Global Market Comments

September 26, 2013

Fiat Lux

Featured Trade:

(THE GOVERNMENT THAT CRIED WOLF),

(BREAKFAST WITH BOONE PICKENS)

Reformed oil man, repenting sinner, and borne again environmentalist, T. Boone Pickens, Jr. says that ?When we turn the US green, it will have the best economy ever.?

I met the spry, homespun billionaire at San Francisco?s Mark Hopkins on a leg of his self-financed national campaign to get America to kick its dangerous dependence on foreign oil imports. For the past 30 years, the US has had no energy policy because ?no one wanted to kick a sleeping dog.?

Production at Mexico?s main Cantarell field is collapsing, and will force that country to become a net importer in five years. Venezuela is shifting its exports of its sulfur-laden crude to China for political reasons, once refineries in the Middle Kingdom are completed to handle it.

Unfortunately, stable energy prices have put urgent alternative energy development on a back burner, with his preferred natural gas (UNG) taking the biggest hit. If the US doesn?t make the right investments now, our energy dependence will simply shift from one self-interested foreign supplier (Saudi Arabia) to another (China).

Wind and solar alone won?t work on still nights, and can?t power an 18-wheeler. Don?t count on the help of the big oil companies because they get 81% of their earnings from selling imported oil. The answer is in a diverse blend of multiple alternative energy supplies from American only sources.? Although Boone now has Obama?s ear, it?s a long learning process.

Boone says he has donated $700 million to charity, and argues that the 20,000 trees he has planted should offset the carbon footprint of his Gulfstream V private jet.

I worked with Boone to organize financing for a Mesa Petroleum Pac Man oil company takeover in the early eighties, when it was cheaper to drill for oil on the floor of the New York Stock Exchange than in the field. Now 85, he has not slowed down a nanosecond.

As Boone walked out the door, I shook hands with him and said ?I want to be like you when I grow up.? He smiled. When you meet a friend who is 85, you never know if you are going to see him again.

Global Market Comments

September 25, 2013

Fiat Lux

Featured Trade:

(MAD HEDGE FUND TRADER HITS THREE YEAR 100% GAIN),

(JOIN THE INVEST LIKE A MONSTER SAN FRANCISCO TRADING CONFERENCE),

(WHY I?M BUYING THE TREASURY BOND MARKET),

(TLT), (TBT)

iShares Barclays 20+ Year Treas Bond (TLT)

ProShares UltraShort 20+ Year Treasury (TBT)

I am pleased to announce that I will be participating in the Invest Like a Monster Trading Conference in San Francisco during October 25-26. The two-day event brings together experts from across the financial landscape who will improve your understanding of markets by a quantum leap and measurably boost your own personal trading performance.

Tickets are available for a bargain $399. If you buy the premium $499 package you will be invited to the Friday 6:00 pm VIP cocktail reception, where you will meet luminaries from the trading world, such as Trademonster?s Jon and Pete Najarian, Guy Adami, Jeff Mackey, and of course, myself, John Thomas, the Mad Hedge Fund Trader. All in all, it is great value for the money, and I?ll personally throw in a ride on the City by the Bay?s storied cable cars for free.

Jon Najarian is the founder of OptionMonster, which offers clients a series of custom crafted computer algorithms that give a crucial edge when trading the market. Called Heat Seeker ?, it monitors no less than 180,000 trades a second to give an early warning of large trades that are about to hit the stock, options, and futures markets.

To give you an idea of how much data this is, think of downloading the entire contents of the Library of Congress, about 20 terabytes of data, every 30 minutes. His firm maintains a 10 gigabyte per second conduit that transfers data at 6,000 times the speed of a T-1 line, the fastest such pipe in the civilian world. Jon?s team then distills this ocean of data on his website into the top movers of the day. ?As with the NFL,? says Jon, ?you can?t defend against speed.?

The system catches big hedge funds, pension funds, and mutual funds shifting large positions, giving subscribers a peek at the bullish or bearish tilt of the market. It also offers accurate predictions of imminent moves in single stock and index volatility.

Jon started his career as a linebacker for the Chicago Bears, and I can personally attest that he still has a handshake that?s like a steel vice grip. Maybe it was his brute strength that enabled him to work as a pit trader on the Chicago Board of Options Exchange for 22 years, where he was known by his floor call letters of ?DRJ.? He formed Mercury Trading in 1989 and then sold it to the mega hedge fund, Citadel, in 2004.

Jon developed his patented algorithms for Heat Seeker? with his brother Pete, another NFL player (Tampa Bay Buccaneers and the Minnesota Vikings), who like Jon, is a regular face in the financial media.

In order to register for the conference, please click here. There you will find the conference agenda, bios of the speakers, and a picture of my own ugly mug. I look forward to seeing you there.

Cling! Cling!

Jon Najarian

Jon Najarian

The Trade Alert service of the Mad Hedge Fund Trader has posted a year-to-date gain of 43.24%, a new all time high. Performance since inception 33 months ago soared to 98.29%. This pegs the average annualized return at 35.7%, putting me in the absolute top tier of all hedge fund managers.

These numbers come off the back of a blistering September month to date of up +5.66%. Some 72% of all Trade Alerts since the beginning have been profitable. Carving out the closed 2013 trades alone, 42 out of 51 have made money, a success rate of 82%. In addition, we are carrying six open trades, which are profitable. It is a track record that most big hedge funds would kill for.

This performance was only made possible by correctly calling the near term direction of stocks, bonds, foreign currencies, energy, precious metals and the agricultural products. This may sound easy, until you try it. Some retirement!

My big win this month has been my major short position in the Japanese yen (FXY), (YCS), which is probing new lows against the dollar as we speak. The Japan win on hosting the 2020 Olympics gave the beleaguered Japanese currency some extra downside momentum. The yen has already collapsed in the crosses, and a further major breakdown against the dollar is imminent.

We really coined it on a short position in the Euro (FXE), coming out near the bottom. A new position in copper producer, Freeport McMoRan (FCX), become immediately profitable, jumping some 5% after the Trade Alert went out. I jumped at the $60 selloff in Apple shares in the wake of their latest product launch, instantly, moving into the green with this holding as well. The same is true for my long in the Australian dollar (FXA).

Only my oil short left me with a hickey, which I stopped out of, thanks to the Syria gas attack. Still, if I had held it for only two more hours it would have made money when the Russian peace initiative for Syria was announced. Risk control is paramount if you want to swing for the fences. Welcome to show business.

The coming autumn promises to deliver a harvest of new trading opportunities. On the menu are the taper, a new Fed governor, a debt ceiling crisis, a possible war with Syria, and the death of the bull market in bonds. The Trade Alerts should be coming hot and heavy.

Global Trading Dispatch, my highly innovative and successful trade-mentoring program, earned a net return for readers of 40.17% in 2011 and 14.87% in 2012. The service includes my Trade Alert Service and my daily newsletter, the Diary of a Mad Hedge Fund Trader. You also get a real-time trading portfolio, an enormous trading idea database, and live biweekly strategy webinars, Global Trading Dispatch PRO adds Jim Parker?s Mad Day Trader service to the mix.

To subscribe, please go to my website: ?www.madhedgefundtrader.com, find the ?Global Trading Dispatch? box on the right, and click on the lime green ?SUBSCRIBE NOW? button.

Some Retirement!

Some Retirement!

Global Market Comments

September 24, 2013

Fiat Lux

Featured Trade:

(APPLE?S BLOWOUT NUMBERS SEND BEARS SCAMPERING),

(AAPL), (QCOM), (CHL), (SSNLF), (MSFT), (GOOG),

(EXPIRATION OF MY YEN BEAR PUT SPREAD),

(MY PERSONAL LEADING ECONOMIC INDICATOR),

(NOTICE TO MILITARY SUBSCRIBERS)

Apple Inc. (AAPL)

QUALCOMM Incorporated (QCOM)

China Mobile Limited (CHL)

Samsung Electronics Co. Ltd. (SSNLF)

Microsoft Corporation (MSFT)

Google Inc. (GOOG)

Add this one to the ?WIN? column.

I strapped on this position because I believed that the world was adding risk, expecting major bull moves, once it becomes clear that the multiple disasters now threatening the world don?t actually happen. The list includes war with Syria, the taper, the Bernanke replacement, the debt ceiling crisis, another sequester, yada, yada, yada.? A yen short is one of many ways to achieve this.

This is why US stocks refuse to sell off in any meaningful way. We are setting up for a great ?buy the rumor, sell the news? event. Remember when the first Gulf War started in 1991? Stocks drifted for six months in the run up, then soared once the bombs actually fell. We could be in for another one of those. That would take the yen and the euro to new lows for 2013.

Count on President Obama to draw out the Syria crisis for as long as possible. This gives the message of the coming military action the greatest political impact internationally. It also boosts his own political fortunes at home, leaving the Republicans drifting in the wind. Why be in a hurry to end it? They are now in the uncomfortable position of having to turn pacifist, after supporting Middle Eastern wars with a blank check for the last 11 years.

All of this worked out exactly as expected for our yen short, which is why it expired on Friday at its maximum value. The expiration print of $98.35 cleared our nearest strike of $103 by miles. This added a welcome $1,330 in profits to our $100,000 model trading portfolio for 2013.

On to the next one.

Kaching!

Kaching!

One of the joys of having small children is that you get to know the guy at the local plumbing supply shop really well. It?s amazing what will fit down a toilet these days.

He once told me that when Troll Dolls hit the market, every plumber in the country was guaranteed a job for life. When I went there yesterday I thought I?d pick up some leading economic indicators as well. After a deadly year, business is picking up a bit. Sure, it is still down from the onset of the Great Recession five years ago, but there is a definite improvement going on.

This was the Eureka moment! His comments confirm the sort of modest recovery I have been expecting. We aren?t going to zero anymore, but it is not exactly off to the races either. Throughout the nineties, a salesman at Circuit City (RIP) walked me through every generation of technology, and he was worth his weight in gold. All I had to do was buy a new TV from him every year, and they kept getting bigger and more expensive. I bought the second high definition TV sold in California, after George Lucas, who I used to run into at the local IHOP having breakfast with an aspiring young starlet. It was his casting couch.

Sometimes figuring out the direction of the economy is as simple as going down to the local butcher, baker, or candlestick maker and asking. They are on the front lines of economic activity, and they will see any changes months before those of us glued to computer screens. Make it your own unfair advantage, your own heads up in the marketplace. Just keep your eyes open and observe.

Asking George Lucas also helps.

A Troll Doll

A Troll Doll

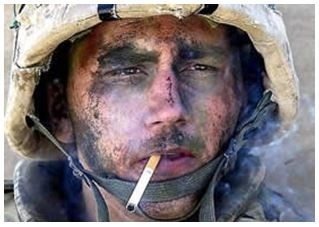

To the dozens of subscribers in Iraq, Afghanistan, and the surrounding ships at sea, thank you for your service! I think it is very wise to use your free time to read my letter and learn about financial markets in preparation for an entry into the financial services when you cash out. Nobody is going to call you a baby killer and shun you, as they did when I returned from Southeast Asia four decades ago.

I have but one request. No more subscriptions with .mil addresses, please. The Defense Department, the CIA, the NSA, Homeland Security, and the FBI do not look kindly on newsletters entering the military network, even the investment kind. If you think civilian spam filters are tough, watch out for the military kind! And no, I promise that there are no coded secret messages embedded with the stock tips. ?BUY? really does mean ?BUY.?

If I did not know the higher ups at these agencies, as well as the Joint Chiefs of Staff, I might be bouncing off the walls in a cell at Guantanamo by now. It also helps that many of the mid-level officers at these organizations have made a fortune with their meager government retirement funds following my advice. All I can say is that if the Baghdad Stock Exchange ever become liquid, I?m going to own it.

Where would you guess the greatest concentration of readers The Diary of a Mad Hedge Fund Trader is found? New York? Nope. London? Wrong. Chicago? Not even close. Try a ten-mile radius centered on Langley, Virginia, by a large margin. The funny thing is, half of the subscribing names coming in are Russian. I haven?t quite figured that one out yet.

So keep up the good work, and fight the good fight. But please, only subscribe to my letter with personal Gmail, Hotmail or Yahoo addresses, or with your spouse?s address. That way my life can become a lot more boring. Oh, and by the way, Langley, you?re behind on your bill. Please pay up, pronto, and I don?t want to hear whining about any damn budget cuts!

I Want My Mad Hedge Fund Trader!

I Want My Mad Hedge Fund Trader!

Global Market Comments

September 23, 2013

Fiat Lux

Featured Trade:

(NOVEMBER 1 SAN FRANCISCO STRATEGY LUNCHEON),

(TAKE A LOOK AT OCCIDENTAL PETROLEUM),

(OXY), ($WTIC), (USO),

(TESTIMONIAL)

Occidental Petroleum Corporation (OXY)

Light Crude Oil ($WTIC)

United States Oil (USO)

Legal Disclaimer

There is a very high degree of risk involved in trading. Past results are not indicative of future returns. MadHedgeFundTrader.com and all individuals affiliated with this site assume no responsibilities for your trading and investment results. The indicators, strategies, columns, articles and all other features are for educational purposes only and should not be construed as investment advice. Information for futures trading observations are obtained from sources believed to be reliable, but we do not warrant its completeness or accuracy, or warrant any results from the use of the information. Your use of the trading observations is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness of the information. You must assess the risk of any trade with your broker and make your own independent decisions regarding any securities mentioned herein. Affiliates of MadHedgeFundTrader.com may have a position or effect transactions in the securities described herein (or options thereon) and/or otherwise employ trading strategies that may be consistent or inconsistent with the provided strategies.