February 5, 2024

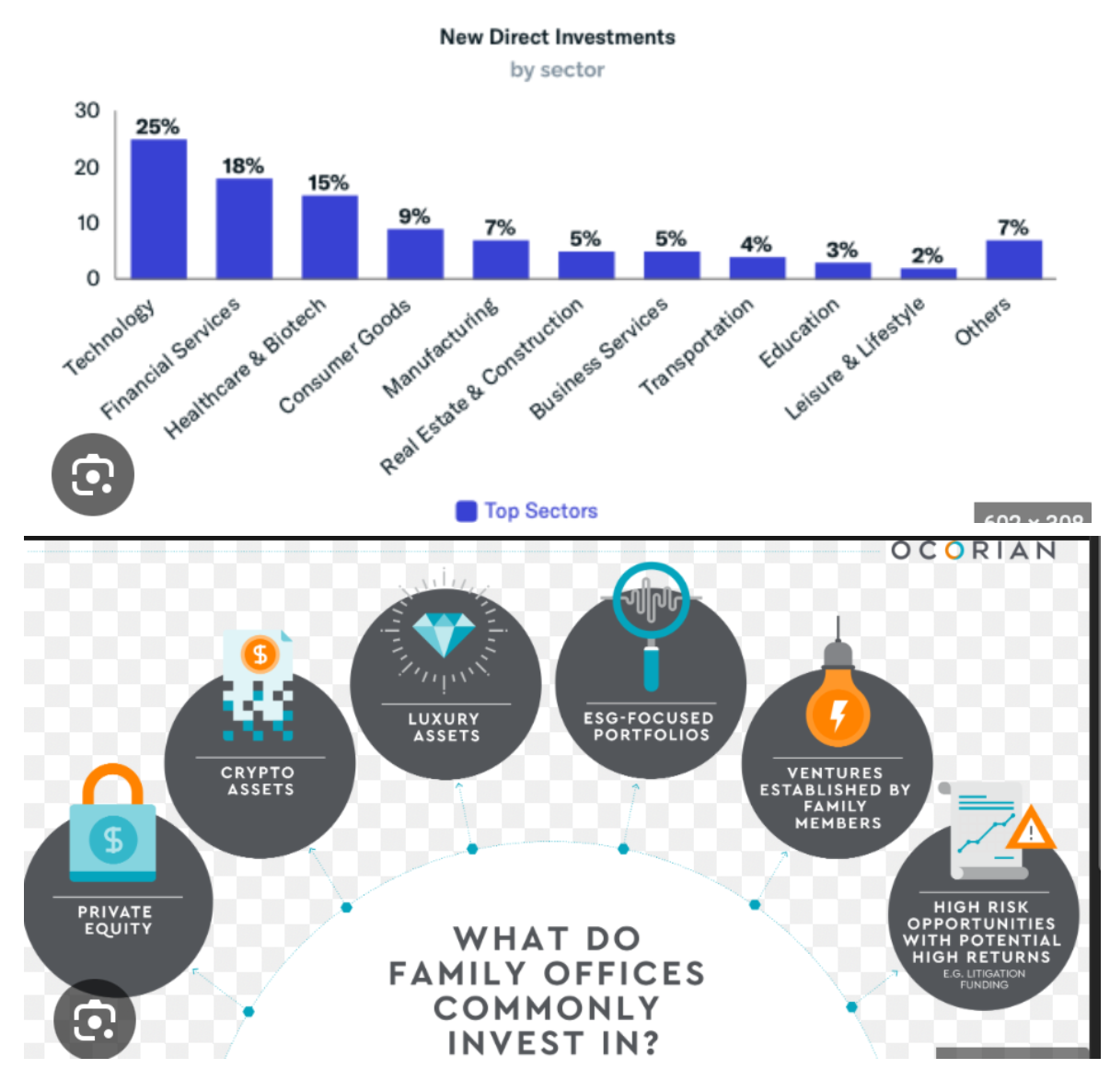

(THE SECTORS FAMILY OFFICES ARE FAVOURING in 2024)

February 5, 2024

Hello everyone,

Welcome to another big week of earnings. Media and consumer names feature this week.

Disney, McDonalds, and Uber Technologies are among the 94 S&P 500 companies due to report this week. 230 S&P500 companies have already reported their 4th quarter numbers. Of those, 75% have exceeded expectations. (All times: Eastern)

Monday, Feb 5, 2024

9:45 a.m. PMI Composite

9:45 a.m. Markit PMI Services

10 a.m. ISM Services PMI

Australia Interest Rate Decision

Previous: 4.35%

Time: 10:30 pm ET

Earnings: McDonald's, Simon Property Group, Estee Lauder Companies, Tyson Foods, On Semiconductor, Caterpillar

Tuesday, Feb 6, 2024

Euro Area Retail Sales

Previous: -0.3%

Time: 5:00 am ET

Earnings: Chipotle Mexican Grill, Prudential Financial, Fortinet, Enphase Energy, Eli Lilly, GE Healthcare Technologies, Ford Motor.

Wednesday, Feb 7, 2024

8:30 a.m. Trade Balance

Previous: $63.2B

Time: 8:30 am ET

3:00 p.m. Consumer Credit

Earnings: Uber Technologies, Wynn Resorts, PayPal, Yum! Brands, CVS Health, Hilton Worldwide, Costco Wholesale, Disney.

Thursday, Feb 8, 2024

8:30 a.m. Continuing Jobless Claims

8:30 a.m. Initial Claims

10 a.m. Wholesale Inventories

Australian Governor Bullock's Speech

Previous: N/A

Time: 5:30 pm ET

Earnings: Motorola Solutions, Expedia Group, Ralph Lauren, T. Rowe Price Group, ConocoPhillips, The Hershey Co., Philip Morris International, Tapestry.

Friday, Feb 9, 2024

Canada Unemployment Rate

Previous: 5.8%

Time: 8:30 am ET

Earnings: PepsiCo

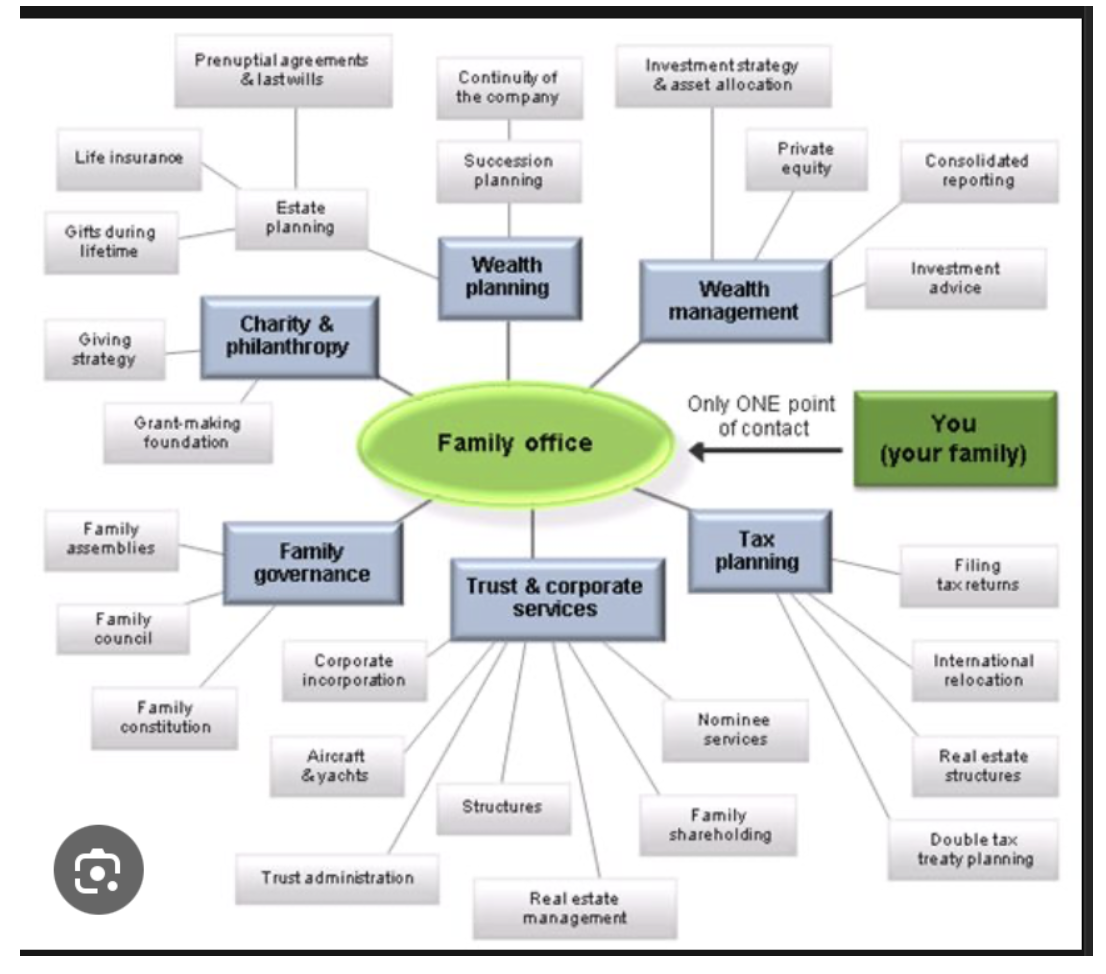

An ever-increasing number of wealthy individuals has contributed to a boom in family offices in the last few years.

In the United States, in the last three years alone billionaires are 46% richer than they were in 2020.

Studies show that the ultra-high net worth population overall declined in Asia last year, but rose in India, while Europe and America recorded smaller declines. The combined net worth of Asia’s super-rich population was at $12.13 trillion, above Europe’s $11.73 trillion.

Family offices typically cater or investors with $100 million or more in net worth. According to a 2023 study by KPMG, 26% of family offices most commonly manage between $251 million and $500 million in assets, while 65 manage over $5 billion. A 2022 report citing various estimates said that family offices were managing more than $6 trillion in wealth.

So how are family offices allocating right now and in the next few years – in the face of major global shifts?

UBS notes that the current trend among family offices is a return to fixed income as a diversifier, although stocks in developed markets remain the most important asset class.

Currently, UBS states, that the most favored diversification strategy globally is high-quality short-duration fixed income. The bank also states that family offices are planning to buy more developed market bonds over the next five years.

The table here shows how family offices are planning to change their asset allocations in the next five years, according to UBS’s 2023 survey.

Citi points out that most family offices have started to shift toward higher-risk asset allocations, which is in line with Citi going overweight on stocks in December for the first time since 2020, as it expects earnings growth to broaden across sectors.

One type of fixed income that family offices are positive on right now is U.S. investment grade credit of long duration and high quality.

There is also more hedging in portfolios now than two years ago, with clients using macro trading strategies tied to geopolitical uncertainty.

What type of assets are family offices looking to buy in the next few years?

Japan stocks are one area. The ‘Japan thesis’ is built around resurgent inflation, and resulting wage growth, which has created better purchasing power for Japanese corporates. Also, better corporate governance.

Japan’s stocks had a bull run last year, and it’s continuing into this year, touching new 33-year highs.

According to Citi, other themes that family offices are bullish on include health care and longevity, the energy transition, and generative artificial intelligence.

Overall, Citi says, that tech led the way as 63% of family offices stated it as their preferred sector to invest in, with real estate coming in second (42%), and health care in third position at 40%.

Providers are showing that alternative assets are also becoming more popular with family offices, such as private equity, private debt, and infrastructure. Private equity is a play on lower interest rates, given so much of the returns from this asset segment are driven by cost and availability of debt. UBS explains that family offices are primarily investing in private equity through funds, which deliver diversification and the ability to enter markets where the family office does not have in-house expertise.

Markets are largely expecting the U.S. Federal Reserve to start cutting rates this year, after a protracted period of hiking.

Cheers,

Jacquie