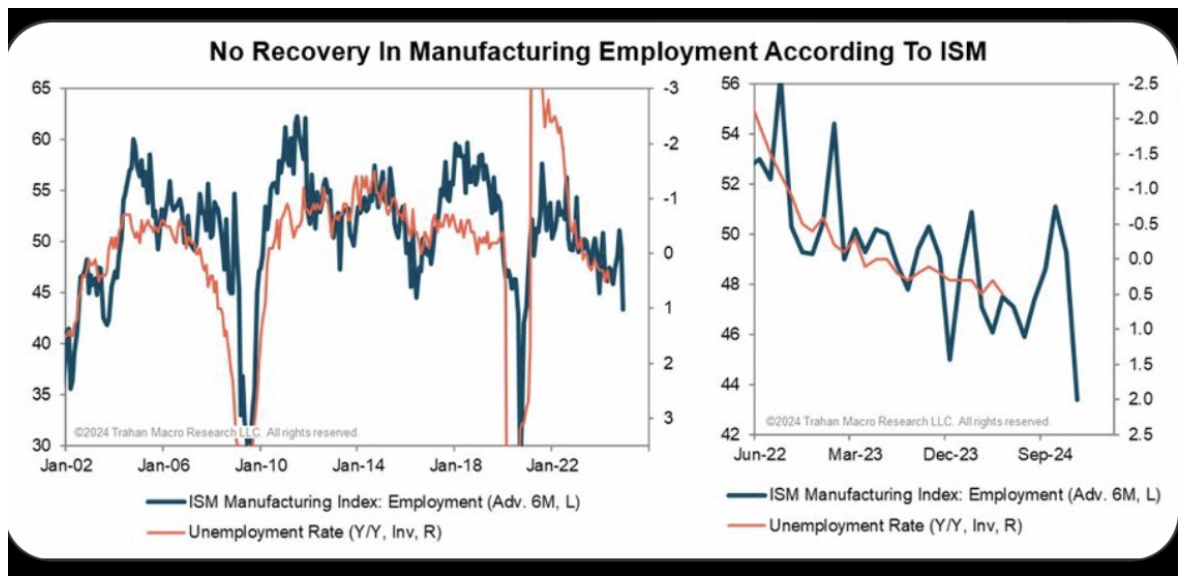

The ISM release was weak overall, but it is the employment component that should be the talking point. If we cut the GFC and the pandemic from the picture – this is the weakest the series has been in over 20 years. The trend is very clear.

This is a sign of cooling domestic growth conditions. A recessionary breeze is starting to pick up, and if this is the case, one rate cut is not going to dent this trend.

Downbeat economic data is making gold upbeat

The metal has found support against a backdrop of slowing economic data, central bank buying, weakness in the dollar, and tensions in the Middle East. Going forward, expect a new range between $2,500 and $2,700 as the metal navigates a turbulent backdrop. Keep scaling into GLD on pullbacks and SLV.

Good news may not be far away for Aussies

Relief could be on the way for mortgage holders across the country as experts tip a rate cut might be on the table before Christmas.

Inflation figures released on Wednesday aren’t considered high enough to warrant a rate hike.

More than 80% of the surveyed economists predict the cash rate will be held at 4.35% when the board meets next week.

Australia’s core inflation rate, which excludes food and energy, has slowed enough to almost rule out another rate rise.

Some, however, are not ruling out a rate hike. University of Sydney economist, James Morley is among 19% of economists predicting an interest rate hike is likely to arrive in August.

While Mr Morley is anticipating a rate increase in August, he still believes that rate cuts will begin later in the year and well into the New Year.

Homeowners are waiting patiently for relief, as almost 50% of homeowners have struggled to pay their mortgage in July.

QI CORNER

Cheers,

Jacquie