GROWTH IN THE ORCHARD

(AAPL), (NVDA), (ADBE), (AI), (APP), (SOUN)

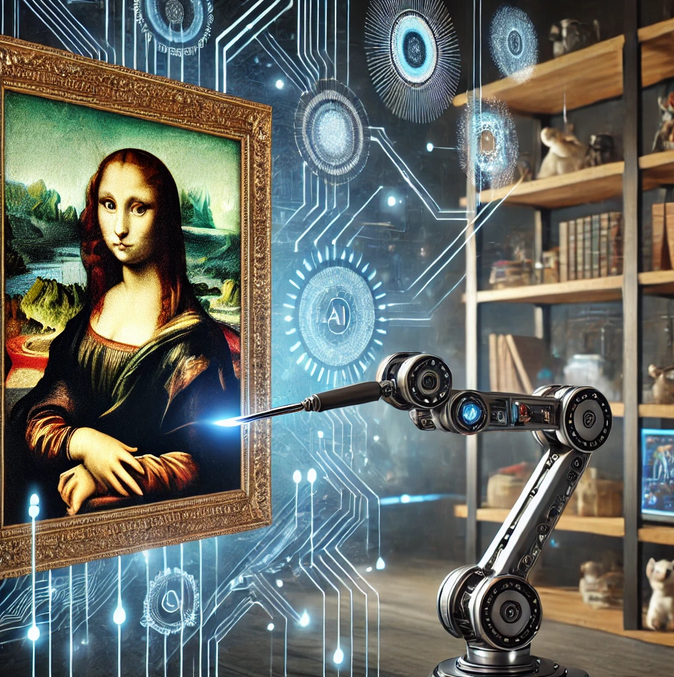

I spent thirty minutes last night trying to get an AI app to turn my cat into a Renaissance painting. The result looked more Picasso than Rembrandt, but it got me thinking about Apple's latest App Store strategy. They're pushing AI apps hard, and not just because someone in Cupertino has a thing for digital pet portraits.

Back in my hedge fund days, we had a saying: "Watch what they do, not what they say." Apple's (AAPL) quiet curation of AI-powered apps tells us more about where the market's heading than any flashy keynote ever could.

The numbers behind this shift are the kind that used to make my traders spill their morning coffee. We're looking at a 35% compound annual growth rate in the AI app market through 2030.

For perspective, that's the kind of growth rate I used to see in emerging market funds during the early 2000s boom - except this time, it's backed by actual revenue and not just optimistic projections.

Speaking of projections, the global AI market could hit $1,339 billion by 2030. I remember when reaching a billion in assets under management was considered a milestone. Now we're throwing around numbers that make billion seem quaint.

NVIDIA's (NVDA) been riding this wave like... well, like NVIDIA. Their GPU technology has become so fundamental to AI development that trying to run modern AI without it would be like trying to run my old hedge fund with an abacus. Trust me, I checked their order books - everyone from basement developers to major corporations is lining up for their chips.

Adobe's (ADBE) Firefly suite is particularly interesting. They've managed to thread the needle between AI innovation and artist compensation - something my legal team would have appreciated during our copyright disputes in the '90s. Their stock performance reflects this elegant solution to a complex problem.

Here's what's really catching my attention: the AI in mobile apps market is set to grow from $16.7 billion to $249.8 billion by 2033.

I've seen enough market cycles to know when numbers are just hype, but these align with what I'm seeing on the ground. Companies are integrating AI faster than my daughter downloads TikTok videos - by 2024, 72% of organizations will have AI in their operations.

Let's talk about C3.ai (AI) for a moment. Their stock chart looks like my heart rate monitor during the 2008 financial crisis, but there's substance beneath the volatility.

AppLovin (APP), meanwhile, is doing something fascinating with AI-driven advertising that reminds me of the early days of programmatic trading, just infinitely more sophisticated.

The subscription models these companies are using remind me of the early days of software-as-a-service, except now we're dealing with AI-as-a-service. The key difference? These apps actually deliver value beyond just moving desktop software to the cloud.

Capital expenditure in AI is expected to cross $1 trillion in 2025. Remember when hitting a billion dollars in tech investment felt monumental? Now, in a world where trillion-dollar valuations are becoming the norm, that barely qualifies as a headline.

What's particularly intriguing is the job creation potential - 133 million new roles by 2030. Having witnessed multiple technological transitions in finance, I can tell you this feels different. We're not just automating tasks – we're creating entirely new categories of work.

The AI app sector brought in $1.8 billion in 2023, with projections suggesting $30 billion by 2030.

These aren't just numbers pulled from an analyst's wishful thinking - they're based on current adoption rates and revenue patterns that remind me of the early internet boom, minus the pets.com-style absurdity.

For those looking to play this trend, I'm seeing opportunities across the spectrum.

Hardware leaders like NVIDIA continue to dominate their niche. Adobe has positioned itself perfectly at the intersection of creativity and AI.

Even companies like SoundHound (SOUN), while still finding their footing, show promise in voice AI that goes beyond asking your phone for weather updates.

Apple's AI app focus isn't just another tech trend - it's a clear signal of where consumer technology is headed. And after decades in the market, I've learned to pay attention when signals this strong appear.

Now if you'll excuse me, I need to go try that AI art app again. My cat's demanding a Baroque period portrait this time. And unlike my creative direction, they’re delivering results worth framing.