Be Careful What You Wish For

The wild whipsaw movements in the markets on Thursday reminded us once again how dependent they have become on monetary stimulus from central banks. As if we needed reminding. Almost simultaneously, officials from the US, Japan and the UK hinted at a coordinated move at this weekend?s G-20 meeting in Cabo San Lucas, Mexico.

Let?s hope for the sake of global financial stability that no one eats a bad taco down there. And say ?Hello? to Miguel for me at the notorious drinking establishment, The Giggling Marlin. Just make sure he doesn?t pick your pocket when he hangs you upside down by your ankles with a block and tackle to give you a tequila shot.

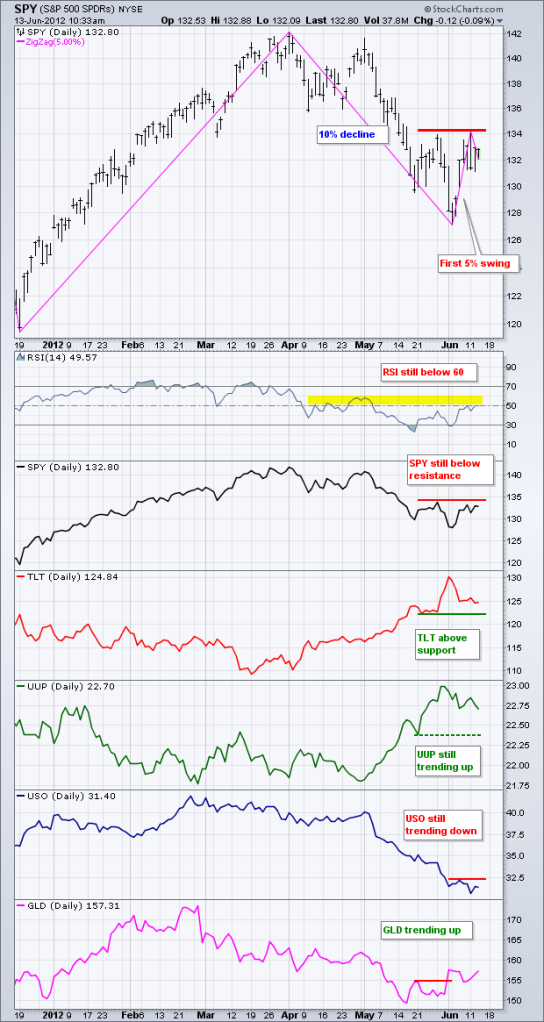

The rumors were enough to cause me to cover my sole remaining short position in the S&P 500 (SPY) and bat out some additional shorts in the Japanese yen, which would go into free fall in such a scenario. If the rumors are true, they will take the (SPX) up to 1,400 and I will make a killing on my hefty long positions in (AAPL), (HPQ), (JPM), (DIS) and shorts in (FXY) and (TLT). If not, then the large cap index will revisit 1,290 one more time and I will be left looking like a dummy while posting an embellished resume on Craig?s List.

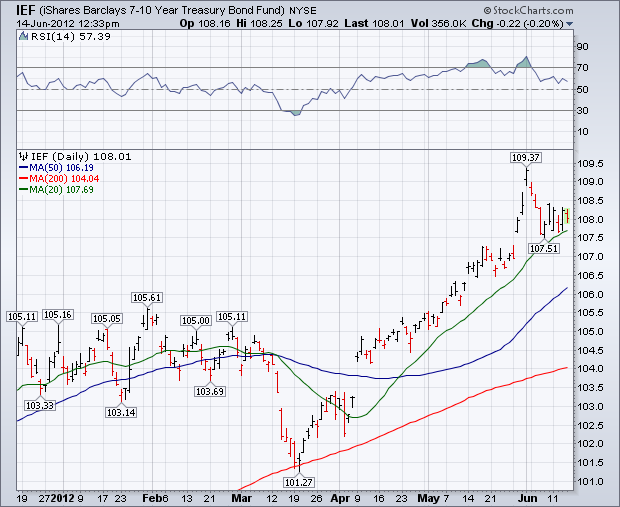

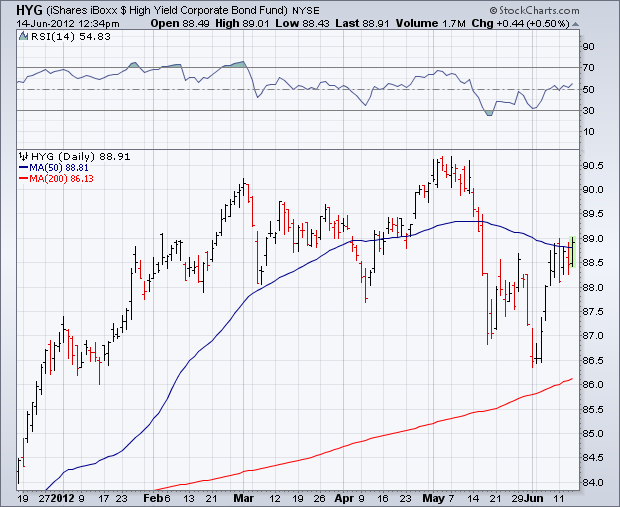

To see how closely risk assets are correlated with quantitative easing, take a look at the chart produced below by my friend, Dennis Gartman of The Gartman Letter. It graphically presents the market response to QE1, QE2, and Operation Twist, which are highlighted in green. In fact, quantitative easing has become the on/off switch of the financial markets. Hence, we get ?RISK ON?/?RISK OFF? gyrations in spades.

While on the topic of monetary policy, let?s consider the implications of a Romney win in the November presidential election. The former Massachusetts governor and son of a Michigan governor has said that he would fire Federal Reserve Governor, Ben Bernanke, on his first day in office.

Well, he actually can?t do that, although it is great fodder for the faithful on the hustings. What he can do is appoint and anti QE, pro-austerity replacement when Ben?s second four year term is up on January 31, 2014. At the top of the list of replacements are Stanford University?s John Taylor of Taylor Rule fame and sitting non-voting board member, president of the Dallas Fed, and noted hawk, Richard Fisher.

How would the financial markets react? Much of the recent buying of stocks and other risk assets has been on the assumption that the ?Bernanke Put? would kick in on any serious selloff. No Bernanke means no Bernanke put. I can already hear portfolio managers thinking ?What, you mean there is risk in these things?? and heading for the exits as quickly as possible. The resulting market crash could make 2008-2009 look like a cakewalk. Your 401k would rapidly shrink to a 201k, and your IRA would become DOA. So be careful what you wish for.

That is unless you are a reader of this letter and a subscriber to my Trade Alert Service. Such a market meltdown would be one of the great shorting opportunities of the century. But to follow the game you have to have a program.