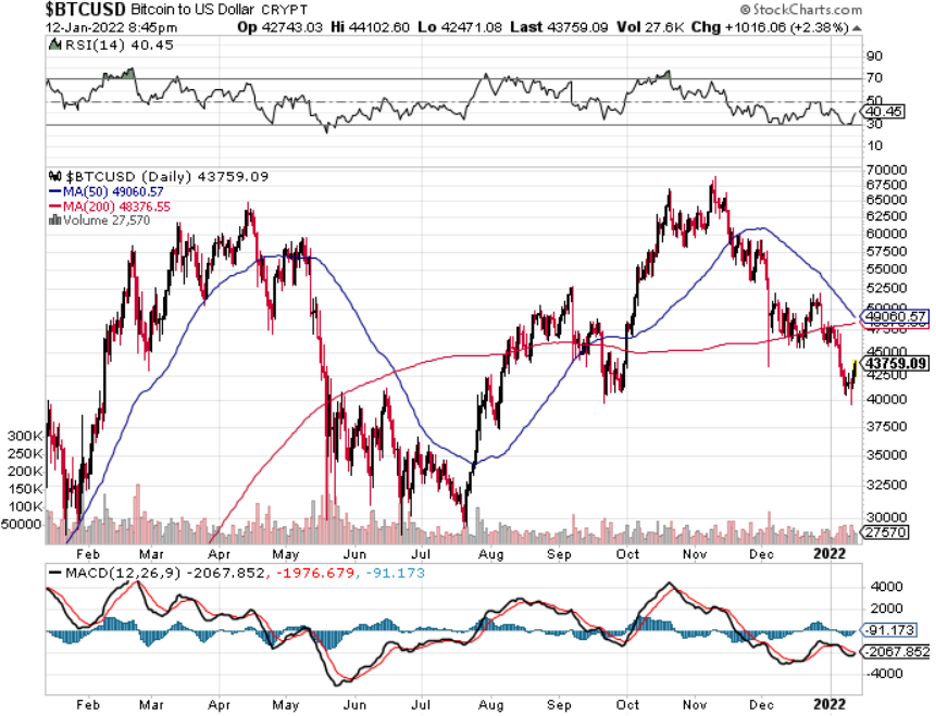

The infamous Death Cross is just around the corner again staring us in the face as another potential liquidity event could drive us lower or higher.

Even if you don’t fancy dealing with this phenomenon, algorithms lap it up and these technical events signal short-term price momentum and the direction of it.

To get even more exact, the death cross is the situation in which an asset's average price over the last 50 days drops below that of its 200-day moving average, an indication that its momentum is toast.

And this event is even more scrutinized after Bitcoin’s disgusting start to the year that has left it languishing in the lower $40,000s.

Not exactly the start we wanted and lots of complaints about the dufus called Fed Chair Jerome Powell and his handling of monetary policy.

Now, we should zone in on the big whales — the ones that hold massive amounts of Bitcoin and by that, I don’t mean 1 BTC or 1.2333 BTC.

All eyes are on them, many have said they will hold until infinity, but that’s easier when you bought BTC 10 years ago and not at $60,000 per unit which is what many retail traders did last year.

As we inch towards the vaunted death cross, will this trigger a 10% escape hatch that deadens the asset?

So far in 2022, Bitcoin has outperformed for just a few days and has been under relentless selling pressure.

To make matters worse, Ethereum appears to be forming a death cross as well.

The macro turning putrid has had a meaningful effect on the drop of Bitcoin prices, and if BTC can get through this death cross quagmire by holding onto the $40,000 level, then that could signal greener pastures ahead in the mid-term.

Speculative investments like Bitcoin are being abandoned under such aggressive tightening. Reports show only 5% of the clients surveyed by JPMorgan Chase expect Bitcoin to reach $100,000 per piece by the end of 2022.

Although the "death cross" is a bearish indicator, Bitcoin's historical record surrounding the indicator remains unclear. When the metric appeared last June, Bitcoin’s performance was dismal. But when the metric appeared last March, Bitcoin’s performance was strong. The emergence of this indicator in November 2019 sent Bitcoin lower.

As the U.S. economy is grappling with rip-roaring inflationary prices searing through the consumer prices to home prices, emerging countries are doing so bad with inflation that some are already completely giving up their own fiat currency.

Sure, El Salvador sucked up all the headlines for nationalizing Bitcoin as the de-facto medium of exchange for their citizens, but Turkey and its massive population of 84 million straddling the European continent have comprehensively pivoted towards Bitcoin as hyperinflation wrecks the purchasing power of the Turkish Lira.

The situation in Turkey is what crypto fanatics want to happen in the United States and it also represents what could unfold if the US Federal Reserve neglect doing their job.

Luckily, we are nowhere near that yet.

The Turkish lira has become so unpredictable that bakeries are closing down by the thousands citing a local currency that has lost most of its value.

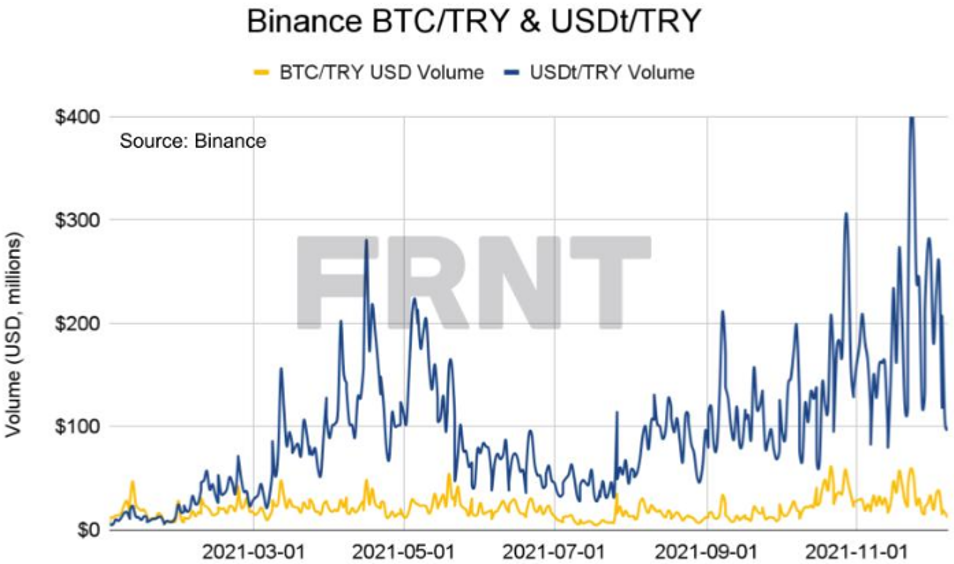

In Turkey, cryptocurrency trading volumes using the lira exploded to an average of $1.8 billion a day across three exchanges, according to blockchain analytics firm Chainalysis.

Turks favor stable coin tether, whose value is pegged to the dollar.

The rise of cryptocurrencies in recent years has presented a unique tool kit in which to store wealth, albeit far more volatile, and the shortage of US dollars circulating has forced the hand of the average Turk.

The Turkish lira has lost 40% of its value against the U.S. dollar in the past 5 months.

In the capital Istanbul, on the ground level, the local bazaars are accepting Bitcoin as standard currency over their own Turkish Lira.

This trend could mirror the future for some of these marginal economies that are run into the ground by renegade dictators.

Although the U.S. Federal Reserve has been irresponsible, the degree of policy mistake in Washington is nowhere near as atrocious as the events in Turkey.

There are numerous countries whose population could resort to crypto as a store of wealth including every ex-Soviet republic, big swaths of the Middle East, and major areas of Central and South America along with all of Africa.

My guess is that over time Bitcoin gets elevated as the de facto third currency behind the U.S. dollar and Euro. At this point, Bitcoin is too big to fail and too big to get rid of.

In a time of desperate need and no access to dollars and euros, Bitcoin is giving hope to large parts of the world as the pandemic and omicron inches closer to their shores.

Wait out this sideways correction then we march higher.