“Bitcoin is the beginning of something great: a currency without a government, something necessary and imperative.” — Said German-American billionaire entrepreneur and venture capitalist Peter Thiel

Mad Hedge Bitcoin Letter

September 16, 2021

Fiat Lux

Featured Trade:

(ONE OF AMERICA’S DIRTY LITTLE SECRETS)

(BTC)

Crypto is still controversial - still this bizarre, unruly, too-big-to-explain thing that half the population dismisses as nonsense and the other half swears will hit six figures “any day now.”

You’d think after all these years the debate would cool off, but if anything it’s turned into a running commentary on the world young people walked into.

Remember when Millennials and Gen Z were mocked for complaining?

“Well of course the economy is screwed. Nobody wants to pay a decent salary, and nobody wants to work.”

Funny how that line hits differently when inflation actually shows up, interest rates rocket higher, and the cost of living goes from “annoying” to “how is this even allowed?”

But here we are. And if you believed the economy was compromised, then naturally something else had to fill the ideological gap.

Crypto stepped in, not just as a speculative lottery ticket, but as a middle finger to a system that politely thanked young people for their degrees and then handed them a lifetime of rent payments.

The roots of this frustration aren’t mysterious. The US spent decades outsourcing manufacturing, suppressing wages, and printing money like a kid discovering the family label maker.

That era of zero-percent interest rates and endless quantitative easing felt like a cheat code until 2022–2023 ripped it away. Suddenly money wasn’t free. Inflation wasn’t theoretical. The bill had arrived.

And then remote work blew the doors off the old labor map. Wage arbitrage used to be something corporations did. Now individuals do it, too.

People work from Bali, Buenos Aires, or Boise while competing with candidates from everywhere. Geography melted. Job markets stretched. And wages…stayed stubbornly unimpressive.

Meanwhile, the cost of living decided to cosplay as a space rocket. Housing affordability didn’t just get worse - it went full dystopian. Real wages moved an inch while prices sprinted a mile.

Even well-paid professionals found themselves barely clearing the month. The “just get a good job” advice aged about as well as a bowl of shrimp in the sun.

Put all that together and it’s no wonder younger adults turned to crypto. Was it partly hope? Yes. Was it partly desperation? Also yes. Was it also a little bit of “screw it, the system isn’t giving me anything anyway”? Absolutely.

Crypto became the alternative ideology because the old one - work hard, buy a home, retire someday - stopped functioning as advertised.

But here’s the twist: by 2025 that original crypto narrative has mutated into something completely different.

After the spectacular blowups of 2022 (we all remember them), crypto didn’t die. It matured.

Bitcoin ETFs launched in 2024. The IRS finally drew up rulebooks instead of threats. Global regulators settled on actual frameworks. Big banks stopped pretending crypto didn’t exist and quietly rolled out services like it was no big deal.

We went from “crypto is too wild to regulate” to “crypto is now part of my retirement account.”

In other words, the industry that was supposedly “too big to fail” is now simply part of the same financial system it once tried to disrupt. Not exactly the revolution the early evangelists dreamed of, but certainly more stable than the critics predicted.

And yet, underneath all the regulation, all the institutional adoption, all the shiny ETF commercials on cable news, something deeper remains. Young people still want ownership. Of something. Anything. A stake in a world that constantly feels like it’s slipping further out of reach.

Crypto didn’t fix that existential ache. It just became one of the few places where the door didn’t slam shut on them.

But reality check: if crypto does end up creating massive new wealth (again), it will still go mostly to the people who had disposable income to invest.

The vast majority living paycheck to paycheck aren’t buying Bitcoin; they’re buying dinner. Volatility is not a luxury they can afford.

And now they’ve got a new anxiety: AI. Automation. Entire job categories looking shakier than a meme coin on a Sunday night. Younger workers aren’t throwing rocks at the system; they’re just trying to stay afloat while the rules change every five minutes.

This is why crypto still feels like a real option in 2025. Not because it’s a secret to getting rich (that’s over) but because it’s one of the few places where younger generations can participate without asking permission from gatekeepers.

But let’s be clear: crypto is not a golden ticket. It’s not a lottery. It’s not the road to Lambo-land. It’s simply an asset that survived hype cycles, regulatory crackdowns, spectacular failures, and global uncertainty - and came out the other side as part of the mainstream.

We don’t need to overhype it. We don’t need to bury it. We just need to acknowledge what it actually is now: a tool. A legitimate piece of the financial puzzle. A place where the rules are finally written down. A sector driven not by chaos but by clarity.

Crypto isn’t a passport to extravagant dreams anymore. It’s a viable strategy in a world where traditional routes to stability have eroded.

And maybe that’s the point. Maybe what younger generations wanted all along wasn’t a revolution but a chance to belong to the economy they were promised.

Crypto didn’t give them that. But it did tell the truth about the world that made them look for it.

“Bitcoin is like anything else: it's worth what people are willing to pay for it.” – Said Hedge Fund Manager Stanley Druckenmiller

Mad Hedge Bitcoin Letter

September 14, 2021

Fiat Lux

Featured Trade:

(CRYPTO IS LEGIT)

(HOOD), (BTC), (FINRA), (SEC), (CFTC)

There was a fresh wave of optimism that swept across Washington when SEC Chair Paul Atkins spoke to Congress about making the United States a global hub for digital-asset innovation. Headlines painted him as the opposite of Gary Gensler - friendlier, more flexible, and eager to strike a “balanced” approach.

But anyone who has lived through a regulatory cycle knows better. The pendulum swings, but the incentives at the center never change.

Atkins now gestures to the Senate committee that overly harsh enforcement may have stifled innovation - and that perhaps it is time to bring crypto into a more cooperative regulatory framework. These developments suggest the industry has grown too large and systemically relevant to operate outside the official perimeter of federal oversight.

Don’t blame me for being cynical, but whether the rhetoric is friendly or hostile, boiling this down to money and power still cuts through many adjacent industries.

It’s just the way of life.

Crypto has become lucrative, and every administration - no matter how innovation-forward their branding - still wants a slice of this golden goose.

Why do I say that?

The SEC’s core revenue mechanics have not changed. Every movement on regulated exchanges, from buying to selling, generates the fees that fuel its operations. The language used to justify them may evolve, but the incentive remains untouched.

Investing with retail brokerages is marketed as commission-free, now and forever. They do not charge fees to open or maintain accounts. Yet the fee structure underneath always finds its way back to the same place.

Self-regulatory organizations (SROs) such as the Financial Industry Regulatory Authority (FINRA) impose small fees for sell orders. These fees apply across brokerages. Firms pass them to customers, who indirectly fund regulatory bodies. FINRA is required by law to forward certain fees to the Securities and Exchange Commission.

The numbers shift with time, but the mechanism stays the same: fees ultimately cover the government’s cost of supervising markets and securities professionals.

There are numerous layers of cost embedded into participating on exchanges regulated by the SEC. The result is a well-oiled system of fee collection and institutional reinforcement.

So when Atkins offers his stamp of legitimacy to the crypto sector, the underlying exchange is simple: innovation-friendly messaging in return for bringing digital assets into the fee-generating ecosystem.

For lack of a better word, these fees allow regulators like FINRA and the SEC to rake in the cash, and as we know in this business, money is power.

I only see it as a matter of time before the SEC, FINRA, and Commodity Futures Trading Commission (CFTC) expand their reach further into crypto infrastructure - not just through enforcement, but through officially sanctioned pathways that look friendly on paper yet consolidate control.

And I’m not blaming them. Everyone is in the business of adding to their nest eggs, and the SEC, FINRA, and CFTC are no different.

However, ultimately this is what it’s about: a cash grab dressed up in innovation-forward language. The legitimization of crypto is merely the collateral benefit - one any asset class would be ecstatic to receive.

Take sports as an example. Football leagues scramble for the NFL’s approval, but the NFL rarely offers its blessing. They don’t care if college football and startup leagues battle it out away from the confines of professional football. The cost of lacking an NFL stamp of approval has been devastating for newcomers.

If the SEC once again vouches for large elements of the crypto ecosystem - this time through cooperative rulemaking under Atkins - this will start a chain reaction. It offers an olive branch to wealthy investors who have waited for a friendlier regulator.

Consequently, they would come pouring in, guns blazing, with the heft of their capital and the strength of their financial connections.

Atkins announcing that cryptocurrency exchanges may receive a clearer path to registration, as opposed to the adversarial gridlock of the Gensler era, makes this one step closer to reality.

During his early remarks, Atkins stated that recent regulatory battles left both investors and innovators without adequate clarity. His angle appears the inverse of Gensler’s warnings, but the subtext is the same: the SEC cannot effectively shape a market from which it remains partially excluded.

I want to remind readers that any SEC chair has the choice to allow crypto to operate in a vacuum, but doing so risks letting it grow too big to regulate - and too large to fold into traditional fee structures. They all know that.

Atkins highlights crypto as an asset class with enormous potential, yet one that requires consistent regulatory engagement.

The moral high ground is still shaky.

The SEC continues to permit the listing of foreign firms under structures that allow significant opacity, yet remains eager to frame crypto as the primary risk vector in modern markets.

Atkins acknowledges that Congress must ultimately define jurisdiction, just as Gensler once did. He may sound more cooperative, but the underlying tension is the same.

Regulation would be a huge win for the crypto universe, but it invariably infringes on the decentralized ideals that first drew people to digital assets.

Regulators love to preach about safety, but they preside over a system that endlessly erodes the purchasing power of fiat currency through policy choices far outside the crypto world.

Thus, does anyone sitting in the SEC chair truly believe that preserving the dollar’s value - or crypto’s future - is something they can call safe?

“Mortality is the single best invention in life.” – Said Co-Founder of Apple Steve Jobs

Mad Hedge Bitcoin Letter

September 9, 2021

Fiat Lux

Featured Trade:

(BEST WAY TO EARN PASSIVE INCOME IN CRYPTO)

(CELSIUS NETWORK), (BTC), (ETH), (SNX), (CEL), (LINK), (UNI), (AAVE)

So global yields are in the toilet today?

Savings accounts don’t do what they used to do, do they?

How about we try out a certificate of deposit (CD) to harvest some cash?

Are there simply no other interest-bearing vehicles one can park capital in and gain a healthy return?

I would say you are right, but then I would be the fool here and I am certainly not in that line of work. But there is an elixir to the anathema.

Enter the world of crypto-based yield, the place you end up when you realize the banks stopped trying years ago. There are no logos to worship and no slick pitches to fall for, only the tools that actually make your money move.

This is a landscape of financial mechanisms built on collateralized lending, decentralized liquidity pools, and blockchain driven demand, designed to offer yields traditional banks would not dare whisper about.

A Look Back: The Early 2020s

Back in the early 2020s, centralized crypto lenders promised stable, high-yield returns by lending digital assets to traders and institutions.

The model was clear on paper: depositors supplied assets, borrowers posted collateral, and interest payments cycled back to the depositors.

The appeal was obvious, too. Floating rates far above bank offerings, over-collateralized loans that ostensibly reduced default risk, and automated liquidation engines that protected lenders from sharp drawdowns.

But those years also revealed something deeper: crypto yield wasn’t magic; it was mechanics. And mechanics depend entirely on transparency.

Several major lenders that once rode parabolic growth arcs ultimately shut down or restructured following liquidity stress and market drawdowns.

These events carved a permanent lesson into the industry: when yields come from undisclosed leverage, black-box rehypothecation, or concentrated risk, the music eventually stops.

How Crypto Yield Works (When Done Responsibly)

Today’s more mature landscape emphasizes mechanisms rather than miracles:

- Over-collateralized lending: Borrowers post more collateral than the value of the loan.

- On-chain liquidity pools: Smart contracts handle matching between liquidity providers and traders.

- Staking and validator incentives: Networks reward participants for securing blockchains.

- Real-yield models: Revenue from actual usage (trading fees, borrowing demand, network operations) flows directly to providers.

These systems function best when transparency is verifiable, incentives are aligned, and custody risks are minimized.

They fail when promised APYs float on wishful thinking, opaque balance sheets, or dependence on perpetual bull markets.

The Modern Reality Reveals A Maturing Ecosystem

For years, the traditional banking business has conditioned us naive folk to accept steep fees and no yield earnings on holdings as the status quo.

I will tell you right now that it’s a load of garbage and nobody should accept these pitiful offers from dinosaur banks.

There is so much more out there that we can access now because of crypto.

But as of 2025, the responsible path isn’t chasing a single platform but understanding the underlying engine.

Evaluating any crypto yield opportunity now requires asking questions like:

- What is the source of the yield? (Fees? Borrowing demand? Emissions?)

- How transparent is the collateralization and liquidation framework?

- Is custody centralized or verifiably on-chain?

- What are the failure modes in extreme market conditions?

- How quickly can one withdraw funds?

- Are audits and risk reports published and verifiable?

A Clearer Awakening

You’re not dreaming, crypto yield does exist. But in 2025, the real deal isn’t a single star player but in an entire ecosystem’s hard-earned maturity.

Wake up to a clearer understanding of how crypto yield works, easily convertible into better financial decisions.

Participate not by trusting a brand name, but by understanding the mechanics that make the entire machine run.

If the early 2020s were defined by explosive growth and painful lessons, the mid-2020s are defined by something far more sustainable: clarity.

These days, crypto yield is no longer a deal of a lifetime but a financial primitive. And like any powerful tool, it rewards those who learn how to use it responsibly.

Mad Hedge Bitcoin Letter

September 7, 2021

Fiat Lux

Featured Trade:

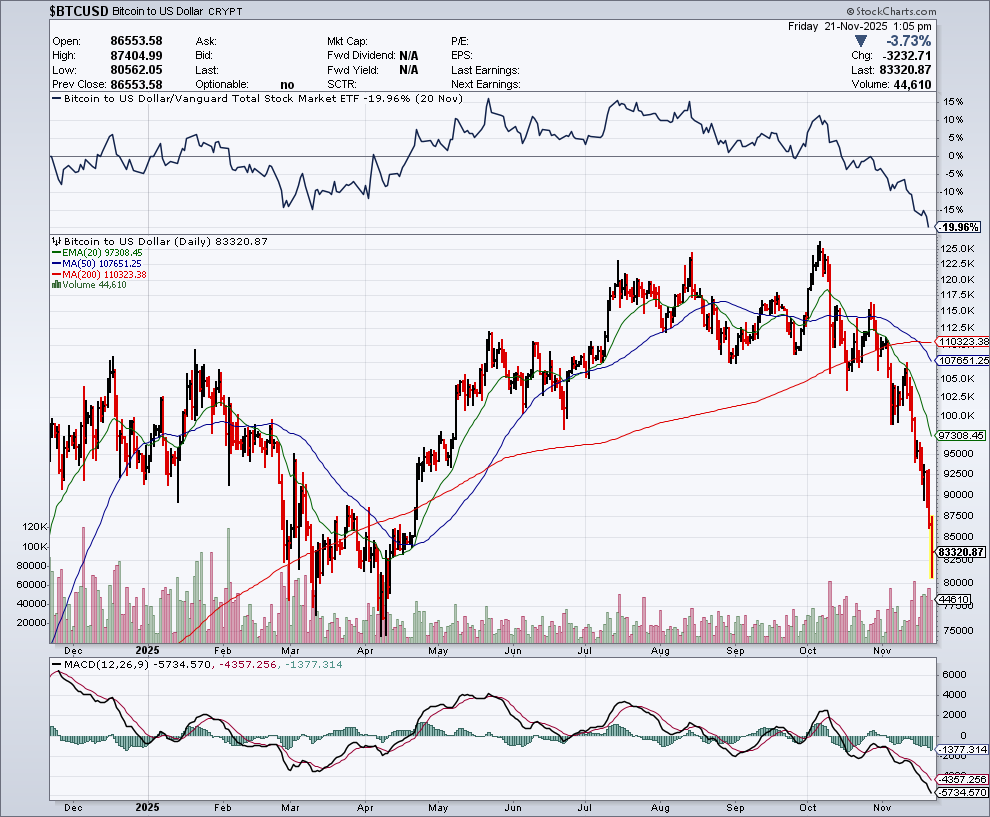

(RECORD-BREAKING INFLOWS)

($BTCUSD), ($ETHUSD), (GLD)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.