August 7, 2024

(STAY COOL IN THE FACE OF A TURBULENT MARKET & START LOOKING FOR OPPORTUNITIES)

August 7, 2024

Hello everyone,

The market has been throwing a little tantrum over the last few days, and we all know why.

Unwinding of the yen carry-trade

Economic market data

The Fed turning up to the party with no rate cuts. Late again Mr Powell…

AI over-exuberance

Today, Tuesday, we saw some calmer waters, but the stinger is that more volatility may be yet to come. We are waiting for a signal that the bottom is formed in this correction.

YEN CARRY TRADE

What an epic unwinding of the yen carry trade. Are we done or is there more to come?

A few investment bank analysts are indicating more unwinding is yet to happen.

What is the Yen carry trade?

Investors borrow from low-interest economies like Japan to invest in higher-yielding assets elsewhere. The strategy hit turbulence when the Bank of Japan raised interest rates last week, prompting a surge in the yen and a rush for the exits by some investors. This move led to significant losses in global stock markets, with Japan’s Nikkei suffering its worst day since 1987.

HIGHER INFLATION IN THE YEARS AHEAD

It won’t matter who wins the Presidential election in November in relation to the markets. Both parties favour large deficits despite a strong economy. The federal debt is now at $34.5 trillion, or about $11 trillion higher than where it stood in March 2020. As a portion of the total U.S. economy, it is now more than 120%. Debt has soared under Biden after Trump’s aggressive spending response to the pandemic increased the levels.

HEADLINES CORNER

Gov. Tim Walz gets the nod to be Democratic running mate beside Harris.

Reserve Bank of Australia keeps rates steady at 4.35%.

WHERE TO ADD WEIGHT (Scale in over time)

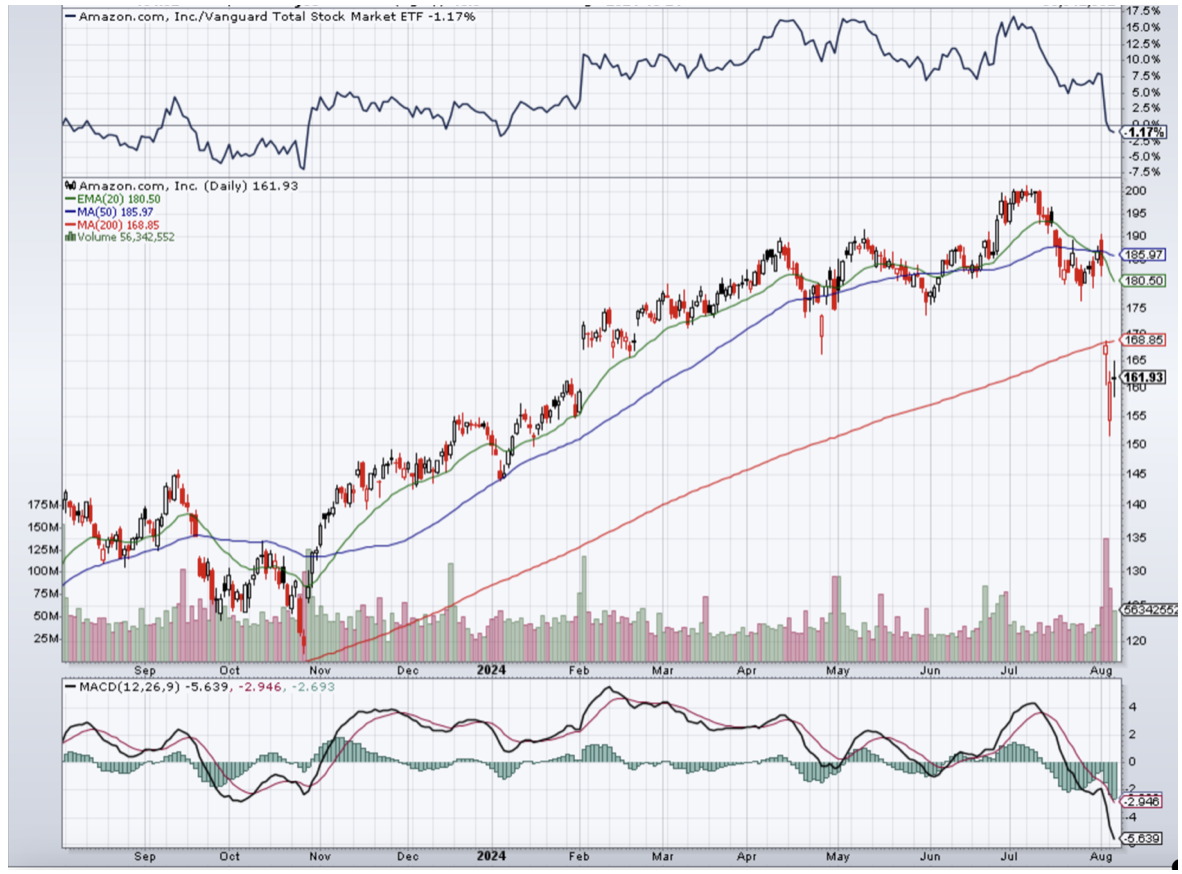

Amazon

Stock trades at just under 30 times expected earnings for the next 12 months.

E-commerce business continues growing & remains competitive.

Grew advertising revenue 20% in the second quarter.

Cloud sales rose 19%, driven by artificial intelligence products.

Spending should remain in check in relation to revenue growth, so profit margins should expand.

Wall Street expects EPS to grow about 37% annually through 2026 from this year. (FactSet)

Amazon Daily Chart

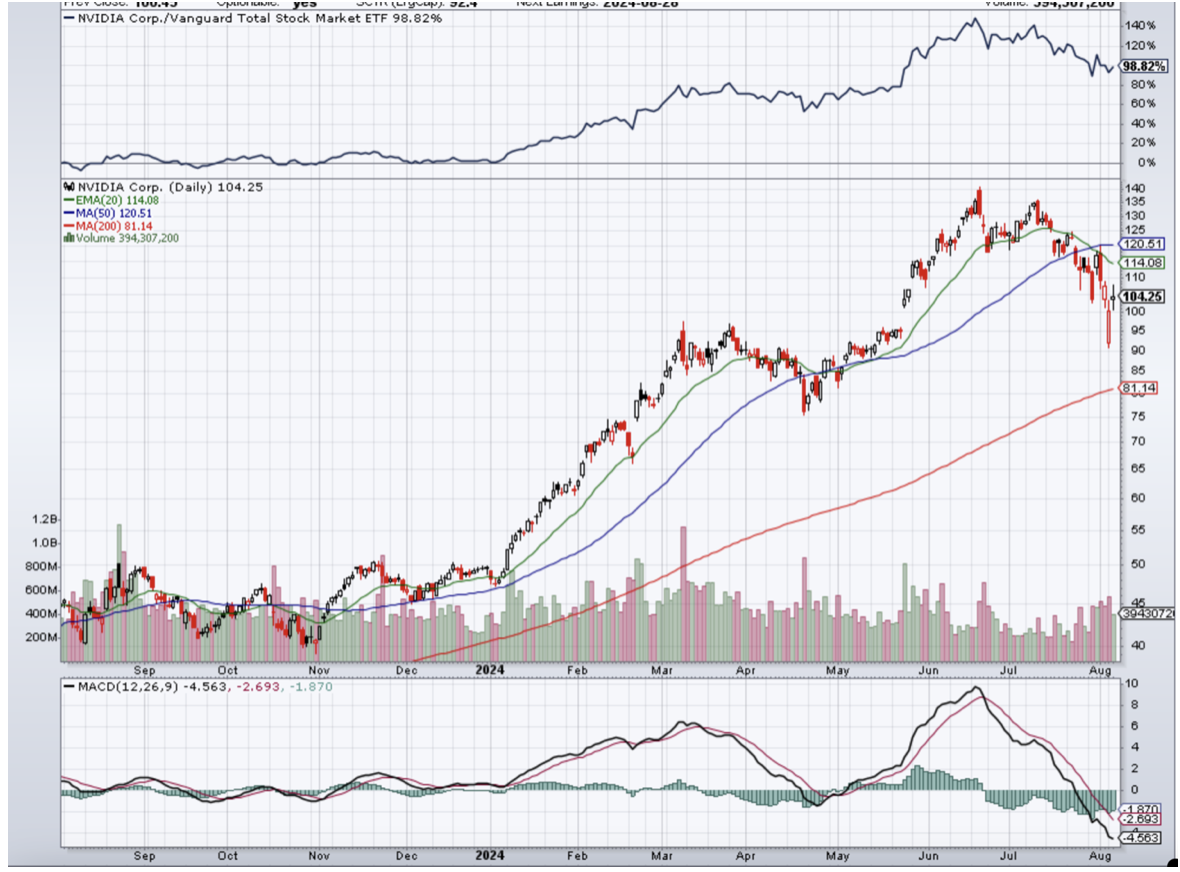

Nvidia

Analysts expect stock to reach over $100 billion in revenue this year.

Total sales of $115 billion for 2024 appear realistic.

Earnings per share (EPS) estimate of $2.59 has not changed.

Considering all the above, NVDA could be on track to grow to the expected $3.66 next year.

Stock trades at 28 times expected 2025 earnings per share.

Nvidia Daily Chart

CRYPTO CORNER

If you have been watching this area, you saw that Bitcoin dropped below $50k briefly on Monday to around the $48k area. All these corrective selloffs are scale in days, if you are interested in Bitcoin and the crypto space. With institutional adoption only increasing and political parties shifting their stance toward crypto indicating a warmer embrace of the asset, this could be an opportune time to add exposure to bitcoin ahead of what could be excellent returns over the coming year and beyond.

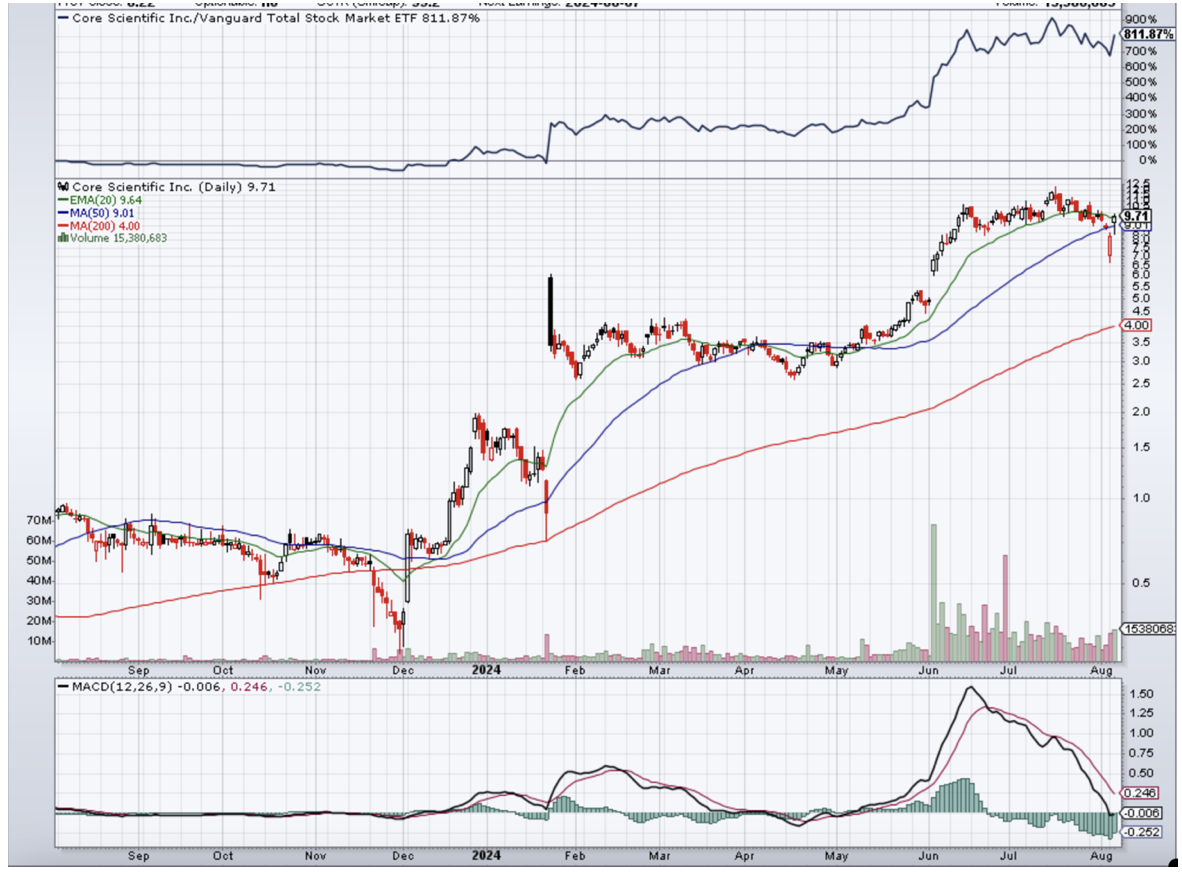

For those who are interested in Bitcoin miners, there are about a half dozen recommended by analysts. Of these, there is just one I would give my attention to. Core Scientific (CORZ). ($9.71)

Core Scientific turned down an offer from the cloud AI startup CoreWeave to acquire them for $5.75 per share. It is believed that the bid is higher now and that the deal will increase considerably in the coming months. Some analysts, including Cantor Fitzgerald, have a $20 price target on the stock, implying about 143% upside. (Note: our only crypto exposure is MicroStrategy).

Daily Chart (CORZ) $9.71

Weekly Chart (CORZ) $9.71

Cheers,

Jacquie