August 9, 2013 - MDT Midday Missive Part 2

While the Diary of a Mad Hedge Fund Trader focuses on investment over a one week to six-month time frame, Mad Day Trader, provided by Jim Parker, will exploit money-making opportunities over a brief ten minute to three day window. It is ideally suited for day traders, but can also be used by long-term investors to improve market timing for entry and exit points.

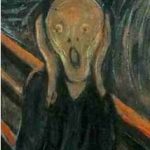

I have a serious case of Traders Stare.

This is a function of too much time in front of a screen.

"Head up Butt syndrome"...We all get it sooner or later.

You look at the screen and everything looks the same, one big blur.

We write in the here and now "real time"

It's past time to turn off the electronics and recharge.?

September is going to be busy. We're off to unplug and reboot.

Time for a hiatus in the mountains with no cell service for the next week.?

The Mad Day Trader is going dark for the next week!

The next post will be? 8/19/13

Miners!!!!!!!!!!!!!!!!!!!!!!!!

This is what's in play. They have the potential for a 20% rally from this low,which is long overdue.

We wrote about this yesterday. The breakout above today's opening ranges have sealed the deal. You should focus on trading the miners for the next couple of weeks!!!!

The miners bottomed with the AUD/USD @ 88.50. I am not a fan of selling the Aussie period. This can rally to 96 + off this low with the miners leading.

Closing above 93 will lead to this level.

EUR/AUD...144.00 is weekly support. The sell stops are @ 143.11. Below look for the 137's.

Spu's...would not be surprised to see some downside over the next week or so if we can close below this weeks low of 1680.50.

1650 mid-week next and you'd have to start looking at individual names again.

1620's would be a gift to accumulate new longs for a fall rally into year end.

USD/JPY...when markets trade Risk Off the Yen goes bid. A break in the Equity indices of this weeks low next week will likely see USD/JPY under 95.80. This level is key for the next swing.

Do not fade price action under 95.80 USD/JPY ( over 104.50 Futures)

For Glossary of terms and abbreviations click here.