Crypto Regulation is Far Away

Indecision.

That’s what you get when Washington tries to wrap their brains around crypto regulation.

Cryptocurrency industry executives appeared before Congress to debate whether crypto technologies hold a use case for the future.

A Republican even brought up whether politicians “know enough about this technology to have a serious debate.”

So we are talking about really low levels of crypto comprehension here.

It almost reminds me of the Senate discussions on Facebook years ago when government officials failed to understand what digital advertising was or how Facebook made money.

It was something of that sort, but of course, with a different asset class altogether.

At least Facebook dealt in terminology that was closer to what Congress could understand.

Some Democrats at the hearing couldn’t make a decision about whether crypto is an inherent good or bad.

I feel that this could be the biggest threat where Democrats pit crypto against the US dollar and see it as a necessary evil to take down.

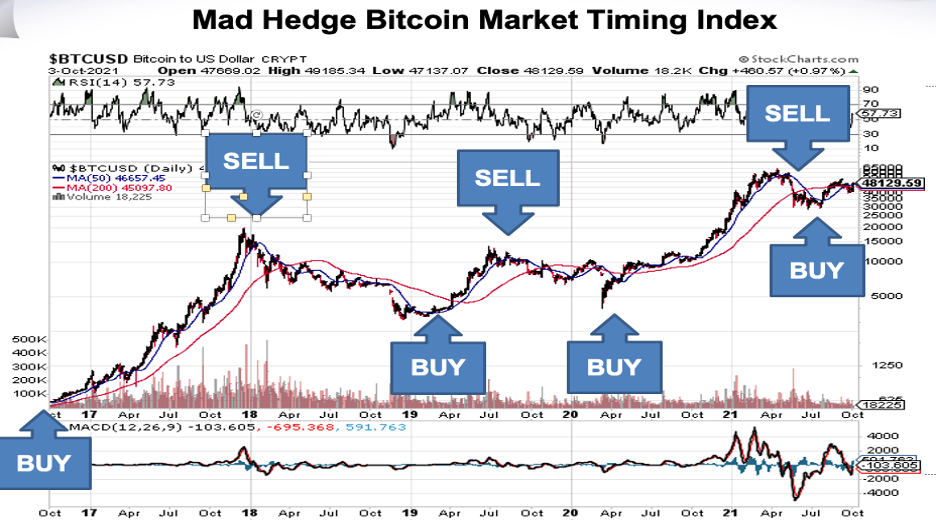

No wonder Bitcoin had a slightly down day in the crypto market as the net net of the talks was consensus that this is going to take a long time to get any meaningful victories and Congress barely knows what this is.

There is nothing smash and grab about this.

Everyone wants their piece of it.

It’s no coincidence that California has the highest income tax regime out of any state and let’s hope Democratic politicians don’t take that type of attitude to crypto.

We are not talking about technical questions here.

This is a $3 trillion market and it’s no joke.

A few Republicans were highly laissez-faire in nature during talks and proposed having minimal regulation realizing not to kill the goose that lays the golden eggs.

The argument revolved around making sure America was the heart and center of the future crypto industry.

Readers should remember that China banned crypto and expelled their crypto miners who had to flee to Texas and Kazakhstan.

China has made its decision that it won’t partake in any upside to the crypto industry.

A widely accepted principle of modern politics is that the American right loathes regulation and that Republicans will do everything in their power to get rid of as much government as possible.

Ever since the Reagan Presidency, Republicans have built this anti-government narrative, claiming that government crushes personal freedom, outsources jobs, and sabotages economic growth.

If Republicans flip the house in 2022 during the mid-term elections, crypto regulation will most likely be put on the backburner for good.

I don’t see any deal breakers coming our way, but certainly, the indecision during this meeting caused a dark shadow over the direction of crypto even if for a split second.

It was a reminder that crypto isn’t the panacea for all evils.

Even if nothing gets decided now, but down the road something does, it would be something more than insanity for Congress to kill a $5 trillion or $10 trillion industry by the time they can get around to destroying it.

The silver lining in the short-term is that investors will keep pouring capital into crypto-based and blockchain investments and technology like the metaverse will still get built with crypto tokens being the heart and central to a metaverse payment system.

None of that will get shut down for years and like many other industries in America, this just might get too big to fail, maybe gift in a few or several bailouts along the way as well ala the banking sector.

Remember, this still is America!

Maybe I am being a little too cynical, but remember that Facebook and its blatant and brazen theft of data business model just need to pay lip service to Congress during Senate hearings once in a while and they are good to go.

Crypto does nothing nearly as terrible as Facebook.

And Facebook is still the leader in creating the Metaverse after all of that.

Congress still hasn’t done squat and I can easily see crypto following the same type of game script.

Get ready for the same old story, crypto executives and politicians sitting within a 4-wall room agreeing that something needs to be done but without creating deadlines or any call to action.

Long term this is great for crypto and there will be no meaningful regulation for years.