Buy the Big Dip in Gold.

Look at the charts for the barbarous relic below and you can only come to one possible conclusion. If the Federal Reserve disappoints on Thursday, just a little bit, even by a smidgeon, and does not deliver QE3 and gold sells off big, you should jump in and by the stuff like crazy.

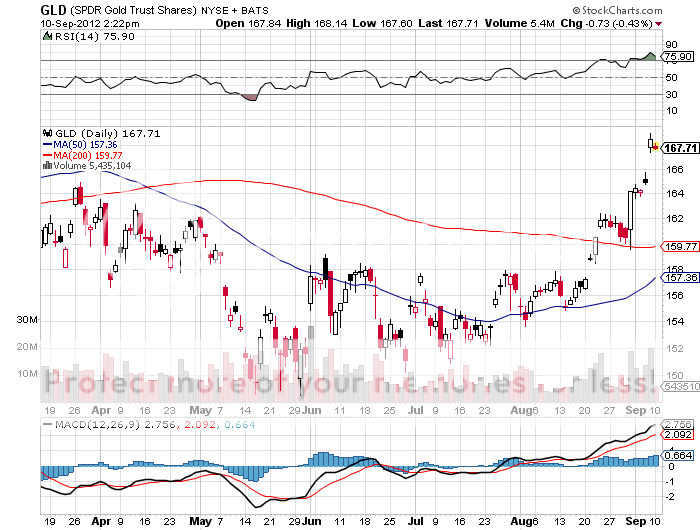

All of the charts for gold and the derivative plays are showing major breakouts to the upside. This is true for spot gold and the ETF (GLD), which broke a major downtrend line last week. It is the case for the gold miners ETF (GDX). It is also the reality for silver, the silver ETF (SLV), and the silver miners (SIL).

The entire precious metals space has been floated since the prospect of further quantitative easing from the world?s central banks started in earnest on May 15. Since then, it has been prudent and profitable to buy every dip.

European Central Bank president Mario Draghi did the heavy lifting in mid-July by promising to ?Do whatever it takes to rescue the Euro? (read: huge quantitative easing). He then put his money where his mouth was last week by announcing an unlimited bond-buying program.

Assorted dovish Federal Reserve governors have done their bit by talking up the prospect of further monetary easing. China threw in its ten cents by announcing a $150 billion reflationary budget on Friday. Even the Bank of Japan has been heard murmuring about additional money printing. It all has the smell of an international coordinated effort to reflate the global economy.

Where exactly do you get back in? The sweet spot in the (GLD) will be the 200 day moving average at $159.66, which fell at the end of August. That is down $7.94 in (GLD), or $79.40 in the spot market from here.

Would you Consider a Long-Term Relationship?