Gotta Love That November Nonfarm Payroll

The November nonfarm payroll blew out to the upside once again, with 203,000 souls landing jobs for the month. Previous months were substantially revised up. The headline unemployment rate made a whopping great fall from 7.3% to 7.0%, the sharpest drop in years.

The much feared collapse in the jobs market triggered by the October Washington shut down was dead on arrival. Imagine what the number would have been without it? 300,000? 400,000?

Especially stunning was the fall in the broader U-6 unemployment rate, known as the ?real? unemployment rate, from 13.8% to 13.2%. This figure has remained stubbornly high for years, for demographic reasons, according to Philadelphia Fed governor Charles Plosser, an ardent quantitative easing opponent. This is because once baby boomers retire, they tend never to return to work.

This comes on the heels of Thursday?s blockbuster Q3 GDP number, which came in at a blistering 3.6%, the highest such report since Q1, 2012. It all confirms my predictions that the economy is going faster than anyone else realizes, that all surprises will be to the upside, and that share prices have yet to reflect this.

For more depth on the bullish posture which I have been maintaining since the summer, please click here for ?Why US Stocks Are Dirt Cheap?, here for ?You Just Can?t Keep America Down?, and? ?The Rising Risk of a Market Melt Up?.

The developments also explain the mercurial performance of my own Trade Alert Service, which blasted through to another all time high for 2013, up 59.72% (see below). Here, we eat our own cooking, and recently the fare would rate a third Michelin star.

You would be right to ask if all these positive developments bring forward the risk of a taper by the Federal Reserve. But it won?t happen in December.

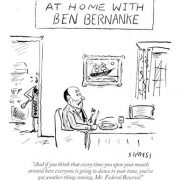

It would be the height of rudeness for Ben Bernanke to launch a major change in monetary policy just before his friend, Janet Yellen, takes the helm.

I have been watching America?s central bank closely for 40 years, all the way back to the days of the giant (literally and figuratively) Paul Volker. The one line lesson from this massive investment of my time is that they are oh so Slooooooow?.

They work in reverse dog years. What takes us mere mortals to conclude in a month, they take seven months, or longer. This all augurs for a taper that starts no earlier than Janet?s first meeting as governor during March 18-19, no matter how positive the economic numbers run.

There is not another Fed meeting until January 28-29, 2014, so it is pedal to the metal for all risk assets until then.

On Donner! On Blixen!