Hash Rate Collapse

It’s no secret that the price of Bitcoin is directly correlated to a growing hash rate.

These are truly one of the essential indicators of the underlying health of Bitcoin.

As buy and sell volume increases in the network, mining introduces more liquidity by delivering fresh coins, and the activity increases when more people buy and sell bitcoin.

This unwritten contract keeps supply and demand in check as the steady flow of newly minted coins lurches ever closer to the final tally of 21 million Bitcoin.

However, I never said there wouldn’t be bumps on the road on the way there.

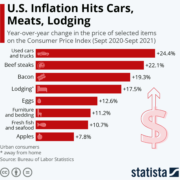

It’s no coincidence that the price of bitcoin has been slowed down because of the exorbitant energy prices around the world.

Higher energy costs are having a ripple effect where crypto mining companies are adversely affecting by a slowing hash rate.

A developing and healthy mining infrastructure is critical to a higher bitcoin price and what I am seeing are short-term bottlenecks that can only be resolved with easing conditions.

What is hash rate?

Hash rate is the measure of computational power used to verify transactions and add blocks in a Proof-of-work (PoW) blockchain. Bitcoin, among others, utilizes mining to mint new coins and verify transactions.

Hash rate can represent the number of individuals or entities in the world participating in the process of mining. Therefore, the more people mining bitcoin, the higher is the hash rate.

Why is hash rate important in mining?

The mining process, which involves miners solving complex computational puzzles to add blocks to the blockchain, leads to a more secure network.

In addition, miners have an incentive to mine for higher prices.

This system of reward ensures that there will always be new coins added to the economy of bitcoin while keeping the integrity of the blockchain network.

Mining is a business and miners can’t successfully mine if expenses are high combined with a low bitcoin price.

Once a miner produces a coin, it’s common to sell that coin back into the marketplace to recoup the costs of running a mining operation.

Higher rewards lead to a virtuous loop of higher prices and higher revenue while the opposite results in a vicious feedback loop that turns into a downward spiral.

The hash rate has decreased by around 5% in the last few months.

The hash rate recovered well from last summer when China banned Bitcoin and miners fled abroad to restart operations.

These are the growing pains in order to stabilize a new asset class.

The infrastructure of a new asset class doesn’t get built in one day and hopefully, the hash rate can shrug off the latest pullback.

Yet we face an upcoming summer with spiking electricity prices across the world as one of the world's largest exporters of fossil fuels, Russia, is enthralled in a military conflict and global energy supply chains are being severed by sanctions.

Unfortunately, Kazakhstan, the 2nd largest Bitcoin mining country, is facing some more short-term squeezes as Kazakh authorities said they seized almost $200 million of equipment from crypto mining operations as they crack down on illicit mines.

Legally operating miners in Kazakhstan had their power cut off at the end of January, as the government grappled with energy shortages.

The withdrawal of capacity from Kazakhstan is currently limiting bitcoin's hash rate growth.

This might feel highly esoteric because these events happen thousands of miles away.

But it matters because Bitcoin is still vulnerable to supply shocks just like the global supply chains are.

Deteriorating hash rates could signal to traders to delay Bitcoin purchases and as Bitcoin is also fighting with other assets for fiat currency, the incremental trader could be inclined to pay for groceries, gas, and housing before they dip back into the crypto market.

If the hash rate starts to tick upwards as we head into the summer, this could be the genesis of a Bitcoin rally.