Easiest Way to Short Bitcoin

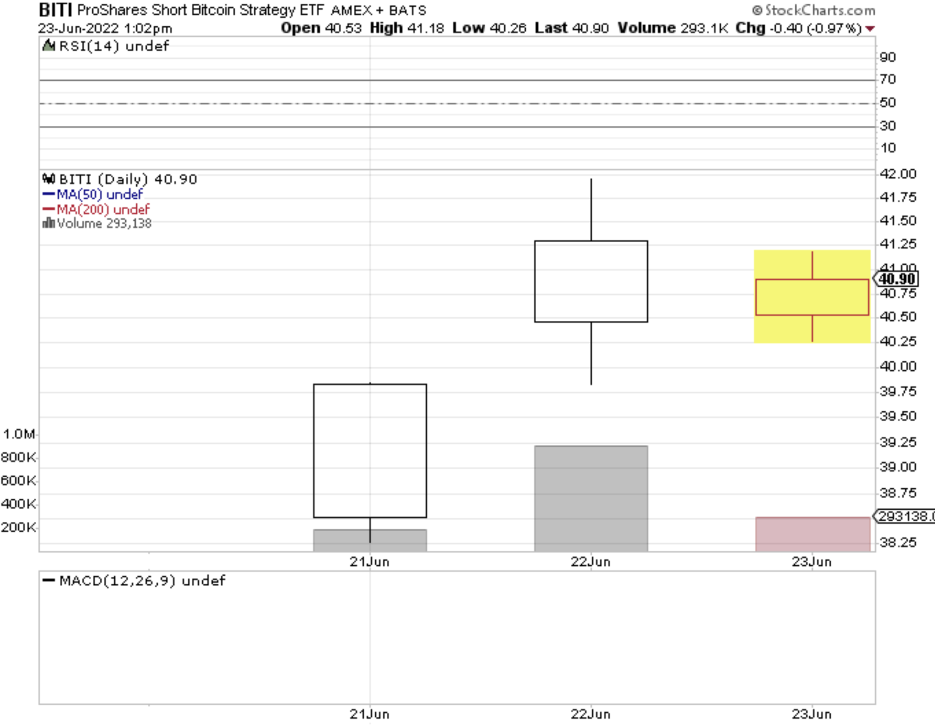

The ticker symbol is BITI – write it down in your journal.

What’s that?

That’s the new ProShares Short Bitcoin ETF that just started trading on the New York Stock Exchange 2 days ago.

It’s been a long time coming.

Crypto ETFs have had an arduous journey to finally join other assets trading publicly.

Handcuffed by regulation behind the scenes, crypto has been roadblocked.

The really underscored the enormity of situation and how difficult it is to get approved in America, much like building an oil refinery in the United States.

It only took eight months after first creating the initial U.S. bitcoin futures ETF.

What does this mean?

Instead of executing some type of exotic trade exposing an investor to a short Bitcoin position on some alternative market, investors can now just click and buy a product that bets against an appreciating price of Bitcoin.

In short, if Bitcoin goes down, profit is accrued.

This makes it even easier to hate crypto if the gateways to bet against it have enlarged.

Before this, the best way to really expose oneself in an insured marketplace was to sell short MicroStrategy (MSTR).

However, MSTR never correlated 1:1 with Bitcoin and it was something closer to 85% correction.

The fall to $17,000 for Bitcoin means that it has not participated in the latest bear market rally but only participated in the selloffs.

That’s never something you want to hear if you are interested in buying into an asset class.

Considering that traditional brokerage accounts can now bet against Bitcoin will result in more short sellers and not less.

BITI will be the first ETF of its kind in the U.S. Horizons ETFs has a short bitcoin ETF listed on the Toronto Stock Exchange.

ProShares said BITI is designed to deliver the opposite of the performance of the S&P CME Bitcoin Futures Index and that it seeks to obtain exposure through bitcoin futures contracts.

How well-timed the launch remains to be seen? Markets remain fraught with uncertainty, and I do believe Bitcoin will trend towards $12,000 per coin in the short-term.

I know there's a ton of people who had massive FOMO from missing the rise of Bitcoin and they have been even happier that they missed the elevator down as well.

I've taken calls from friends and even family asking if they should buy the dip and the answer is no.

Bitcoin is bereft of dip buyers as small and large buyers have gone AWOL for different reasons.

Much of the new incremental capital has gone into shorting interest rates and buying commodities.

Other institutional capital like Ray Dalio’s Bridgewater hedge fund just doubled their bet against Europeans stocks to $10.5 billion.

Bitcoin, as it exists in its current form, just isn’t attractive to the incremental buyer.

As Bitcoin gets cheaper, one might say it’s on sale, but sales can be lowered and that’s the path of least resistance unless something changes.