Get Your Geiger Counters Ready

Hang on to your Geiger counters because we're about to dive deep into the world of radiopharmaceutical therapy. I bet even Marie Curie would be impressed by the mind-blowing leaps we've made since her ground-shattering discoveries a century ago.

Now, don't get me wrong, she's a tough act to follow. But the big guns in pharma have taken up the challenge, piling up billions on the roulette table of targeted radiopharmaceutical therapy.

And from where I'm sitting, the odds are looking pretty darn exciting.

Just picture the scene: Radiation that directly takes the fight to those nasty tumor cells, like a microscopic missile strike that zaps cancer cells while ignoring the innocent bystanders.

How? By hitching a radioactive particle to a targeting molecule - think Uber, but for cancer therapy.

This healthcare game-changer, dubbed radiopharmaceutical therapy is projected to become a whopping $25 billion goldmine.

Forget the clunky radiation therapy your grandparents endured – this is precision, it's innovation, and it could potentially enrich your investment portfolio.

Actually, everyone seems to be piling into the radiopharma race. Experts say we're merely at the start line and these next-gen technologies could bring a windfall.

Evidence? The recent flurry of acquisitions, with no less than four deals being sealed just these past months.

Now, let's put some names to this game.

Novartis (NVS) is leading the pack with two radiopharmaceutical showstoppers under its belt. With their drugs Pluvicto and Lutathera, they're forecasted to rake in a whopping $5 billion by 2028 – that's more zeros than I can count on two hands.

Not just resting on their pile of success, they've scooped up Mariana Oncology in a $1 billion deal. This strategic move solidifies Novartis' dominion in the radiopharmaceutical arena – and you can quote me on that.

Inspired by Novartis' success, other pharmaceutical titans are catching the FOMO fever.

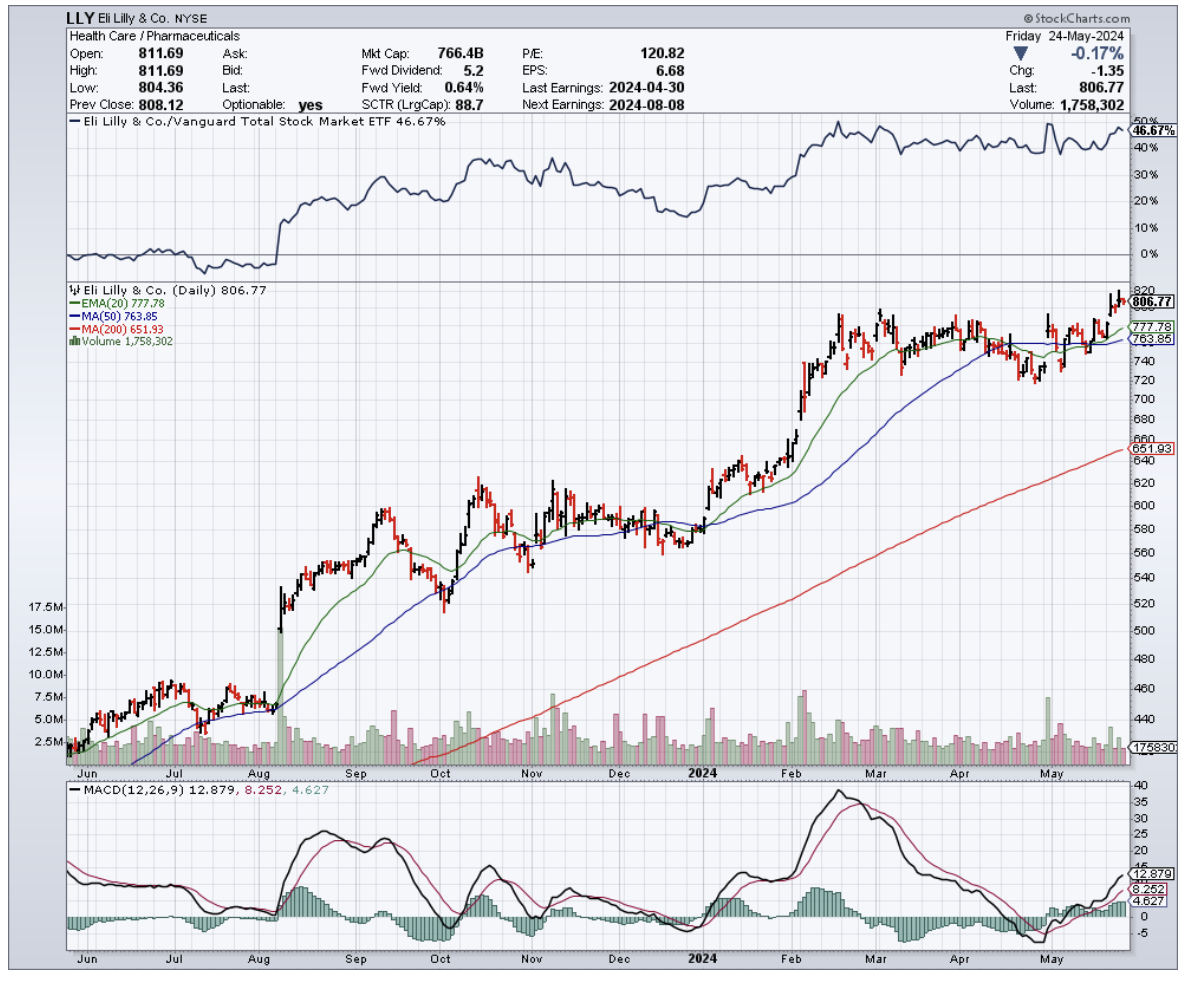

Eli Lilly (LLY), for instance, handed over $1.4 billion to acquire Point Biopharma and its promising radiation drug, PNT2002.

The investors’ darling this year with a near 38% surge in stock price (thanks to the overwhelming success of its obesity drugs), Eli Lilly is set to maintain its upward trajectory by venturing into the radiopharmaceutical space.

Bristol-Myers Squibb (BMY) isn't about to be left out of the radiopharmaceutical race either.

They ponied up a cool $4.1 billion for RayzeBio, snagging a promising pipeline of treatments. One standout is RYZ101, a late-stage targeted radiopharma therapy already making waves in trials for gastroenteropancreatic neuroendocrine tumors and small-cell lung cancer.

This acquisition followed closely on the heels of their $14 billion buyout of schizophrenia drug developer Karuna Therapeutics. Clearly, they’re feeling the heat as patents on some of their older cash cows are set to expire.

So, sure, BMY’s stock has been a bit sluggish lately, but this radiopharmaceutical gamble could be the shot in the arm they need.

And the acquisition spree doesn't stop there. AstraZeneca (AZN) also dove headfirst into the radiopharmaceutical pool, shelling out $2.4 billion for Fusion Pharmaceuticals in March.

Fusion's pipeline, including their Phase 2 candidate FPI-2265 for metastatic castration-resistant prostate cancer, adds another potential blockbuster to the mix.

Meanwhile, several biopharma companies are still standing tall, catching the eye of investors.

In fact, the venture capital poured into radiopharmaceutical drugs surged to $518 million last year, a cool 722% increase from 2017.

The race isn't slowing down anytime soon either. Researchers are exploring the use of radiopharmaceuticals alongside other treatments like immunotherapy, and even envision a future where this technology could be applied to any cancer, including ovarian, breast, or brain tumors.

And with only two products currently in the market, the potential for growth in targeted radiotherapies seems almost infinite.

So, I'll say it one more time – get your Geiger counters ready. The radiopharmaceutical revolution is just getting started, ladies and gentlemen. It’s time to zero in on this hotbed of innovation and watch your investments go nuclear.