February 7, 2025

(IS THE AI WAKE UP CALL FROM CHINA A STORM IN A TEACUP OR SOMETHING BIGGER?)

February 7, 2025

Hello everyone

China and Australia are having a spat, or Is China & the world having a spat?

Australia has moved to ban the Chinese AI company Deep Seek from all its government systems and devices on national security grounds. Australia joins Taiwan and the U.S. state of Texas, which have similar Deep Seek restrictions on government phones. One European country – Italy – has gone even further. It has banned Deep Seek entirely by forcing its removal from app stores.

China has accused Australia of ideological discrimination and following in the footsteps of the U.S., which is also approaching the app with caution.

In the U.S., both NASA and the Pentagon have ordered staff to steer clear of Deep Seek.

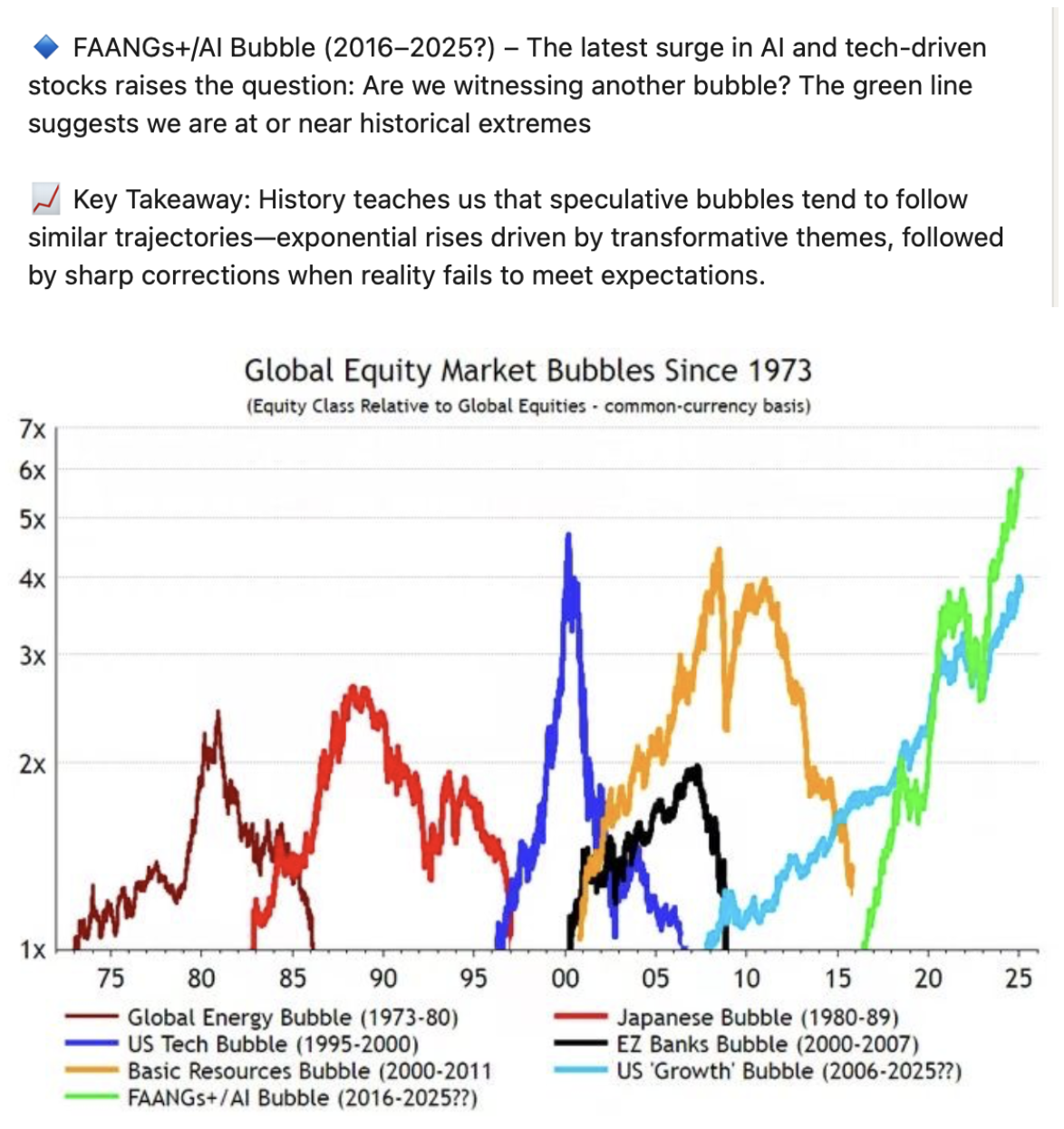

I think there could be further shocks to the market from the AI corner.

Palantir has catapulted itself into the clouds

I recommended Palantir on March 20, 2024, when it was $23.00.

We are still holding this stock. At its closing price on Thursday at $111.28, we have made 383% on this stock. So, you would be wise to take some profits off the table.

Shares of the government contractor and artificial intelligence play are trading at a 62 forward price-to-sales ratio, the highest of any company in the S&P500. The next closest nonfinancial stock in terms of forward price-to-sales is Texas Pacific Land Corp, at 32 times estimates for sales over the next year, according to FactSet data.

Palantir’s valuation comes after a 24% jump in its shares last Tuesday as the company reported a 36% increase in sales for the last quarter and raised its sales forecast for the full year.

Analysts agree that Palantir’s stock price is not sustainable even if it does become a primary contractor for the U.S. government that is looking to modernize processes and increase efficiency.

Jefferies software analyst Brent Thill notes that although the stock’s fundamentals are strong, PLTR would have to raise growth to 50% for 4 years and trade at 13.5x CY28E revenue just to hold its stock price. Thill’s stock price target is $28.00. Palantir closed at $111.28 on Thursday.

Could this rally be typical of retail trader enthusiasm, which often represents late-stage bull markets?

QI CORNER

Cheers

Jacquie