August 5, 2024

(THE CORRECTION IS UPON US – BUCKLE UP)

August 5, 2024

Hello everyone,

U.S. Markets turned down sharply last Friday after the July nonfarm payroll revealed the highest unemployment rate since 2021, catching many by surprise. (If you had read my Monday, July 29 newsletter last week, you would have already known we were in a Wave 4 down period and would have been aware of the targets). Many stocks were absolutely battered, including Intel. No sector was left untouched. Yields fell, and the TLT rallied strongly. But you knew all this was about to happen – you had been forewarned.

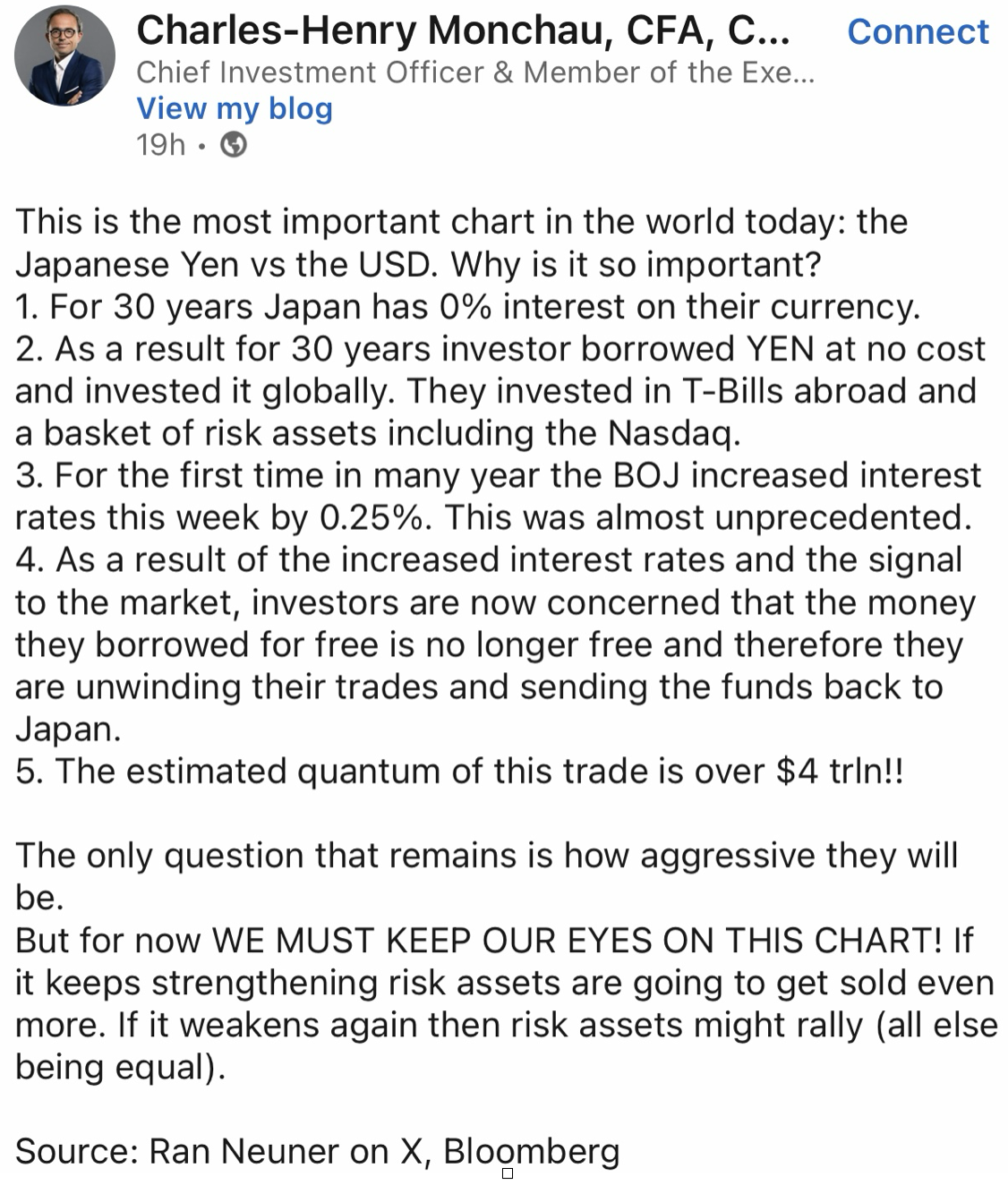

The US dollar depreciated against all major currencies, with particularly steep declines against traditionally risk-off currencies like the Swiss franc (CHF) and the Japanese yen (JPY). In response to this data, markets are now pricing in steep rate cuts – as many as 150 basis points – from the Federal Reserve by year’s end. ( I said earlier in the year that the slowdown in the economy would show up in the second half of the year and steamroll its way through the economy like a ball falling down a hill, gathering momentum as it fell, and this is exactly what is showing up in the data now – the economy is slowing faster than most realize, and the Fed is where it was when it went to raise rates - slow to the party - and will now be expected to act aggressively.)

All Aussies will be watching the Reserve Bank on Tuesday. No change is expected, but many are hoping for a rate cut.

Economic data points from China, including the trade balance and inflation figures, will give some insight into an economy that is still struggling post-pandemic.

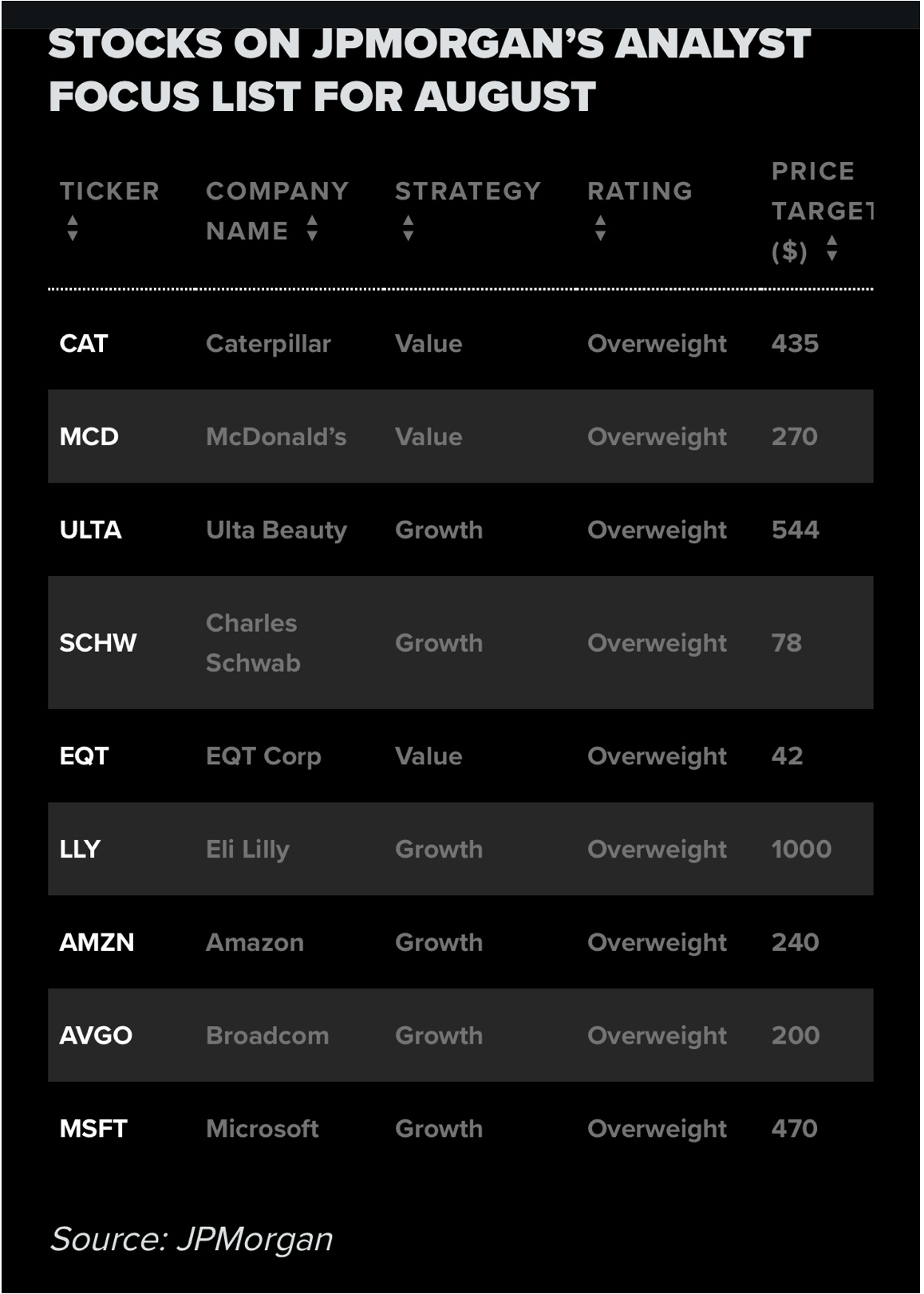

I am not suggesting you buy any of the stocks listed above at this time. I am merely showing you what the bank is focused on. We hold three of these stocks in our portfolio: Caterpillar, Amazon and Microsoft.

Week ahead calendar

Monday, August 5

9:45 a.m. PMI Composite final (July)

9:45 a.m. S&P PMI Services final (July)

10:00 a.m. ISM Services PMI (July)

Previous: 48.8

Forecast: 51

Earnings: Simon Property Group, Diamondback Energy, Tyson Foods, Progressive

Tuesday, August 6

8:30 a.m. Trade Balance (June)

12:30 a.m. Australia Rate Decision

Previous: 4.35%

Forecast: 4.35%

Earnings: Super Micro Computer, Fortinet, Devon Energy, Airbnb, Wynn Resorts, Axon Enterprise, TransDigm Group, Yum Brands, Fidelity National Information Services, Uber Technologies, Marathon Petroleum, Caterpillar

Wednesday, August 7

3:00 p.m. Consumer Credit (June)

10:00 a.m. Canada Ivey PMI

Previous: 62.5

Forecast: 58

Earnings: Costco Wholesale, Warner Bros, Discovery, Occidental Petroleum, Ralph Lauren, CVS Health, Hilton Worldwide Holdings, Walt Disney Company

Thursday, August 8

8:30 a.m. Continuing Jobless Claims (07/27)

8:30 a.m. Initial Claims (08/03)

10 a.m. Wholesale Inventories final (June)

9:30 p.m. China Inflation Rate

Previous: 0.2%

Forecast: 0.3%

Earnings: Gilead Sciences, Akamai Technologies, Take-Two Interactive Software, News Corp, Paramount Global, Expedia Group, Martin Marietta Materials, Eli Lilly

Friday, August 9

8:30 a.m. Canada Unemployment Rate

Previous: 6.4%

Forecast: 6.4%

MARKET UPDATE

S&P 500

Correction sell-off in progress. Support zone = between 5,265 – 4,950. Sustained break of 4,950 would probably see a much deeper sell-off toward the late 4,500’s.

GOLD

If gold can hold $2,350 area, the metal could advance to the mid $2,500’s. A break of the latter level would see gold rallying toward the $2,650 zone. However, if gold does fall below the $2,300 area, we could see a fall toward $2,260 or even $2,200.

BITCOIN

As I write this Post Sunday after/evening, I am watching the price action of Bitcoin, which is now sitting at $54,190.00. There is strong support at the $50k level, and at the $40k level.

PSYCHOLOGY CORNER

Herd Behaviour

This occurs when investors follow the actions of the majority, often leading to trends and bubbles. Herd behaviour can result in significant swings as large groups of investors buy or sell simultaneously.

Exploiting Herd Behaviour

By understanding how herd behaviour drives market movements, investors can position themselves to benefit from the irrational actions of the crowd. For example, contrarian investors often buy when others are selling and sell when others are buying.

QI CORNER

AUSTRALIAN CORNER

It’s the Olympics, so we must celebrate our athletes’ achievements.

Australian, Saya Sakakibara, wins the gold medal in BMX and dedicated it to her brother.

GOOD VIBES CORNER

Cheers,

Jacquie