Biting Off More Than They Can Chew

"If you build it, they will come." But what happens when they come before you've finished building?

That's the billion-dollar question facing the makers of GLP-1 weight loss drugs.

GLP-1 drugs, the newest darlings of the pharmaceutical world, are selling like hotcakes. Eli Lilly (LLY) and Novo Nordisk (NVO), the current heavyweights in this arena, raked in a whopping $10.4 billion and $6.85 billion respectively last year.

Basically, the demand is there, but the supply? Well, that's another story.

So far, Lilly and Novo have been throwing money at the problem like it's going out of style. We're talking billions here. Novo's earmarked $6.5 billion for production this year alone, while Lilly's already shelled out $5.3 billion to beef up its manufacturing muscle. They're expanding facilities faster than you can say "miracle weight loss drug."

But even that's not enough. Lilly admits the industry needs at least 10 to 15 dedicated sites to even come close to meeting demand.

It's like trying to serve a five-course meal to a packed restaurant with just one chef and a microwave.

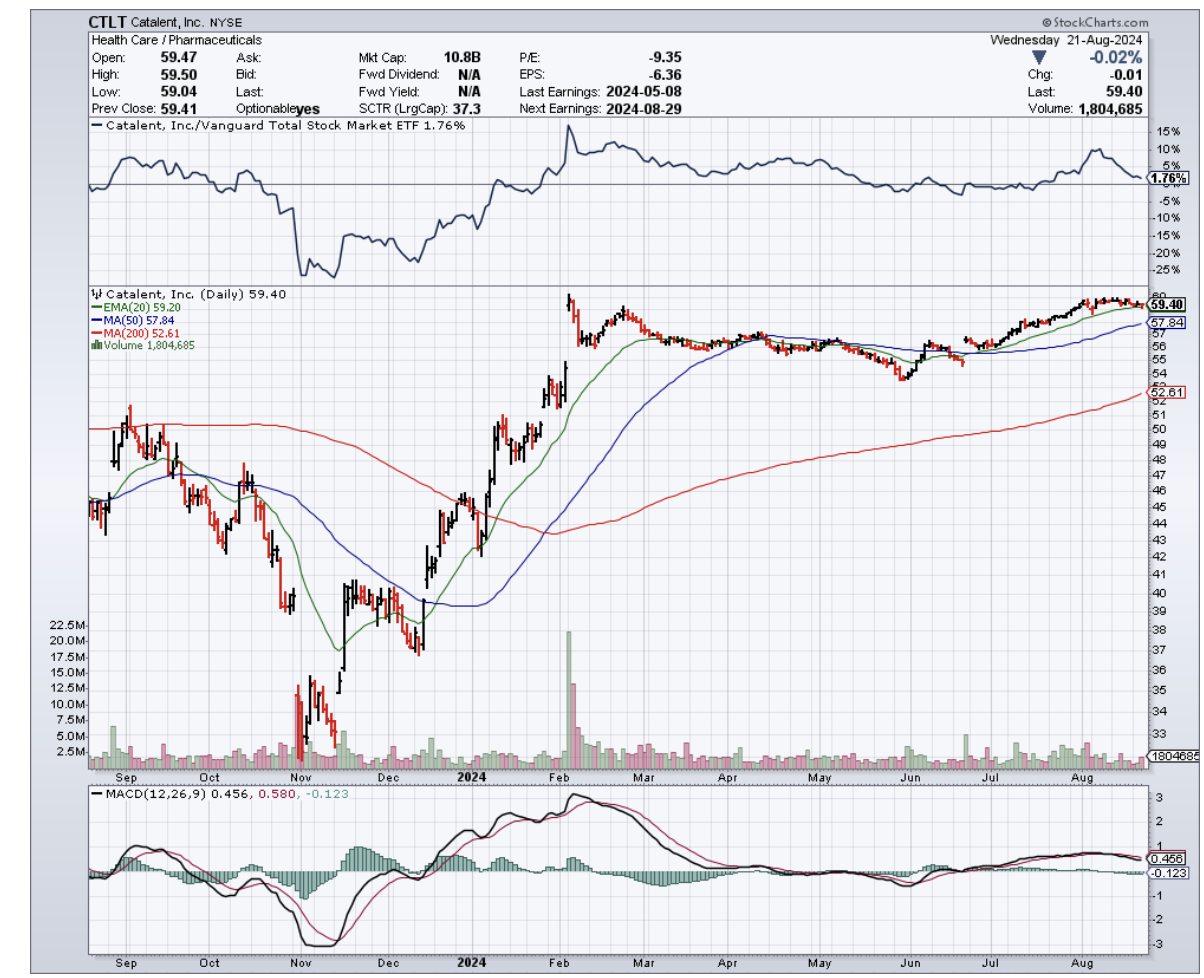

And let's not forget about the price tag on these manufacturing sites. Novo just dropped $11 billion to buy three fill-finish sites from Catalent (CTLT). Talk about paying a premium for prime real estate.

While Lilly and Novo scramble to ramp up production, their manufacturing woes have created a window of opportunity for competitors eyeing a slice of the GLP-1 pie.

Boehringer Ingelheim and Zealand Pharma (ZLDPF) are closest to market with their Phase 3 drug survodutide.

Meanwhile, Roche (RHHBY) and Amgen (AMGN) aren't far behind in Phase 2. Even Pfizer's (PFE) dipping its toes in the water with an early-stage drug.

But here's where it gets interesting for us who want a piece of the action. These newcomers are facing a manufacturing dilemma of their own.

Do they build their own facilities and risk being late to the party? Or do they outsource and potentially lose control over production?

Some, like Boehringer and Roche, are already talking about using third-party manufacturers. It's like hiring a catering company instead of building your own restaurant – less upfront cost, but you're at the mercy of someone else's kitchen.

Enter the contract manufacturing organizations (CMOs), the unsung heroes of the pharmaceutical world who might just hold the key to unlocking the full potential of the GLP-1 market.

Let’s take a look at the big players in this space.

Lonza Group (LZAGY), with its $6.6 billion in annual revenue and 10% market share in biologics contract manufacturing, is a force to be reckoned with. They're not just sitting on their laurels either – they're pumping $850 million into a new biologics facility in Switzerland.

Then there's Thermo Fisher Scientific (TMO), the 800-pound gorilla of the industry. With a cool $44.9 billion in revenue last year and an 8% to 10% market share in contract manufacturing, they're a go-to partner for big pharma.

They've been on a shopping spree too, scooping up Pharmaceutical Product Development (PPD) for $17.4 billion to boost their manufacturing capabilities.

And, of course, let's not forget about Catalent. They might have sold some facilities to Novo, but they're still a major player with $4.8 billion in revenue last year. They're betting big on biologics, with plans to increase capacity by 40% by 2025.

As for those looking for growth potential, keep an eye on Samsung Biologics. They're the new kid on the block, with a 30% compound annual growth rate over the past five years and the world's largest single-site biologics manufacturing facility.

So, there you have it. The obesity epidemic is a tragedy, but it's also a trillion-dollar opportunity.

With half the population projected to be obese by 2030, this isn't just a health crisis—it's a financial frontier.

The GLP-1 market is poised to balloon to $130 billion, creating a feeding frenzy for those ready to capitalize on the supply squeeze.

But here's the real meat of the matter: in this gold rush, it's not just the drug developers who are striking it rich. The real winners are the manufacturers—those with the capacity to meet the insatiable demand. They're the ones handing out the "shovels" in this weight loss bonanza.

So while everyone else is focused on the flashy GLP-1 drugs, I suggest you also keep a watchful eye on these behind-the-scenes players.

Now, if you'll excuse me, I'm off to patent my groundbreaking idea: GLP-1-infused kale chips. Who says you can't have your cake and eat it too?