Mad Hedge

HOT TIPS

Fiat Lux

(and what to do about them)

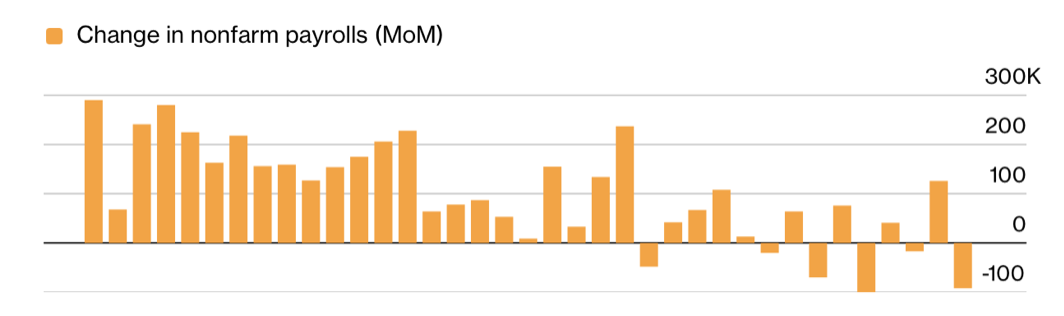

in February, the worst since the Pandemic. The Headline Unemployment Rate rose to 4.4%. The recession is here. Imagine what the March numbers will look like with the war and a stock market crash. The report calls into question whether the labor market is actually steadying. While job growth jumped in January and unemployment insurance claims have settled at a low level, companies may be starting to follow through on a series of previously announced layoffs.

up 50% so far this year. Some 90 tankers a day are prevented from passing through the Straits of Hormuz, and 8 have been hit by missiles so far. The Wall Street Journal reported that Kuwait has begun cutting production at some oil fields after running out of places to store bottled-up crude, the latest sign of a hit to supply in the region. Citigroup Inc estimates that the crude oil market is losing 7 million to 11 million barrels a day of supply due to the disruption through Hormuz.

Find Out Moreanother recessionary indicator. Inventories advanced 1.6% on a year-over-year basis in December. The report was delayed by last year's shutdown of the federal government.

Find Out More

portending a move in inflation to mid-single digits. If the conflict prolongs, the airline could see an impact in the second quarter as well. Fuel prices have jumped by 15% in the past week, adding to the pressure on an airline industry already hit hard by the conflict, which has led to more than 20,000 flight cancellations and left thousands of passengers stranded.

Find Out MoreInvestors divested a net $21.92 billion of U.S. equity funds during the week in their largest weekly net sales since January 7. Money market funds spar. As the conflict in the Middle East entered its seventh day on Friday, oil prices were on track for the biggest weekly gains since early 2022, fanning worries of inflation, potentially delaying rate cuts by the U.S. Federal Reserve. U.S. growth funds suffered $11.15 billion worth of outflows, the biggest for a week since December 17, 2025. Investors still bought $146 million worth of value funds, logging a fourth weekly net purchase.

Find Out MorePublished today in the Mad Hedge Global Trading Dispatch, the Mad Hedge Technology Letter, the Mad Hedge Biotech and Health Care Letter, the Mad Hedge AI Letter, and Jacquie’s Post:

Global Trading Dispatch

(A BUY WRITE PRIMER),

(AAPL), (AMZN), (GOOGL)

Mad Hedge Technology Letter

(JOBY ON THE RIGHT SIDE OF HISTORY)

(JOBY)

Mad Hedge Biotech & Health Care Letter

(NOBODY GETS RICH ROOTING FOR THE PETRI DISH)

(TMO), (NVDA)

Mad Hedge Jacque's Post

(PRICE OFTEN MOVES BEFORE THE NARRATIVE CHANGES)

Mad Hedge AI

The Bank That Handed 20,000 Employees Their Own AI Workforce

Futures trading involves a high degree of risk and may not be suitable for everyone.

Copyright © 2026. Mad Hedge Fund Trader. All Rights Reserved.