Follow Up to Trade Alert - (FXE) August 24, 2016

As a potentially profitable opportunity presents itself, John will send you an alert with specific trade information as to what should be bought, when to buy it, and at what price.

Further Explanation to Trade Alert - (FXE)- TAKE PROFITS

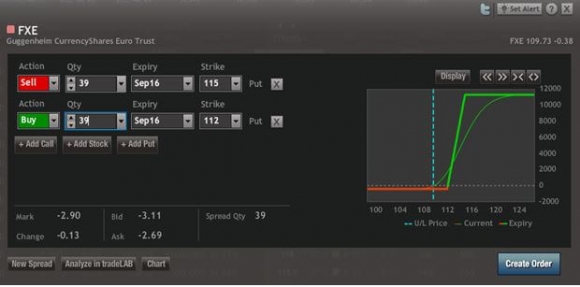

SELL the Currency Shares Euro Trust (FXE) September, 2016 $112-$115 in-the-money vertical bear put spread at $2.90 or best

Closing Trade

8-24-2016

Expiration date: September 16, 2016

Portfolio weighting: 10%

Number of Contracts = 39 contracts

A one day 10.26% profit in a single trade certainly works for me. I bet it works for you too.

THIS MEANS THAT 9 OUT OF THE LAST 10 TRADE ALERTS HAVE BEEN PROFITABLE, MOST IMMEDIATELY SO.

With this morning?s plunge in the Euro, we now have realized 73.63% of the maximum potential profit in our short position.

I?m thinking take the money and run, don?t look a gift horse in the mouth, and three birds in the hand are worth four in the bush.

So I am taking profits on my position in the Currency Shares Euro Trust (FXE) September, 2016 $112-$115 in-the-money vertical bear put spread.

I think the fix is in. Fed vice chairman Stanley Fischer showed his hand a couple of days ago.

Fed speakers will talk up the chance of an interest rate hike all the way until their September 20-21 Federal Open Market Committee (FOMC) meeting. They will then do absolutely nothing.

So until then, you can expect the entire yield play space to trade sideways or get battered. That?s all we need for this position to work.

Higher interest rates are great news for the US dollar, and terrible for all other currencies.

Interest rate differentials are far and away the largest driver of foreign exchange markets.

In the meantime, Europe will continue to signal that their rates will stay lower for longer.

Rising dollar : falling Euro? sounds like a trade to me.

If you have the ProShares Ultra Short Euro ETF (EUO), the 2X short Euro fund, keep it. The Euro is going much lower.

To see how to enter this trade in your online platform, please look at the order ticket below, which I pulled off of optionshouse.

If you are uncertain on how to execute an options spread, please watch my training video on ?How to Execute a Bear Put Spread? by clicking here at http://www.madhedgefundtrader.com/ltt-executetradealerts/. You must me logged into your account to view the video.

The best execution can be had by placing your bid for the entire spread in the middle market and waiting for the market to come to you. The difference between the bid and the offer on these deep in-the-money spread trades can be enormous.

Don?t execute the legs individually or you will end up losing much of your profit. Spread pricing can be very volatile on expiration months farther out.

Here are the specific trades you need to execute this position:

Sell 39 September, 2016 (FXE) $115 puts at????.?.??$5.40

Buy to cover short 39 September, 2016 (FXE) $112 puts at...$2.50

Net Proceeds:??????????????????.....$2.90

Profit: $2.90 - $2.63 = $0.27

(39 X 100 X $0.27) = $1,053 or 10.26% in 1 trading day.