Born With A Silver Sequence

When my kids were born years ago, the most advanced technology in the delivery room was the fetal heart monitor, which had all the predictive power of a Magic 8 Ball with a medical degree.

Those primitive days feel like ancient history now.

Today, as I watch my friends' grandchildren entering the world, they're getting something I would have traded my first hedge fund for: a complete genetic blueprint that makes a heart monitor look like two cups and a string.

Enough nostalgia. Let me cut straight to the chase, because nothing makes me twitchier than analysts who dance around the point like nervous fathers in a delivery room.

What I want to say is that I'm betting big on something called whole genome sequencing (WGS) for every newborn. And don't worry - this isn't just another biotech pipe dream cooked up by optimistic PhDs with too much venture capital.

Having spent years in Japan during the 1970s watching semiconductor technology transform from an expensive curiosity into an industrial necessity (rather like sushi in Manhattan), I recognize the same patterns emerging here.

The cost trajectory alone is enough to make a value investor weep with joy - from $100 million per genome in 2001 (roughly the price of a small island) to less than $600 today, with Illumina (ILMN) pushing to bring it to $100.

And what do we get for this bargain-basement pricing?

The numbers from the GUARDIAN project are juicier than an insider trading tip - and completely legal, I might add.

They're screening newborns for over 200 genetic conditions, while most hospitals are still stuck at 30, like they're using a genetic View-Master instead of an IMAX theatre.

In their first 4,000 participants, they found actionable diagnoses in 3.7% of newborns - conditions that traditional screening would have missed like a banker misses market crashes.

Let's look at the hard economics.

In NICU settings, ultra-rapid genome sequencing is already saving $14,265 per child and changing patient management in 37% of cases.

Early intervention in spinal muscular atrophy alone saves over $4 million in lifetime costs per patient - the kind of numbers that make healthcare administrators actually smile, a rare sight indeed.

These clinical benefits translate directly to the bottom line.

Just consider the market size. We're looking at $62.9 billion by 2030, growing at 18.2% annually.

The newborn screening market alone will hit $2.27 billion by 2025, and if that doesn't get your investment synapses firing, you might want to check your own genetic predisposition to opportunity recognition.

But impressive market numbers are just the beginning.

The technology landscape is shifting faster than trading algorithms during a Flash Crash. Stanford Medicine is now diagnosing genetic diseases in under eight hours - a process that used to take longer than getting approval for a mortgage.

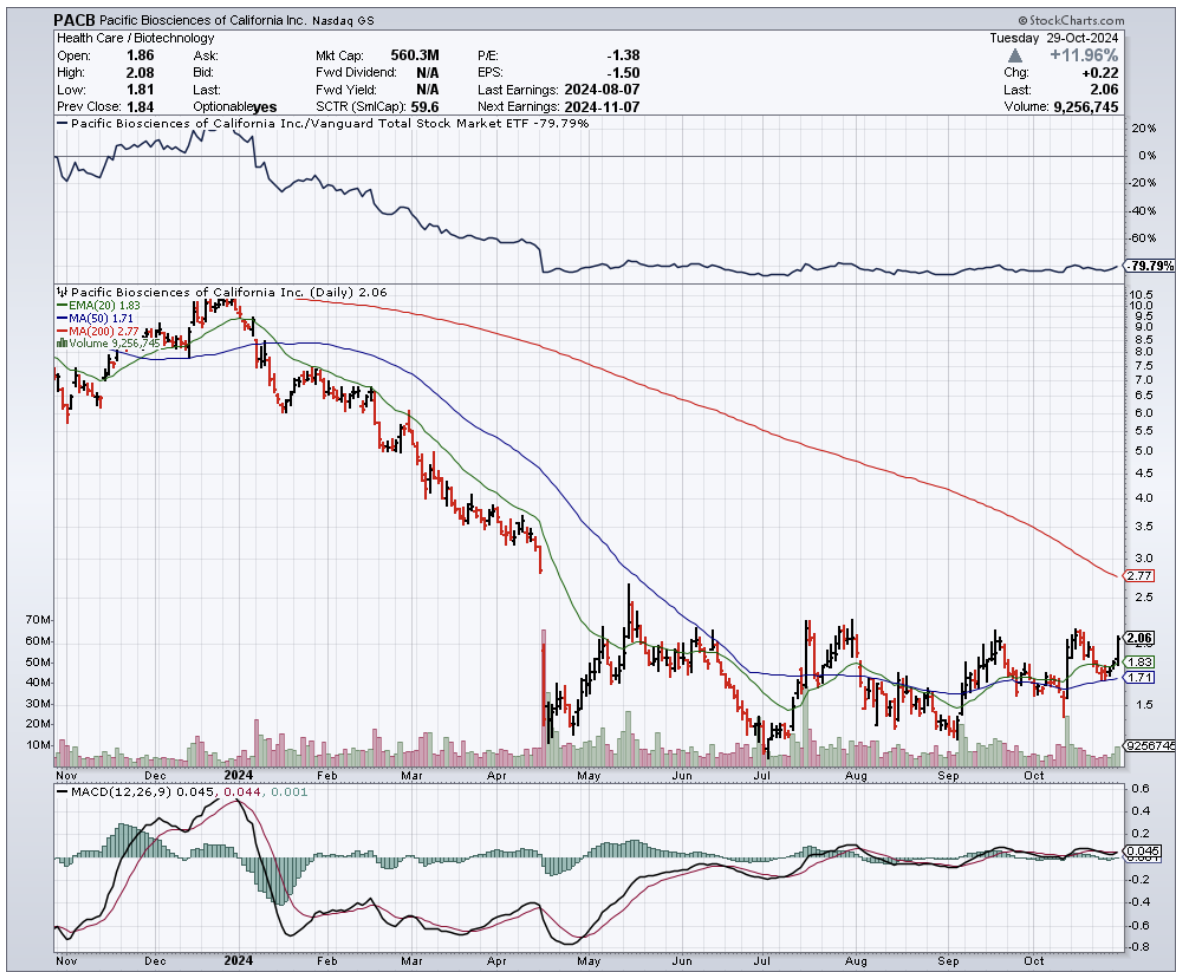

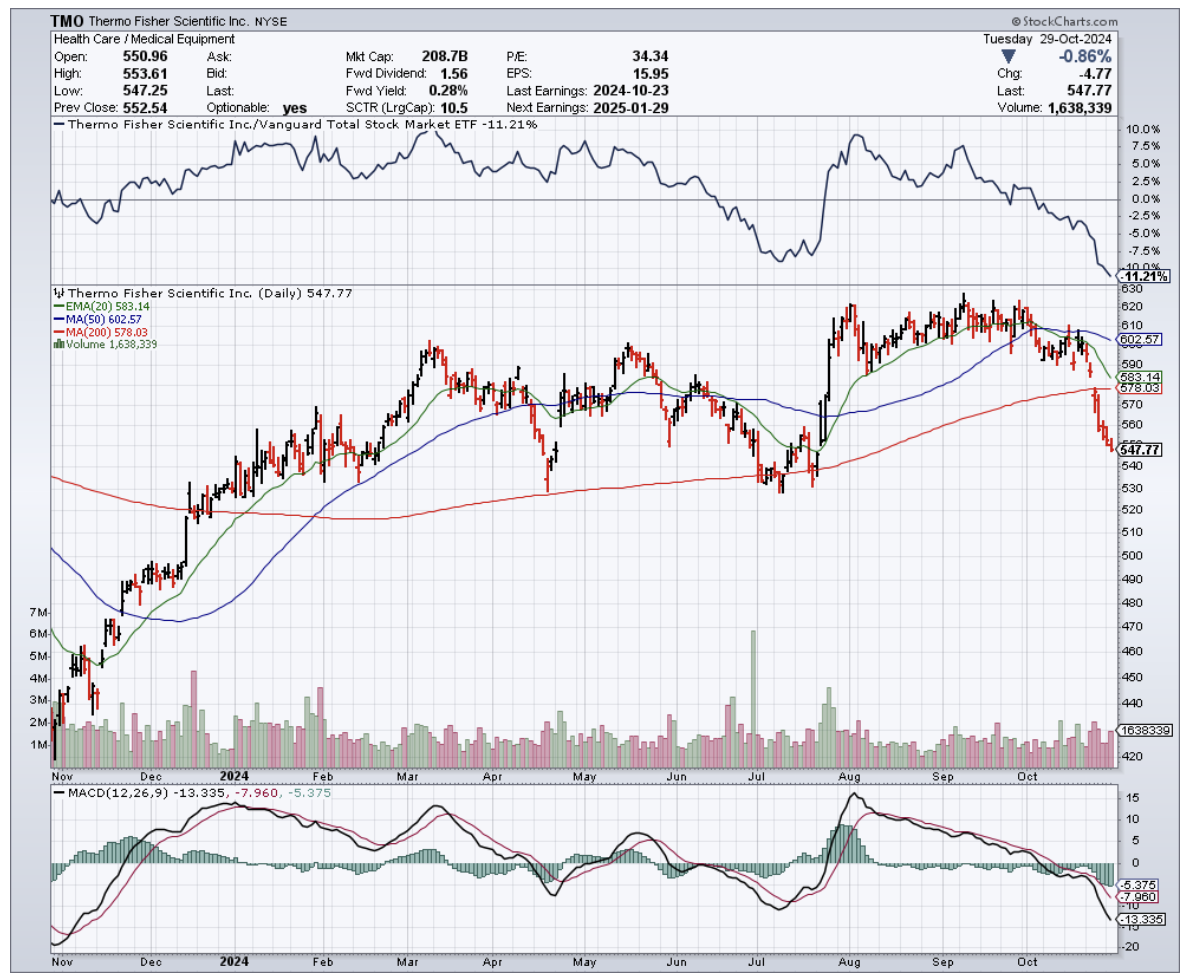

Companies like Illumina, Pacific Biosciences (PACB), and Thermo Fisher Scientific (TMO) are playing a game of genetic leapfrog, each advance more impressive than the last.

Meanwhile, Sophia Genetics and their AI cohort are turning genetic data into actionable insights faster than you can say "double helix."

Having watched technology transformations unfold before, I know what I'm seeing.

My years in Japan taught me one crucial lesson (aside from never mix wasabi with everything just because you can): the difference between routine technological advancement and true paradigm shifts is as clear as the gap between a good investment and a great one.

What we're witnessing now - plummeting costs, advancing technology, and clear market demand - is rarer than a hedge fund manager admitting they were wrong.

And the implications are staggering. Think about this: we're approaching an era where every child starts life with a complete genetic roadmap.

It's like getting the ultimate user manual at birth, except this one actually tells you something useful, unlike those assembly instructions from Swedish furniture companies.

Smart money should be building positions now, while the broader market is still scratching its head like a freshman in advanced calculus.

The companies that establish themselves as leaders in this field won't just be successful - they'll be as fundamental to healthcare as smartphones are to teenagers.

As both a parent and an investor who's seen more market cycles than a laundromat, I haven't been this excited since I discovered you could actually make money going short. This is one of those rare moments when doing well and doing good align so perfectly, it's like finding a unicorn that also files your taxes.

Don't miss this one. Some opportunities in life are as rare as a bearish call at a bull market convention - this is one of them.