Global Pension Funds Next in Line

Once it rains, it pours.

South Korea’s public pension ecosystem has long been viewed as conservative, but that perception has been steadily eroding. One of the country’s largest institutional pools of capital, the Korean Teachers’ Credit Union (KTCU), has explored digital asset exposure as part of its broader effort to improve long term returns.

The fund considered gaining Bitcoin exposure through exchange-traded funds in early 2022, a move that would have been unthinkable for most public pensions just a few years earlier.

I am not going to touch on whether there is a moral high ground when it comes to investing employee retirement assets. The reality is that the fixed-income instruments pension funds traditionally rely on have struggled to deliver adequate returns in a prolonged low-yield environment.

The definition of insanity is repeating the same approach when it no longer works.

Faced with a shrinking menu of viable options, institutional allocators have been forced to expand their definition of alternative assets, and crypto has increasingly entered that conversation.

Pension fund managers have performance targets like everyone else and are ultimately judged on results.

This shift does not represent the old status quo for retirement capital, but it does reflect a broader change in how alternative investments are evaluated.

KTCU’s exploration of Bitcoin-linked exchange-traded products included funds associated with South Korean asset manager Mirae Asset Global Investments, which launched Bitcoin futures-based ETFs through its Canadian subsidiary Horizons ETFs in 2021.

Today, KTCU oversees more than $45 billion in assets under management, with a substantial portion allocated to alternative investments alongside domestic and international equities.

The mere consideration of crypto and blockchain exposure by pension funds has opened a new chapter in the digital asset market, one where the most conservative capital pools in the world no longer dismiss the asset class outright.

What once seemed bizarre has become increasingly rational when viewed through the lens of portfolio construction and risk management.

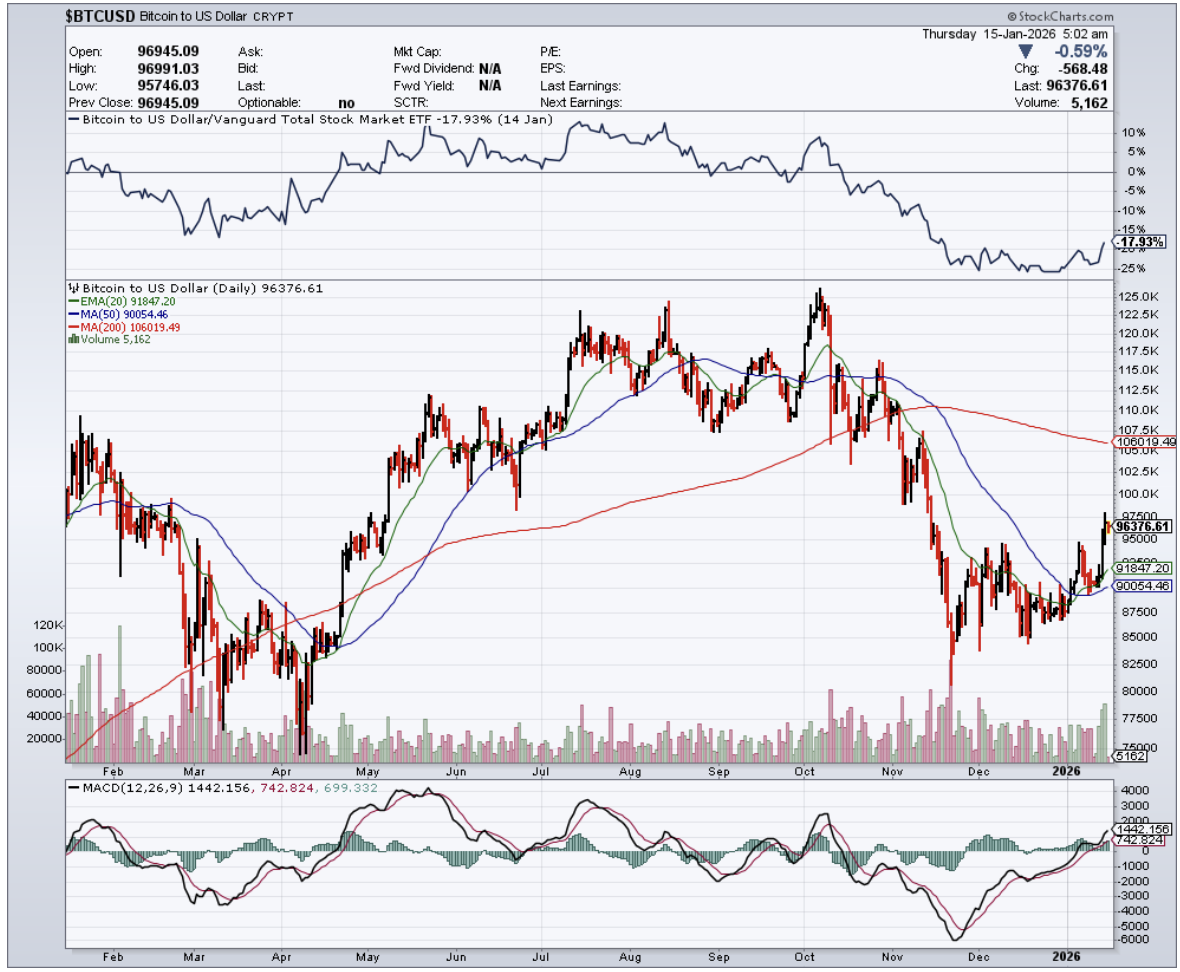

Despite lingering concerns about volatility, crypto has established itself as one of the most actively traded and institutionally monitored asset classes globally.

Regulatory clarity has improved over time, particularly following the approval of spot Bitcoin exchange-traded funds in major markets, including the United States, which significantly lowered the barrier to entry for large institutional investors in Bitcoin.

Traditional stewards of retirement capital have begun voting with their currency, and this trend has extended beyond Korea into other parts of Asia.

Family offices were early adopters of crypto funds, but pension plans and endowments have since followed, accelerating the professionalization of the digital asset ecosystem.

The market has grown more sophisticated and more institutional, driven by post pandemic monetary policy, inflation concerns, and the search for assets that behave differently from traditional markets.

Being risk-averse no longer automatically means avoiding cryptocurrency. Increasingly, it means understanding it.

Several high-profile pension-related moves have underscored this evolution.

The Houston Firefighters’ Relief and Retirement Fund confirmed allocations to Bitcoin and Ethereum, marking one of the earliest United States public pension entries into digital assets.

Canada’s Ontario Teachers’ Pension Plan Board participated in a major funding round for crypto exchange FTX. That investment was later written down following FTX’s collapse, reinforcing the importance of counterparty risk management rather than reversing institutional interest in digital assets more broadly.

This growing channel of institutional capital has reshaped the crypto market structure, providing deeper liquidity and a more resilient base of long-term participants.

With more buyers able to access the market through regulated products, crypto has moved further into the financial mainstream, even as volatility remains a defining feature of the asset class.