February 20, 2024

(WHEN IT COMES TO INVESTING DIVERSIFICATION IS KEY)

February 20, 2024

Hello everyone.

The darling of the AI space reports this week. (We all know which stock that is.) And investors will watch closely to see if the frenzied rally will fizzle or fly higher. Even if Nvidia meets or beats expectations, the stock may pull back because of profit-taking.

The path forward for interest rates will also be a talking point this week as the Federal Reserve meeting minutes are also set to be released on Wednesday. The CME Fed Watch Tool reveals that markets are now pricing in only a roughly 50% chance of a quarter percentage point cut in June, based on interest rate futures trading.

There are multiple factors keeping investors on edge about equity markets. High valuations in mega-cap tech stocks, the potential for downside risk in interest rate sensitive sectors such as regional banks, geopolitical risks, and possible volatility around the U.S. election later this year. Many investors believe any of these may limit upside in the equity markets.

Isn’t diversification key here?

If you are wringing your hands about stocks, balance out your portfolio with some bonds. When you invest in the market, you must be comfortable with a certain amount of risk, but having some weight in bonds, if risk materializes out of nowhere, is going to pay if volatility rips through the stock market. With all that being said, any 5-10% pullback in stocks should be seen as an opportunity to buy back in. When rate cuts do happen, they will be fuel for small caps, which have underperformed this year. The Russell 2000 is ahead just 0.7% in 2024.

Markets are closed Monday in celebration of the President’s Day holiday.

Week ahead calendar

Monday Feb. 19, 2024

Presidents Day Holiday

Australia RBA Meeting Minutes

Previous: N/A

Time: 7:30 pm ET

Tuesday, February 20, 2024

10 a.m. Leading Indicators (January)

Canada Inflation Rate

Previous: 3.4%

Time: 8:30 am ET

Earnings: Public Storage, Palo Alto Networks, Diamondback Energy, Caesars Entertainment, Walmart, Home Depot.

Wednesday Feb. 21, 2024

2 p.m. FOMC Minutes

Earnings: Nvidia, Marathon Oil, Etsy, Analog Devices, Exelon.

Thursday Feb. 22, 2024

8:30 a.m. Chicago Fed National Activity Index (January)

8:30 a.m. Continuing Jobless Claims (02/10)

8:30 a.m. Initial Claims (02/17)

9:45 a.m. PMI Composite preliminary (February)

9:45 a.m. S&P PMI Manufacturing preliminary (February)

9:45 a.m. S&P PMI Services preliminary (February)

10 a.m. Existing Homes Sales (January)

Earnings: Booking Holdings, Live Nation Entertainment, Intuit, Edison International, Dominion Energy, Moderna, PG&E, Keurig Dr. Pepper

Friday, Feb. 23, 2024

Euro Area Business Climate (DE)

Previous: 85.2

Time: 4:00 am ET

Earnings: Warner Bros, Discovery

REVIEW

S&P500

The S&P is playing cat and mouse with the 5,000 level – now considered a Big Number, a sort of psychological resistance, which may continue for a while yet. Any sustained break above the 5,048 high of February 12th signals the resumption of Uptrend.

Support lies at 4,920, 4,850/4,820.

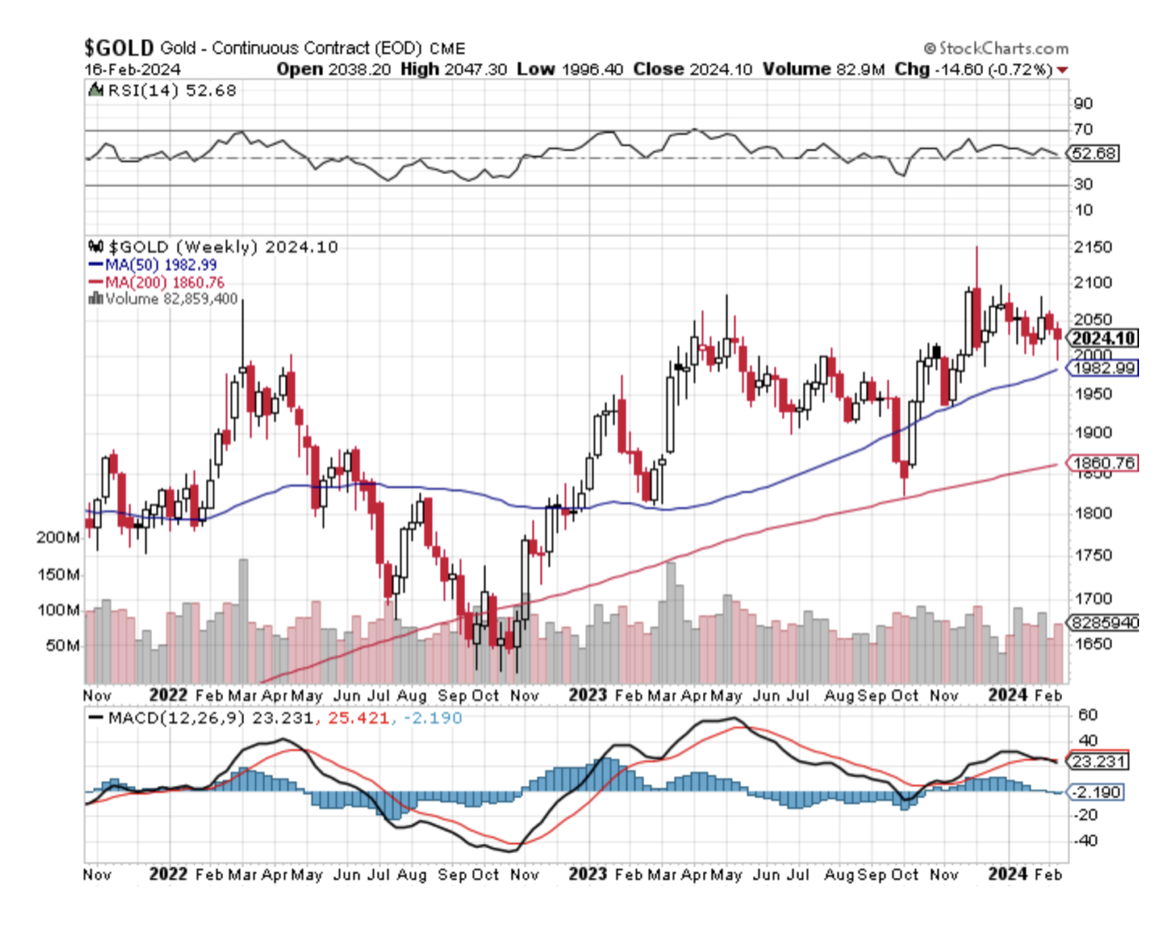

GOLD

Gold has been undergoing a broad corrective consolidation, which may be morphing into a larger Symmetrical Triangle pattern. On every pullback, keep accumulating small parcels in gold/silver stocks – average in.

BITCOIN

Uptrend in progress. Using Elliott Wave analysis, Bitcoin is interpreted to be advancing toward its next target around $57,000.

The Bigger Picture remains bullish with the potential to advance toward Key $69,000 resistance and beyond.

Ethereum also presents a bullish picture.

Something to keep in mind…

When investing in equities it pays for individual investors to be long-term investors as opposed to traders.

Cheers

Jacquie