December 27, 2024

(THE LONG-TERM INFLATION TARGET MAY BE 2%, BUT THE REALITY WILL LIKELY BE QUITE DIFFERENT)

December 27, 2024

Hello everyone

The era of stable inflation is over.

Yes, the Fed might get inflation down to close to 2%, but I believe they will struggle to keep it there.

Let’s check out the reasons why here.

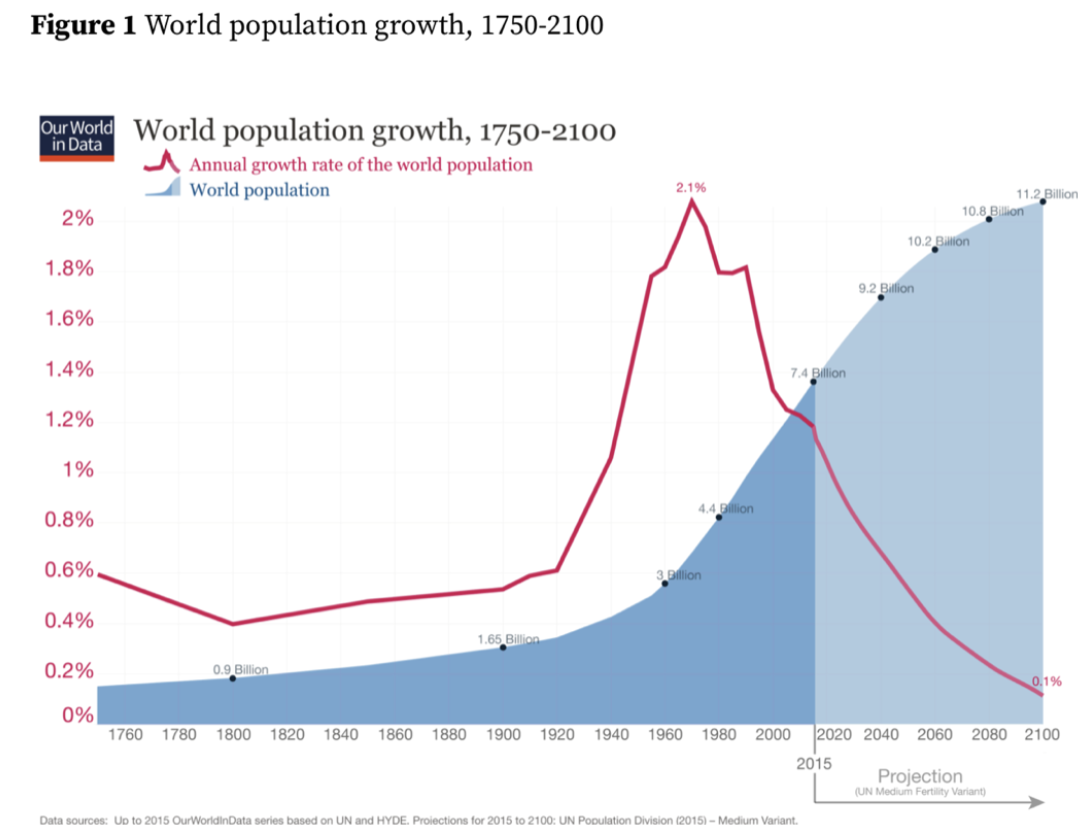

First, demographics.

The U.S. and other Western industrial countries – even China – are facing declining populations that will result in a persistent shortage of labour. Tight labour markets in turn will keep upward pressure on wages as businesses compete for workers.

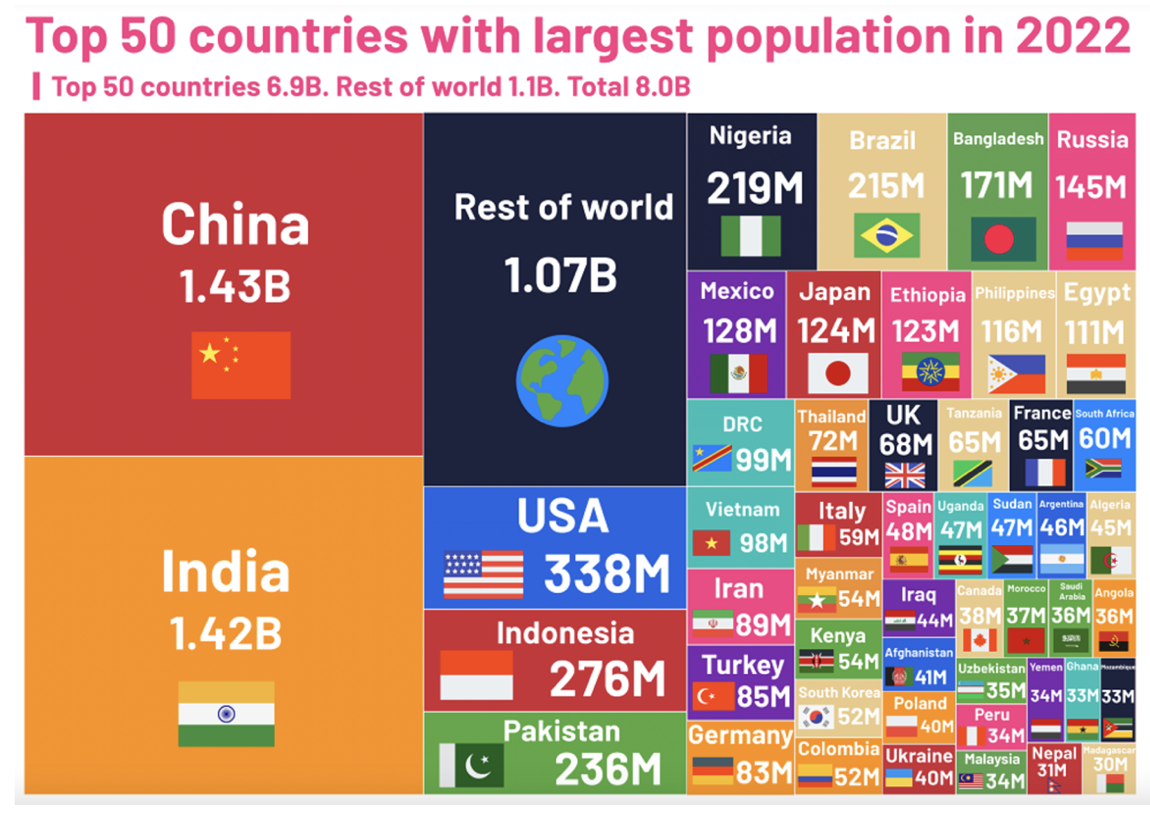

AND THESE ARE THE TOP 50 COUNTRIES WITH THE LARGEST POPULATION IN 2050.

And then there is the era of global free trade, which is taking a backseat to security concerns in the wake of the Russian war on Ukraine and Western tensions with China after the pandemic. Any tensions between the U.S. and China tend to be costly.

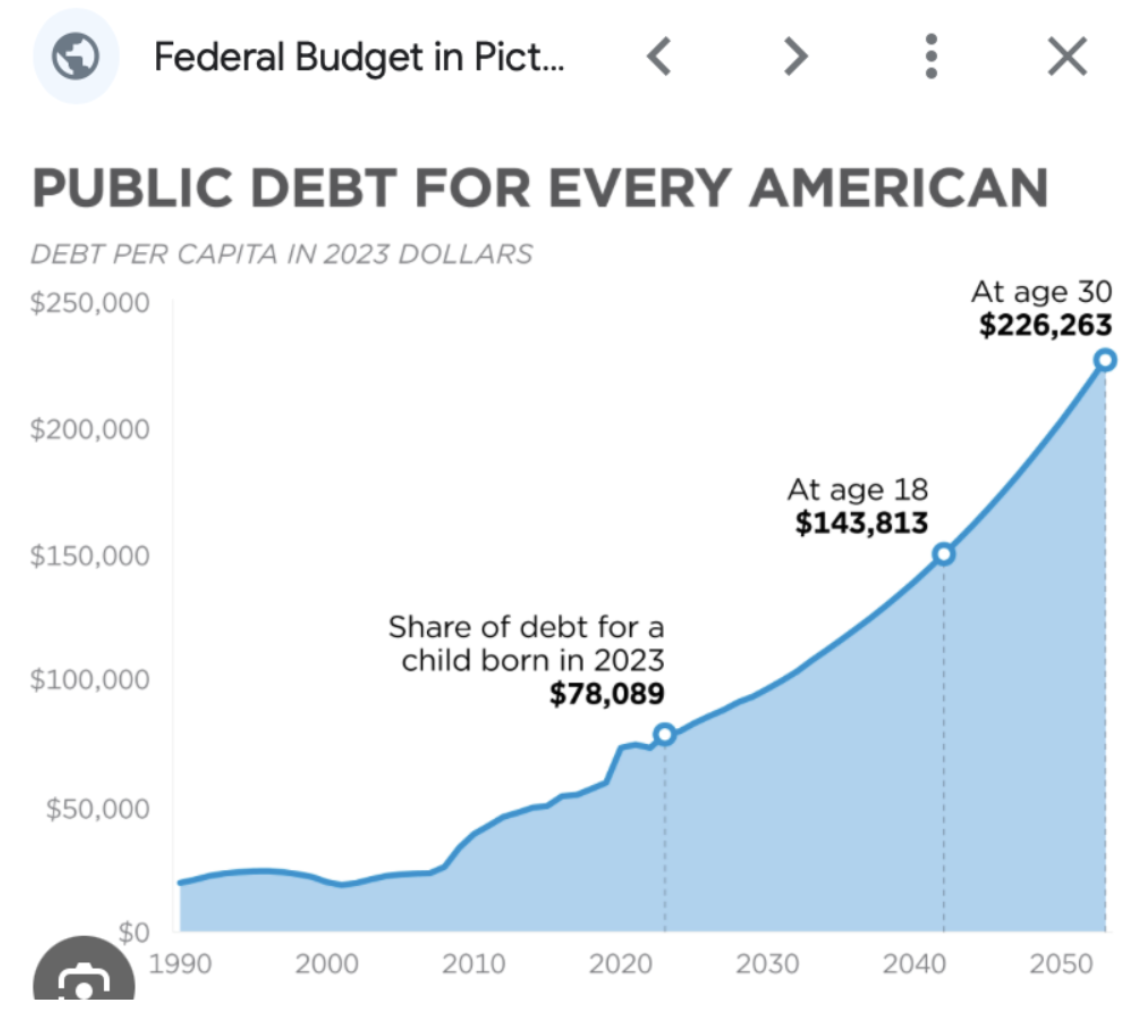

The growing government deficit – does anyone really think about this and its consequences? – is also fuel for inflation. The U.S. has been running trillion-dollar deficits since the pandemic and the national debt is expected to continue to grow by leaps and bounds.

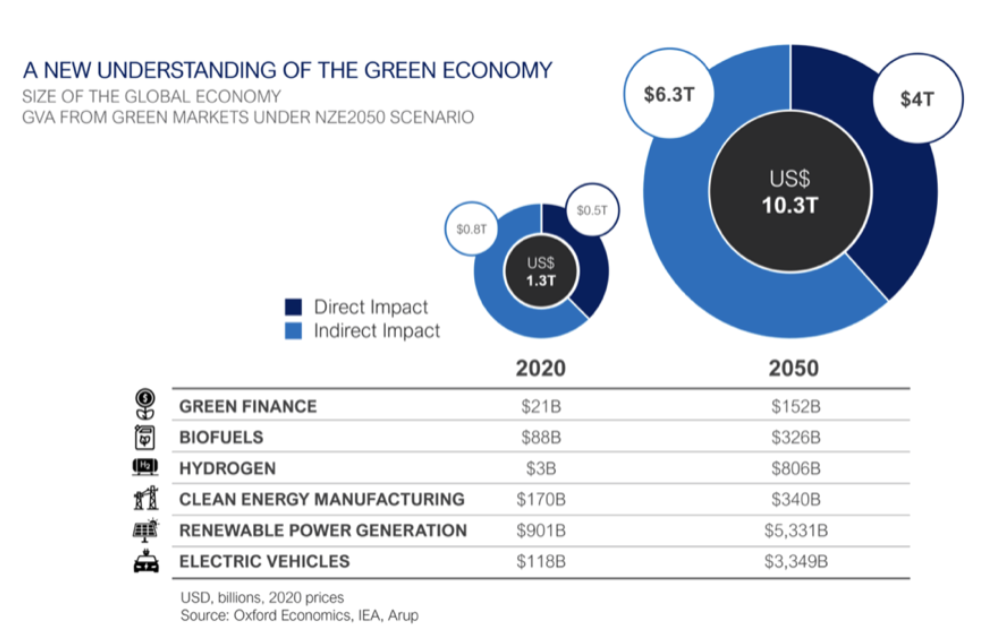

The importance of greening the economy is a concept we all appear to accept. But this is another potential inflation accelerator. And what about the implications here? The U.S. would need to spend trillions of dollars to modernize its electric grid and feed the insatiable appetite of emerging technologies such as artificial intelligence. Lots of older, valuable assets such as coal-or gas-fired could also get stranded.

2% inflation has gone by the wayside for the long term? We’re probably looking at a 3% inflation world.

The only way to get to 2% long term would be to drive up unemployment and collapse the economy. Hands up who thinks the Fed is going to do that?

Cheers

Jacquie