“We've arranged a civilization in which most crucial elements profoundly depend on science and technology.” – Said American astronomer and cosmologist Carl Sagan

“We've arranged a civilization in which most crucial elements profoundly depend on science and technology.” – Said American astronomer and cosmologist Carl Sagan

Mad Hedge Bitcoin Letter

September 27, 2022

Fiat Lux

Featured Trade:

(AN INDUSTRY ON THE ROPES)

(LUNA), (BTC), (DAI)

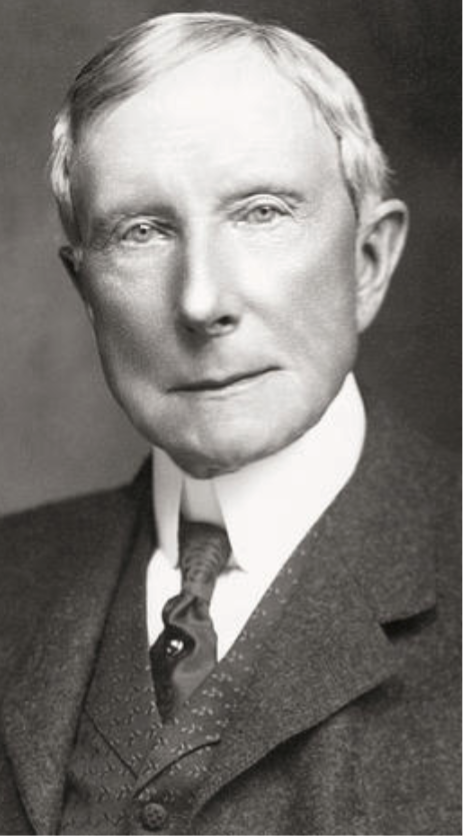

“Don't be afraid to give up the good to go for the great.” — Said American Industrialist and Oil Tycoon John D. Rockefeller

Mad Hedge Bitcoin Letter

September 22, 2022

Fiat Lux

Featured Trade:

(THE UPGRADE THAT WASN’T AN UPGRADE)

(ETH), (BTC)

The Ethereum (ETH) merge was hyped up as some grand event, but its impact has been anti-climactic and anemic.

Originally referred to as Ethereum 2.0, the merge is an upgraded version of the Ethereum blockchain that uses a proof-of-stake consensus mechanism to verify transactions via staking.

I have been asked many questions about this Ethereum merge and the hoopla surrounding it.

I’ve been asked whether the price of Ether would surge on this or not and I’ll give you my hot take.

It would have to take something quite miraculously to change the negative sentiment around the broader crypto narrative and a shift in staking method is not enough.

It’ll most likely be a footnote in the story of Ethereum and it’s done nothing to entice traders to pour money in the asset.

I would say the opposite has occurred and I’ll explain why.

The way it will manufacture Ether coins will change, but that doesn’t mean that solid value is found just because of the change.

If McDonald’s suddenly switches the shredded cabbage it uses to produce a BigMac, most consumers aren’t going to rush out to buy 1000s of BigMacs for friends and family just because the cabbage is sourced differently.

There’s not much value added unless one is a climate change supporter who will highlight that energy use will decrease by 99.5% in this new form of staking Ether.

Basically, I am saying I would not even call this an “upgrade.”

How about the issues that real Ether buyers and sellers care about?

The merge didn’t fix Ethereum’s high fees or congestion.

Seriously, the developers need to fix this. It shouldn’t cost a fee between $50-$200 to buy into this coin and until something is improved on this front, it will remain less competitive than Bitcoin (BTC).

Laying the groundwork for the future is something that buyers and sellers of Ether simply don’t care about in the short-term and the price action reflects this sentiment.

In fact, I would strongly argue there are more outright negatives than positives that came out of this staking switch.

For example, the change spurred a hard fork, splitting the blockchain in two and giving rise to an offshoot chain called Ethereum PoW.

Some exchanges and platforms have shown support for the forked version, which still uses proof-of-work (PoW) verification, and at least 19 former ether mining pools are active on it.

Another Ether variant, Ethereum Classic has been another main beneficiary of the Merge, as its hash rate has doubled, with other graphics-processing-unit (GPU) compatible PoW blockchains such as Ravencoin and Ergo also witnessing big increases.

Like most products, it’s not smart to cut buyer capacity in half and then ditch the infrastructure behind for others to use.

Ethereum has now divided its product by leaving the old miners nowhere to go which gave way to a fork that now produces multiple types of variant Ether.

These miners followed the other side of the fork because the investment in mining equipment could be easily onboarded onto the forked Ether coins.

The move was idiotic, to say the least.

Another massive concern is Ether has become less decentralized because now just a few parties control the mining.

Wasn’t crypto supposed to nix the centralization aspect of currency which is why crypto enthusiasts hate fiat money?

The Merge is the first of five upgrades planned for the blockchain.

Therefore, dropping proof of work has uplifted the competition around them which is another terrible strategic decision.

This is survival of the fittest and turning your back on critical infrastructure that now is servicing infrastructure for another rival coin is outrageous.

All told, the Ethereum merge created more problems than solutions and at the end of the day, traders could care less that there is less energy used to mine Ethereum.

In fact, Ethereum miners are just using their equipment to mine other coins leading me to say that no energy savings were accrued in crypto whatsoever.

Either way, macro forces are still the leading driver of crypto prices as we lurch from one crisis to the next and we are still in the middle of crypto winter.

I am bearish Ether in the short term.

“Study hard so that you can master technology, which allows us to master nature.” – Said Argentine Revolutionary Che Guevara

Mad Hedge Bitcoin Letter

September 20, 2022

Fiat Lux

Featured Trade:

(THE SAVIOR)

(BTC), (FTX), (SKYBRIDGE)

Enigmatic crypto investor Sam Bankman-Fried, founder of crypto exchange FTX, acquired a 30% stake in Anthony Scaramucci’s SkyBridge Capital, an alternative investment firm.

I believe this deal highlights the desperation the crypto industry currently faces.

I also don’t see the value in it.

Bankman-Fried is essentially the only prominent investor liquid enough to bank mediocre crypto infrastructure mostly because he has skin in the game and would potentially get shellacked with monstrous losses if crypto as an industry goes under.

Doing his best to prop up the mess is in his interests, otherwise, his brainchild FTX would suffer too.

As harrowing as this sounds, I don’t think crypto as an industry will go under, but the wounds get rawer by the day.

The deal was inked through SBF's venture-capital firm FTX Ventures and will support growth initiatives for SkyBridge.

SkyBridge will deploy the capital from FTX to buy $40 million in cryptocurrencies, which it will hold on its balance sheet.

SkyBridge investors are demanding redemptions from the fund ever since the price of Bitcoin has tanked causing anyone involved with the crypto industry a world of pain.

Many are anointing Bankman-Fried as the savior of crypto, but I would argue that this shows the inferiority of crypto as an industry.

It’s signaling that no other big names are coming to save crypto. No Marc Andreesen or anyone of that magnitude.

Crypto has shown it’s only viable when liquidity is in the process of loosening, and currently, the opposite is happening.

In fact, it appears as if liquidity will get even tighter heading into year-end.

And if that wasn’t bad enough, the integrity of the crypto industry has been under attack from all directions for quite some time.

Yet another explosive headline came out saying that a founder of a cryptocurrency investment research firm was accused by the SEC of promoting an initial coin offering without disclosing that he had been given incentives to do so.

Ian Balina, 33, promoted the SPRK token on social media platforms including YouTube and Telegram without revealing that he had been compensated by the company that offered it, the Securities and Exchange Commission said in a suit filed Monday in federal court in Austin, Texas.

It’s certainly a bad look that crypto is attracting such bad actors and the brand name downgrade just keeps getting clearer.

I believe crypto will weather this crypto winter but for the 10s of thousands of other crypto products, let’s call them collateral damage.

The next question is at what point does Bankman-Fried stop whipping his savior capital around and at what point does the crypto infrastructure get so bad there’s no way back?

Considering Bankman-Fried has wealth of around $24 billion, a $50-$70 million investment in some marginal crypto hedge fund is just a drop in the bucket for him.

SkyBridge doesn’t do that much, it just sells a crypto ETF, takes in fees for it, and markets it as a safer pair of hands to handle crypto for the investor. Investors can just go and buy crypto on Bankman-Fried’s FTX for a more direct way to invest in the same thing.

I do believe it’s worth it for Bankman-Fried to save these small companies now, to later unload them for a profit when Bitcoin recovers. He can afford the carry costs as he can pay in cash and avoid the high interest debt markets.

However, I do believe he will abstain from billion dollar purchases.

Even with him, there’s a limit.

As for the crypto infrastructure, just save one coin and that’s Bitcoin and the rest can go to hell. If this scenario takes place, crypto will survive and strengthen after the crypto winter ends.

Until then, it’s about survival for just about everyone in the crypto industry until the next crypto bull market initiates.

“I don’t want to fight old battles. I want to find new ones.” – Said Current CEO of Microsoft Satya Nadella

Mad Hedge Bitcoin Letter

September 15, 2022

Fiat Lux

Featured Trade:

(PICKING A FIGHT WITH GARY)

(BTC), (IRS), (SEC), (COIN)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.